- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- how do i enter my gift to charity from my rmd>

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do i enter my gift to charity from my rmd>

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do i enter my gift to charity from my rmd>

Yes, a qualified withdrawal does lower the AGI. To enter the 1099-R properly:

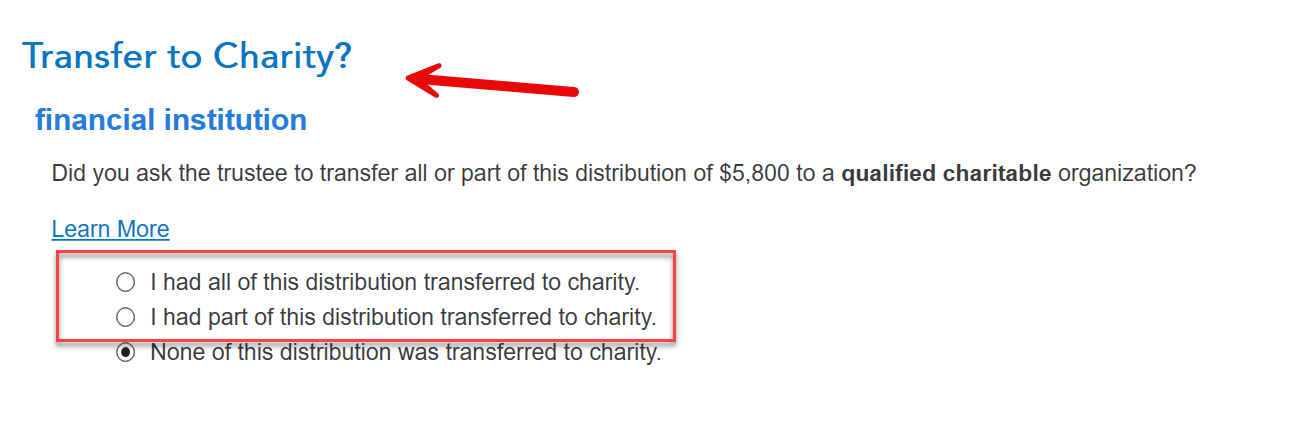

- Edit your 1099-R entry

- When the program asks about a transfer to charity, select all or part

- continue answering questions

Be sure you have it marked as an IRA and you are 70 1/2 or older to qualify.

Qualified charitable distributions allow eligible IRA owners states: The QCD option is available regardless of whether an eligible IRA owner itemizes deductions on Schedule A. Transferred amounts are not taxable, and no deduction is available for the transfer.

Report correctly

A 2024 QCD must be reported on the 2023 federal income tax return, normally filed during the 2024 tax filing season.

In early 2024, the IRA owner will receive Form 1099-R from their IRA trustee that shows any IRA distributions made during calendar year 2024, including both regular distributions and QCDs. The total distribution is shown in Box 1 on that form. There is no special code for a QCD.

Like other IRA distributions, QCDs are reported on Line 4 of Form 1040 or Form 1040-SR. If part or all of an IRA distribution is a QCD, enter the total amount of the IRA distribution on Line 4a. This is the amount shown in Box 1 on Form 1099-R.

Then, if the full amount of the distribution is a QCD, enter 0 on Line 4b. If only part of it is a QCD, the remaining taxable portion is normally entered on Line 4b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Geary-Burns

New Member

syounie

Returning Member

fkinnard

New Member

john

New Member

rodiy2k21

Returning Member