- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

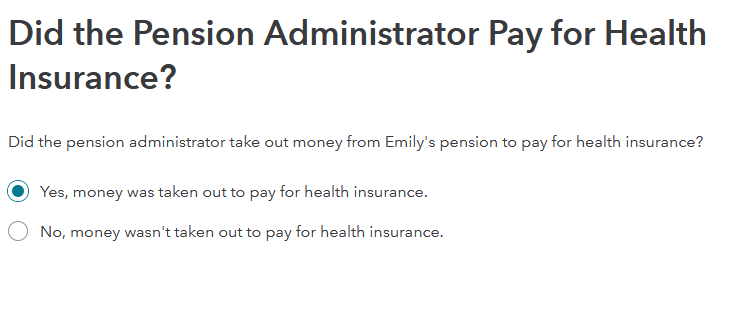

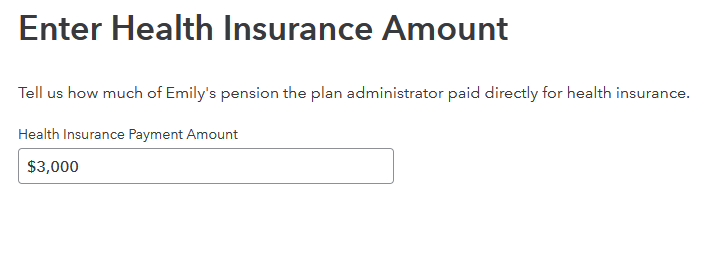

You must be receiving a public safety officer pension. Retired public safety officers may elect to exclude from income a portion of their distributions made from an eligible retirement plan to pay for premiums for accident, health, or long-term care insurance. The total exclusion cannot exceed $3,000. The premium amount is not included in income.

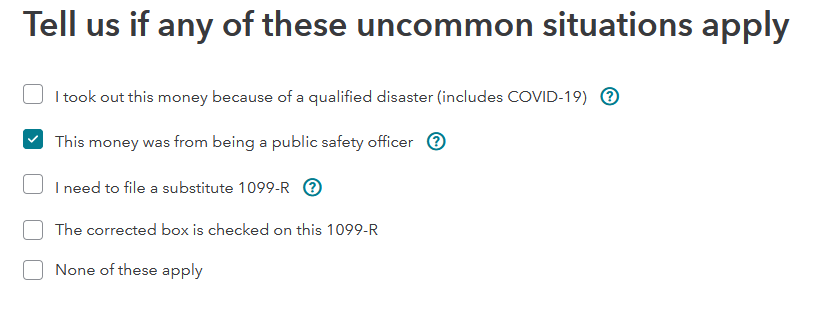

You will need to go through and correct your 1099R form for the maximum amount of $3000. After you have logged in and are in your return in TurboTax Online:

- Go to Search at the top of the screen.

- Enter Form 1099-R in the search box.

- You will see a Jump To function that will take you to the 1099-R input screens.

- There select the 1099R for your pension and edit.

Continue through till you find the PSO pension question. The following screen you will enter the amount of your health insurance. If that does not clear the error, you may need to delete the 1099R and re-enter.

February 23, 2021

1:57 PM