in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- From095-A I must enter0 in ColB for 7mos since not qualified forPTC. 5mos OK. But TTdoesn't allow 0 &says enter in ColB the prem I paid . How to fix IRS vs TT conflict?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

From095-A I must enter0 in ColB for 7mos since not qualified forPTC. 5mos OK. But TTdoesn't allow 0 &says enter in ColB the prem I paid . How to fix IRS vs TT conflict?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

From095-A I must enter0 in ColB for 7mos since not qualified forPTC. 5mos OK. But TTdoesn't allow 0 &says enter in ColB the prem I paid . How to fix IRS vs TT conflict?

Use the higher amount, the SLCSP.

The SLCSP premium is incorrect if:

- Part III, Column B has a “0” or is blank for any month someone in your household had the Marketplace plan

- You had changes in your household that you didn’t tell the Marketplace about — like having a baby, moving, getting married or divorced, or losing a dependent.

If either applies to you, you’ll use the government's tax tool to get the premium for your second-lowest cost Silver plan and fill that cost in column B of form 1095-A. Failure to do this will result in a wrong calculation of the premium tax credit.

If you purchased health insurance coverage through the Marketplace and chose to receive the benefit of advance payments of the premium tax credit, it is important to report certain life events to the Marketplace throughout the year – these events are known as changes in circumstances.

If your household income goes up or the size of your household is smaller than you reported to the Marketplace - for example, because a son or daughter you thought would be your dependent will not be your dependent for the year of coverage - your advance credit payments may be more than the premium tax credit you are allowed for the year. If you report the change, the Marketplace can lower the amount of your advance credit payments. If you don't report the change and your advance credit payments are more than the premium tax credit you are allowed, you have to reduce your refund or increase the amount of tax you owe by all or a portion of the difference when you file your federal tax return.

For the full list of changes you should report, visit HealthCare.gov.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

From095-A I must enter0 in ColB for 7mos since not qualified forPTC. 5mos OK. But TTdoesn't allow 0 &says enter in ColB the prem I paid . How to fix IRS vs TT conflict?

I have the exact same issue here for California. I called covered CA and they said I don't qualify, so the value 0 for column B is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

From095-A I must enter0 in ColB for 7mos since not qualified forPTC. 5mos OK. But TTdoesn't allow 0 &says enter in ColB the prem I paid . How to fix IRS vs TT conflict?

If you were not covered, you were not covered and column B should be left blank (don't enter zeros), but if you were enrolled and covered by the insurance plan, the SLCSP premium is incorrect if:

- Part III, Column B has a “0” or is blank for any month someone in your household had the Marketplace plan

- You had changes in your household that you didn’t tell the Marketplace about — like having a baby, moving, getting married or divorced, or losing a dependent.

If either applies to you, you’ll use the government's tax tool to get the premium for your second-lowest cost Silver plan and fill that cost in column B of form 1095-A. Failure to do this will result in a wrong calculation of the premium tax credit. @jox_tax

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

From095-A I must enter0 in ColB for 7mos since not qualified forPTC. 5mos OK. But TTdoesn't allow 0 &says enter in ColB the prem I paid . How to fix IRS vs TT conflict?

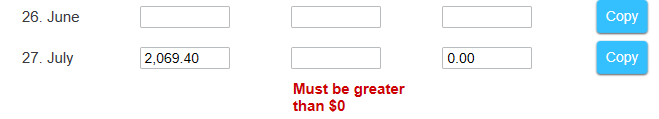

Thanks @DawnC , but the issue is TT doesn't allow me to leave it blank or enter 0. It throws error saying "Must be greater than $0". How do I get around it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

From095-A I must enter0 in ColB for 7mos since not qualified forPTC. 5mos OK. But TTdoesn't allow 0 &says enter in ColB the prem I paid . How to fix IRS vs TT conflict?

You need to use the tool on Healthcare.gov to get the correct amount to enter in column B. The SLCSP premium is incorrect if:

- Part III, Column B has a “0” or is blank for any month someone in your household had the Marketplace plan

- You had changes in your household that you didn’t tell the Marketplace about — like having a baby, moving, getting married or divorced, or losing a dependent.

If either applies to you, you’ll use the government's tax tool to get the premium for your second-lowest cost Silver plan and fill that cost in column B of form 1095-A. Failure to do this will result in a wrong calculation of the premium tax credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

From095-A I must enter0 in ColB for 7mos since not qualified forPTC. 5mos OK. But TTdoesn't allow 0 &says enter in ColB the prem I paid . How to fix IRS vs TT conflict?

Thanks for the responses. The problem still is that the TurboTax screen does not allow me to enter $0 or leave blank for any of the monthly fields for column (b) for 1095-A. TurboTax shows a red error message saying that all the monthly values must be greater than $0. How do I enter $0 or leave blank in TTax?

Still another question that was explained in my original story. The Healthcare Marketplace website for my revised 1095-A came back with blank $ for the 7 months I had 2 insurances. So is it true that I

leave blank in Col (B) for 1095-A data entry in TTax for these 7 months I was not qualified

for the Premium Tax Credit (PTC)... Even though the gov't paid the Marketplace insurance company

the PTC for all 12 months? So if I should leave column B blank for 7 months, HOW do I get around the TTax

error message that requires a Col B values greater than $0? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

From095-A I must enter0 in ColB for 7mos since not qualified forPTC. 5mos OK. But TTdoesn't allow 0 &says enter in ColB the prem I paid . How to fix IRS vs TT conflict?

You might want to delete and reenter your Form 1095-A.

To delete the Form:

- Log into your TurboTax Online account

- Select Tax Tools once your in your Tax Home

- Select Tax Tools from the left side of your screen

- Select Tools

- Select Delete a Form

- Select Delete next to the 1095-A

To enter it again:

- Open or continue your return

- Select Search and enter 1095-a

- Select Jump to 1095-a

- Answer Yes and enter your 1095-A info on the next screen

- We don't need all the info from your 1095-A. We'll only ask about the info that affects your return.

Make sure to leave any blank spaces blank and only enter information on the boxes with amounts.

Please let us know if you continue having issues.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rmilling3165

Level 3

sam992116

Level 4

corbi

New Member

roblesrican

New Member

mlynn88

New Member

Want a Full Service expert to do your taxes?