- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@bigteks2 wrote:

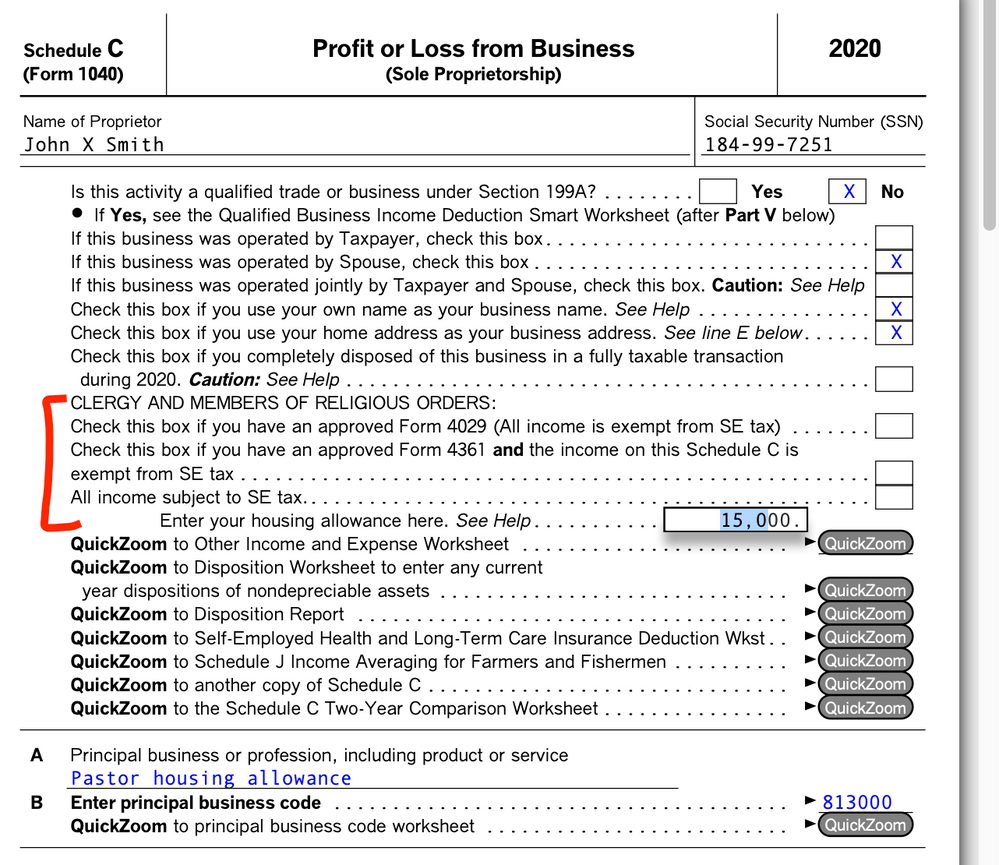

Hi I have a similar problem. I do have a schedule C for my clergy housing income using code 81300, but I do not seem to be able to trigger the housing question. I have entered my housing a an override in the SE worksheet but this disables efiling in home and business 2020. I would much rather efile if possible.

Do you know what steps I need to take in order to trigger the housing questions in TT (Windows) 2020? I also do not have this income reported on a W2 or 1099R so ...

I don't know how you got to the place you are. You may need to start over from scratch, or at least delete your schedule C and everything attached, and start over with that part.

When you create the job with code 813000, you should be asked right away about a housing allowance. If you don't also have taxable income, you can't deduct work-related expenses due to the Deason rule, so you won't have a schedule C, just a schedule SE.

Also, I don't think a simple manual entry blocks e-filing, just an override. Once you create the job, you can enter the housing allowance directly on the schedule C worksheet instead of doing an override on schedule SE or the Schedule SE Adjustment Worksheet.