- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- For some reason, my New York State teacher retirement income is NYS taxable in Turbotax. How so I fix this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For some reason, my New York State teacher retirement income is NYS taxable in Turbotax. How so I fix this

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For some reason, my New York State teacher retirement income is NYS taxable in Turbotax. How so I fix this

You need to indicate that its a New York State Teacher's Retirement in the federal portion of the interview, after entering the 1099-R form.

- Where Is This Distribution From? Choose New York State and City Education and put the dollar amount under New York Distribution Amount.

- On the next screen, select "Qualified Retirement Plan"

- continue with the remaining screens, which will impact its taxability on the federal level

Make sure you look at the IT-201 before filing. The full amount of the income will be on line 10, the full amount of the subtraction will be on Line 26. You will not be limited to $20,000. If you are only seeing the $20k subtraction, you have not made the indications above in the Federal Taxes area for 1099-R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For some reason, my New York State teacher retirement income is NYS taxable in Turbotax. How so I fix this

You need to indicate that its a New York State Teacher's Retirement in the federal portion of the interview, after entering the 1099-R form.

- Where Is This Distribution From? Choose New York State and City Education and put the dollar amount under New York Distribution Amount.

- On the next screen, select "Qualified Retirement Plan"

- continue with the remaining screens, which will impact its taxability on the federal level

Make sure you look at the IT-201 before filing. The full amount of the income will be on line 10, the full amount of the subtraction will be on Line 26. You will not be limited to $20,000. If you are only seeing the $20k subtraction, you have not made the indications above in the Federal Taxes area for 1099-R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For some reason, my New York State teacher retirement income is NYS taxable in Turbotax. How so I fix this

I select the "New York State and City Education" option under "Where Is Thsi Distribution From?" but when I continue ond and then come back to check the entry the system keeps changing my selection to "US Government (Including Military). How do I keep this so the distribution selection remain "New York State and City Education"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For some reason, my New York State teacher retirement income is NYS taxable in Turbotax. How so I fix this

I have done everything you suggest in this reply. TT is exempting the total teacher pension, $38,000, AND the $20,000 pension exclusion for a total exemption of $58,000. This can't be right. How can it exempt more than I'm making? There are no other pensions, IRA dist or annuities. How to fix this? Do I need to start over?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For some reason, my New York State teacher retirement income is NYS taxable in Turbotax. How so I fix this

On the "Where Is This Distribution From", you need to select "Not eligible for exclusion for those over age 59 1/2. This will allow you get the full exclusion of your retirement distribution without TT adding the $20,000 pension exclusion. This screen in TT is VERY confusing because they are asking 2 different things here - where the distribution comes from (which you never get to answer), and if you should be exempt from NYS $20,000 pension exclusion. TurboTax really needs to fix this as there are probably people out there getting taxed on a large portion of their non-taxed pension!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For some reason, my New York State teacher retirement income is NYS taxable in Turbotax. How so I fix this

Indeed! It's confusingly written.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For some reason, my New York State teacher retirement income is NYS taxable in Turbotax. How so I fix this

This solution does not work no matter what I do. I am at the point where I will need to get a new program from some other source. When I try to check “New York State and City Education” as source of pension it automatically overrides it every time and makes it government employee (icluding Military) None of the online solutions work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For some reason, my New York State teacher retirement income is NYS taxable in Turbotax. How so I fix this

Follow these steps.

For TY 2024, on the federal side, you will select qualified plan, not disaster, periodic, cashed it and other answers along the way.

The state section is where the changes take place.

Federal

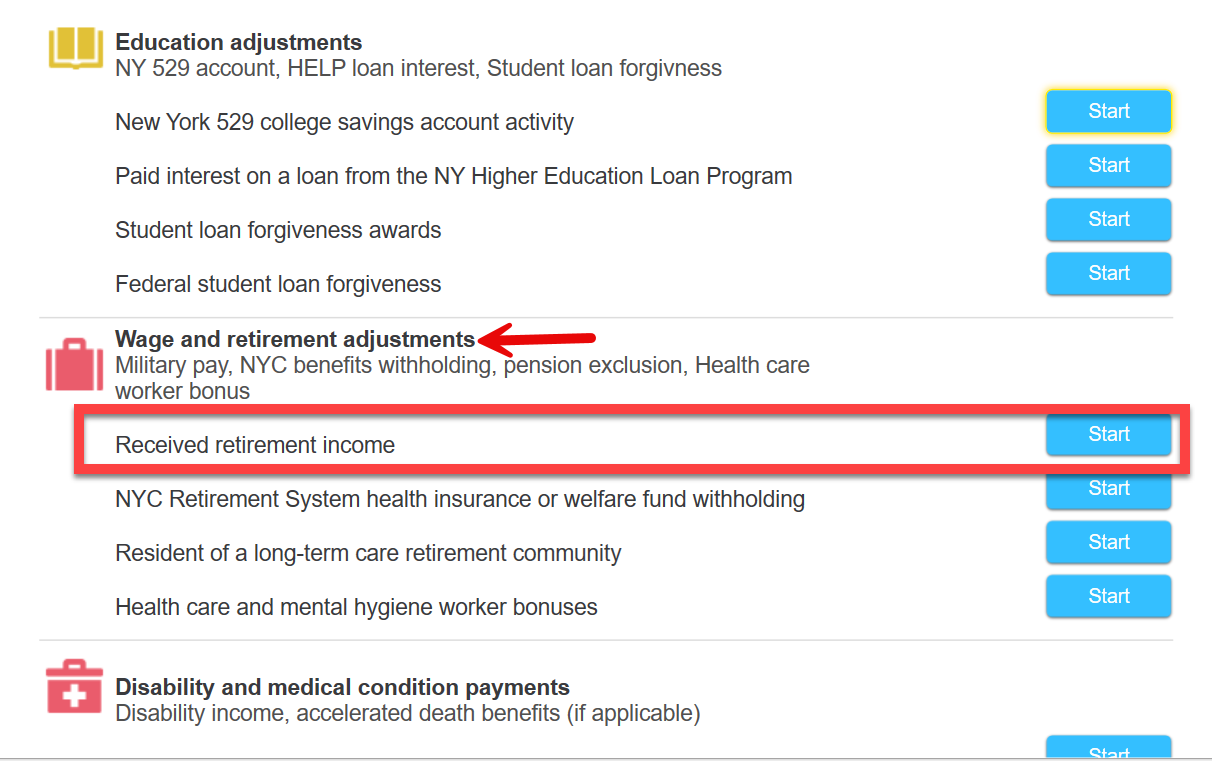

In the NY program, go thought until you reach Changes to Federal Income.

Select Received Retirement Income

You have to select Edit to your retirement distribution

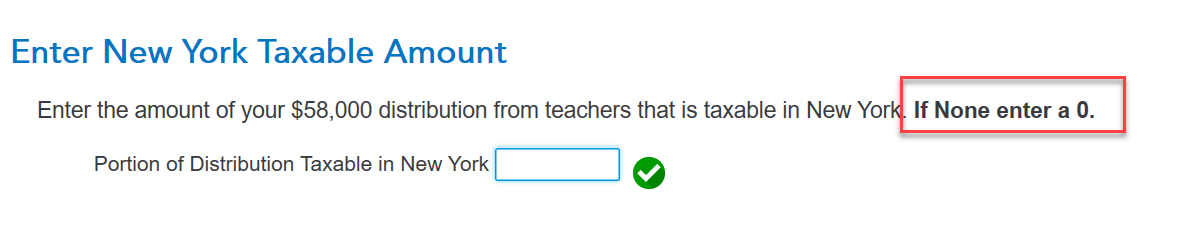

Enter the taxable portion. If all of it is nontaxable, enter zero.

Select Done

@Rostron1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DenverDad

Level 4

mdktech24

Level 3

Sherry B

Returning Member

saylor

New Member

gir0106

New Member