- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Form1009R Smart Work Sheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form1009R Smart Work Sheet

When I run the error check I show 1 Error

Line 26d $6000 shows in that box

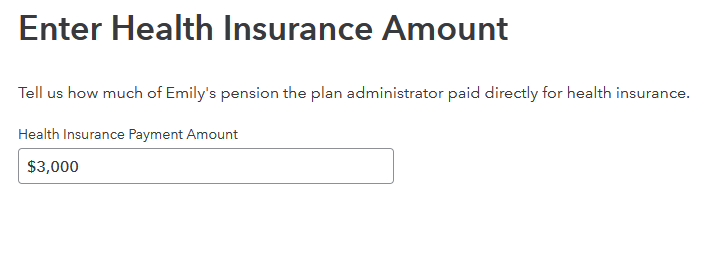

The error states that the amount can not be more then $3000

$6922.96 as shown on my 1099 R ( box5). That amount was deducted from my retirement to pay for my Medical Insurance Premium (Blue Cross and Shield).

Where is this number on the work sheet drawn from and how do I correct this error?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form1009R Smart Work Sheet

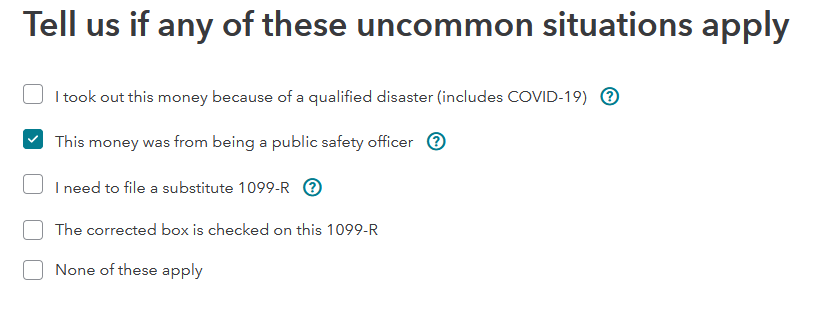

You must be receiving a public safety officer pension. Retired public safety officers may elect to exclude from income a portion of their distributions made from an eligible retirement plan to pay for premiums for accident, health, or long-term care insurance. The total exclusion cannot exceed $3,000. The premium amount is not included in income.

You will need to go through and correct your 1099R form for the maximum amount of $3000. After you have logged in and are in your return in TurboTax Online:

- Go to Search at the top of the screen.

- Enter Form 1099-R in the search box.

- You will see a Jump To function that will take you to the 1099-R input screens.

- There select the 1099R for your pension and edit.

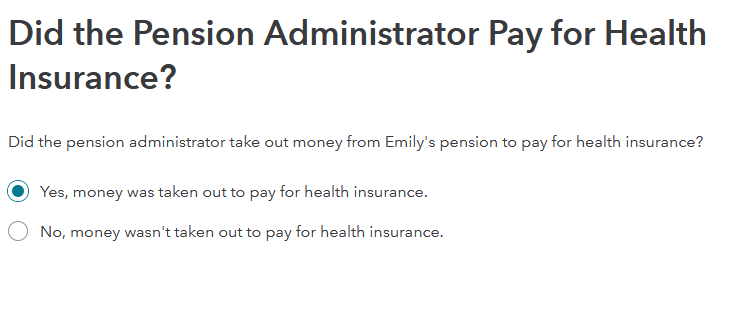

Continue through till you find the PSO pension question. The following screen you will enter the amount of your health insurance. If that does not clear the error, you may need to delete the 1099R and re-enter.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

broyae4281

New Member

spiralham

New Member

mcintyre210

Level 3

paulinus49

Level 2

alimpich

Returning Member