- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

We'll automatically generate and fill out Form 8606 (Nondeductible IRAs) if you reported any of these on your tax return:

- Nondeductible contributions made to a traditional IRA

- Distributions from a traditional, SEP, or SIMPLE IRA that had nondeductible contributions (excluding rollovers, conversions, recharacterizations, qualified charitable distributions, one-time distribution to fund an HSA, or return of certain contributions)

- Conversions from a traditional, SEP, or SIMPLE IRA to a Roth IRA

- Distributions from a Roth IRA (other than rollovers, recharacterizations, or a return of certain contributions)

Since you had no non-deductible contributions to report in 2022, Form 8606 was not generated for you.

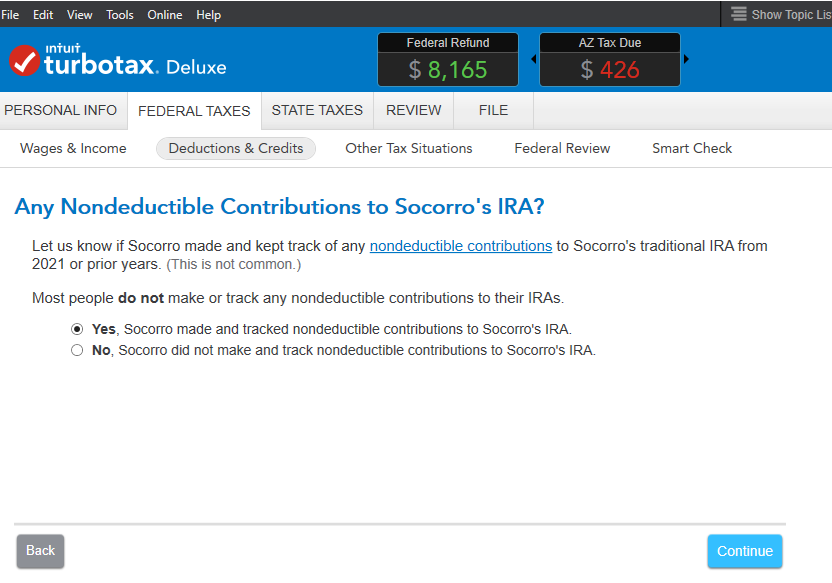

However, if you had prior year non-deductible contributions, you can trigger Form 8606 by answering YES to 'prior year non-deductible contributions' in the IRA Contributions section. You will enter the Basis from your most recent Form 8606.

Here's more info on Form 8606.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 24, 2023

1:05 PM