- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do I enter a clergy housing allowance when no 1099 or W-2 is issued?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a clergy housing allowance when no 1099 or W-2 is issued?

I am a part time pastor who earns a small housing allowance designated as such by the church that does not even cover my housing expenses. Since there is no other salary, the church is not required to issue a W-2 or a 1099.

How is this entered into TurboTax online so that it is subject to the self-employment taxes but not subject to income tax? Previously my CPA reported it on schedule SE, and then has a statement section which is adapted from IRS publication 517 that shows it was all used for housing.

Any help entering this without a 1099 or W-2 would be appreciated. Accountants we have spoken with have confirmed we do not need a W-2 or

1099. I was hoping to save money this year and file using TurboTax, but

I am thinking we may have to go back to an accountant.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a clergy housing allowance when no 1099 or W-2 is issued?

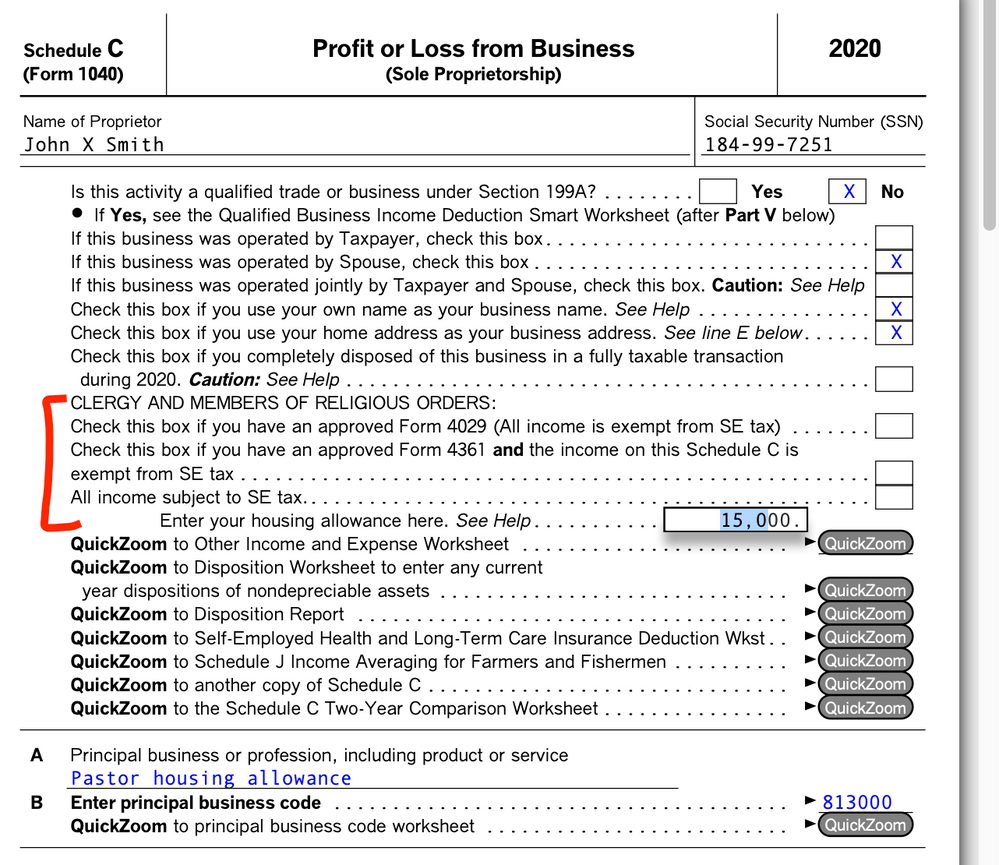

You will need to use the self-employed version if filing with turbotax online. Create your "small business" using occupation code 813000 -- this is a code for religious workers and will trigger questions about your housing allowance, qualified expenses, and self-employment tax. You may not have any 1099-MISC for income, but you may have other cash income such as from weddings and funerals that you would add here.

Note that because all your compensation is a tax-free housing allowance, you can't deduct work-related expenses such as supplies or mileage, due to the Deason rule.

If filing with Turbotax installed on your own computer, you can use the Deluxe version instead of Home & Business, but you still need to create a schedule C business with code 813000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a clergy housing allowance when no 1099 or W-2 is issued?

Hi I have a similar problem. I do have a schedule C for my clergy housing income using code 81300, but I do not seem to be able to trigger the housing question. I have entered my housing a an override in the SE worksheet but this disables efiling in home and business 2020. I would much rather efile if possible.

Do you know what steps I need to take in order to trigger the housing questions in TT (Windows) 2020? I also do not have this income reported on a W2 or 1099R so ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a clergy housing allowance when no 1099 or W-2 is issued?

@bigteks2 wrote:

Hi I have a similar problem. I do have a schedule C for my clergy housing income using code 81300, but I do not seem to be able to trigger the housing question. I have entered my housing a an override in the SE worksheet but this disables efiling in home and business 2020. I would much rather efile if possible.

Do you know what steps I need to take in order to trigger the housing questions in TT (Windows) 2020? I also do not have this income reported on a W2 or 1099R so ...

I don't know how you got to the place you are. You may need to start over from scratch, or at least delete your schedule C and everything attached, and start over with that part.

When you create the job with code 813000, you should be asked right away about a housing allowance. If you don't also have taxable income, you can't deduct work-related expenses due to the Deason rule, so you won't have a schedule C, just a schedule SE.

Also, I don't think a simple manual entry blocks e-filing, just an override. Once you create the job, you can enter the housing allowance directly on the schedule C worksheet instead of doing an override on schedule SE or the Schedule SE Adjustment Worksheet.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ftermine

New Member

woodarr3

Returning Member

bbjd

New Member

pizzagirl34

New Member

sbcus10

New Member