- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

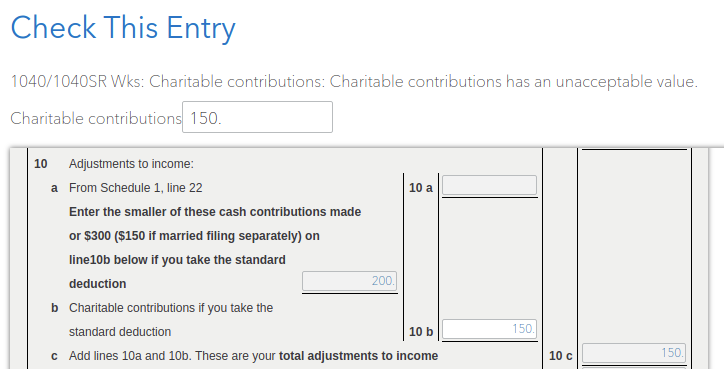

- Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

There is a known issue that produces the message, Charitable contributions has an unacceptable value. Our team is working to fix the software. In the meantime, here are some workaround steps that you can try right now:

- Click Deductions and Credits

- Select Review/Edit

- Click Edit to the right of Standard Deduction

Click OK, Sounds Good - Click Wrap Up Tax Breaks

- Click Continue

- Make sure that $300 is filled in and then click Continue

- Click Lets Keep Going.

If the error persists, then go through the next work around.

Here is the second work around for claiming the Charity Deduction:

- In TurboTax select Federal in the panel on the left

- Select Deductions & Credits at the top of the page

- Under Your Tax Breaks - Charitable Donations

- Click START to the right of Donations to Charity in 2020

- Click YES

- Click ADD next to Money

- Type in the name of the charity that you donated to

- Type the amount of the donation

- Select Done with Donation

- Select Done

Now the deduction should appear on Line 10B and in the Charitable Contributions screen.

How the CARES act changes deducting charitable contributions made in 2020

Previously, charitable contributions could only be deducted if taxpayers itemized their deductions.

- However, taxpayers who don't itemize deductions may take a charitable deduction of up to $300 for cash contributions made in 2020 to qualifying organizations. For the purposes of this deduction, qualifying organizations are those that are religious, charitable, educational, scientific or literary in purpose. The law changed in this area due to the Coronavirus Aid, Relief, and Economic Security Act.

Keep in mind, it is very important to keep records of your charitable contributions. If the IRS asks about them later, they will be denied if you don't have a record, receipt, letter, etc.

Source: ReneeM7122

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

We run into this problem too.

The first workaround didn't work - "Standard Deduction" doesn't appear in the deductions tab anywhere.

So we did the backup workaround and itemized the deduction.

10b is correct but it doesn't pass the "Review"

should we just ignore this error and submit our return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

Yes. There is a known issue with the contributions deduction being finalized. We do not have a estimated date of completion and I suggest you check back often.

There is a problem with the Contributions section of the Itemized deductions and also the above the line $300.00 deduction. Because of the many changes due to the CARES Act, IRS is still developing the forms and publications on this issue. Last update was January 13th where everything is still in draft. Once IRS finalizes the forms, we will be able to update TurboTax to accurately reflect your Contributions deduction.

Here are some of the changes due to the CARES ACT

The new legislation allows tax deductions on two types of charitable gifts. First, it allows up to $300 given to a qualified charity to be claimed as an above-the-line deduction. After the Tax Cuts and Jobs Act, which went into effect in 2018, increased the standard deduction, many taxpayers had less incentive to donate to charities. Instead, they took the standard deduction and stopped itemizing.

For taxpayers who will itemize deductions, the CARES Act effectively suspends the limit on deductions for cash contributions to public charities for 2020. “That allows individuals to completely wipe out their AGI, and their tax liability, with a charitable contribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

Hi;

I have an same issue. I left the box blank empty but I cant skip this. It doesn't pass the review. What we gonna do ? can someone help me please?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

To fix the error, ""Charitable contributions has an unacceptable value," Try these steps:

- Click Deductions and Credits

- Select Review/Edit

- Click Edit to the right of Standard Deduction

Click OK, Sounds Good - Click Wrap Up Tax Breaks

- Click Continue

- Make sure that $300 is filled in and then click Continue

- Click Lets Keep Going

If the error persists, then go through the next work around.

Here is the second work around for claiming the Charity Deduction:

- In TurboTax select Federal in the panel on the left

- Select Deductions & Credits at the top of the page

- Under Your Tax Breaks - Charitable Donations

- Click START to the right of Donations to Charity in 2020

- Click YES

- Click ADD next to Money

- Type in the name of the charity that you donated to

- Type the amount of the donation

- Select Done with Donation

- Select Done

Now the deduction should appear on Line 10B and in the Charitable Contributions screen.

How the CARES act changes deducting charitable contributions made in 2020

Previously, charitable contributions could only be deducted if taxpayers itemized their deductions.

However, taxpayers who don't itemize deductions may take a charitable deduction of up to $300 for cash contributions made in 2020 to qualifying organizations. For the purposes of this deduction, qualifying organizations are those that are religious, charitable, educational, scientific or literary in purpose. The law changed in this area due to the Coronavirus Aid, Relief, and Economic Security Act.

Keep in mind, it is very important to keep records of your charitable contributions. If the IRS asks about them later, they will be denied if you don't have a record, receipt, letter, etc.

@orhanozbek

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

Hi;

Thank for get back to me. I tried this but Unfortunately its still same. Is there any other options? How can I fix this issue ?

Thank you

Sincerely

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

And also I dont want to enter any charitable contribution. Do I have to enter any charitable contribution value?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

Dear @ReneeM7122

Thank for get back to me. I tried this but Unfortunately its still same. Is there any other options? How can I fix this issue ?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

I also have this problem and am unable to get past it using the workaround. I just paid for the software to file my taxes but cannot move forward. Should I wait until the bug is fixed and when will that be?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

Leave the box blank in the Charitable Donations for the Cares Act section. But, you may need to revisit your entries.

The key is the sequencing of the entry in posting cash donations made and having TurboTax recalculate your tax breaks. Anything listed in the Cares Act section before first being entered as a deduction will produce unexpected results.

To do this in TurboTax CD/Download, go to Deductions & Credits and select I'll choose what I work on.

- First, enter in the charitable donation amount as you normally would in the Charitable Donations section of Deductions & Credits.

- When finished entering all donations, select Done with Charitable Donations and Continue.

- Scroll to the end of the Deductions & Credits page and select Done with Deductions.

- You may need to respond to any other additional questions, but eventually see: The Standard Deduction is Right for You!

- Click Continue.

- At Charitable Cash Contributions under Cares Act, you should see any qualified contribution amount already entered from your earlier posts. Select Continue.

For more information, see IRS Charitable Contributions Deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

I'm also having this issue and neither of the provided workarounds seem to work. Is there a way to file despite the error message? How can you guarantee this error will be fixed prior to the filing deadline?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

As you may know, Tax season has been extended to May 17, 2021 because this has been one season for the books. I am unable to guarantee it will be fixed but I can guarantee there will be options. TurboTax is aware of this error but is waiting for IRS to finish creating the forms so that TurboTax can update software to correct the errors. Sorry for the inconvenience, but it will be fixed, but WHEN. No answer yet.

Yes. There is an issue with the contributions deduction and TurboTax is working to fix it. We do not have an estimated date of correction, at this time. I suggest you check back often to see if the correction has been made.

There is a problem with the Contributions section of the Itemized deductions and also the above the line $300.00 deduction. Because of the many changes due to the CARES Act, IRS is still developing the forms and publications on this issue. Last update was January 13th where everything is still in draft. Once IRS finalizes the forms, we will be able to update TurboTax to accurately reflect your Contributions deduction.

Here are some of the changes due to the CARES ACT

The new legislation allows tax deductions on two types of charitable gifts. First, it allows up to $300 given to a qualified charity to be claimed as an above-the-line deduction. After the Tax Cuts and Jobs Act, which went into effect in 2018, increased the standard deduction, many taxpayers had less incentive to donate to charities. Instead, they took the standard deduction and stopped itemizing.

For taxpayers who will itemize deductions, the CARES Act effectively suspends the limit on deductions for cash contributions to public charities for 2020. “That allows individuals to completely wipe out their AGI, and their tax liability, with a charitable contribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

Hello,

I'm still running into errors here and have everything entered correctly. Is there a way to override the error message and submit anyway?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting error: The entry 1040/1040 Wks : Charitable contributions has an unacceptable value. I entered 300 and it shows properly in the form . can you help ?

Do you want to report itemized deductions or the standard deduction and the Charitable Cash Contributions under CARES Act?

To remove the Charitable Cash Contributions under CARES Act, you have to qualify for the standard deduction before the screen Charitable Cash Contributions under CARES Act appears at the end of Deductions & Credits. So you may want to change the value of one or more itemized deductions to $1 so that you qualify for the standard deduction.

If you are in TurboTax Online, the screen Charitable Cash Contributions under CARES Act appears as the end of Deductions & Credits. First you have to pass the screen Based on what you told us, the standard deduction is best for you at the end of Deductions & Credits. Follow these steps:

- At the top of the screen, click on Deductions & Credits.

- Scroll to the bottom of the page and click on Wrap up tax breaks.

- Continue through several screens.

- At the screen Based on what you told us, the standard deduction is best for you, click Continue.

- At the screen Any Charitable Cash Contributions? delete the dollar amount.

- Continue through Federal Review to make sure that things look correct.

- Then restore your itemized deductions dollar amounts.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

branden381

New Member

DALester22

New Member

trader1031

New Member

ahulsey66

New Member

jrneuville

Returning Member