- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Form 8606 is NOT Automatically Generating

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 is NOT Automatically Generating

2022 Tax Return - the 1099-R includes an amount for a Qualified Charitable Distribution. (There were no contributions to the IRA in 2022 and it was not created by any means other than contributions while I was working) However, Form 8606 has not been automatically generated. The Turbo Tax "solution" is that I go to the IRS Website, download the form myself paper mailing it in with my tax return.

Any tips on getting Form 8606 to auto-generate as the Turbo Tax site says it will?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 is NOT Automatically Generating

We'll automatically generate and fill out Form 8606 (Nondeductible IRAs) if you reported any of these on your tax return:

- Nondeductible contributions made to a traditional IRA

- Distributions from a traditional, SEP, or SIMPLE IRA that had nondeductible contributions (excluding rollovers, conversions, recharacterizations, qualified charitable distributions, one-time distribution to fund an HSA, or return of certain contributions)

- Conversions from a traditional, SEP, or SIMPLE IRA to a Roth IRA

- Distributions from a Roth IRA (other than rollovers, recharacterizations, or a return of certain contributions)

Since you had no non-deductible contributions to report in 2022, Form 8606 was not generated for you.

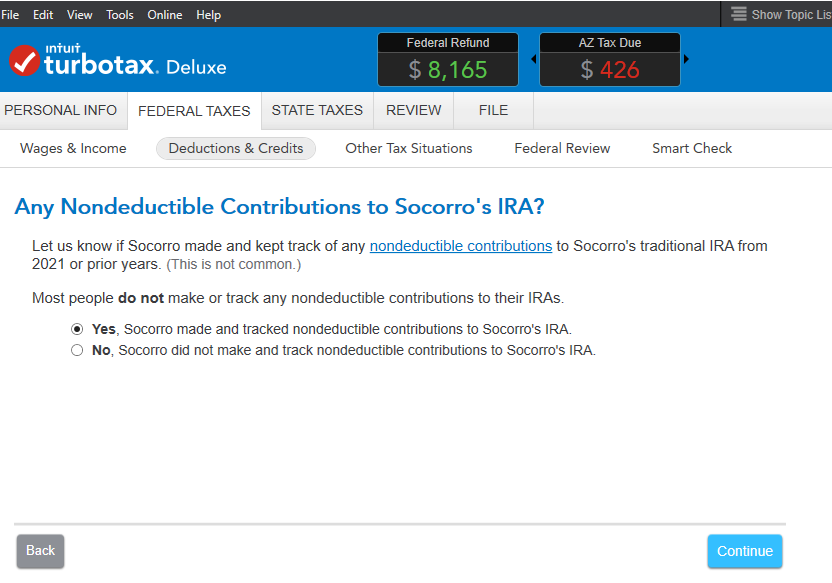

However, if you had prior year non-deductible contributions, you can trigger Form 8606 by answering YES to 'prior year non-deductible contributions' in the IRA Contributions section. You will enter the Basis from your most recent Form 8606.

Here's more info on Form 8606.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 is NOT Automatically Generating

QCDs are not to be reported on Form 8606 because QCDs come only from the pre-tax portion of your IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 is NOT Automatically Generating

Thank you - I think that I have asked the wrong question!

Let me try again - 1099-R has a place for Qualified Charitable Distribution. When that amount is filled in, does it auto-populate any other form? If so, what is that form?

It looks like I can add specific information about where the QCD gift(s) went. Is this suggested or required by the IRS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 is NOT Automatically Generating

A Form 1099-R provided by the payer does not have a place to indicate a QCD. The payer just reports a normal distribution on Form 1099-R. It's up to you to indicate that this is a QCD by answering TurboTax's question in step-by-step mode of the CD/download version or by marking the checkbox in the online version of TurboTax to indicate that some or all of the distribution was a QCD and the amount. TurboTax will include the QCD amount on line 4a of Form 1040 but exclude it from line 4b and will include the notation "QCD" next to line 4b.

TurboTax does not ask anything about the specifics of the QCD other than the amount. It's your responsibility to keep documentation that supports the fact that you made a charitable contribution in case the IRS questions the reporting of the QCD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 is NOT Automatically Generating

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pjd1954

New Member

LionsTIgersBearsRavens

Level 2

garrettbuck512

New Member

love-the-irs

Level 2

dmgsdad

New Member