- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Follow these steps.

For TY 2024, on the federal side, you will select qualified plan, not disaster, periodic, cashed it and other answers along the way.

The state section is where the changes take place.

Federal

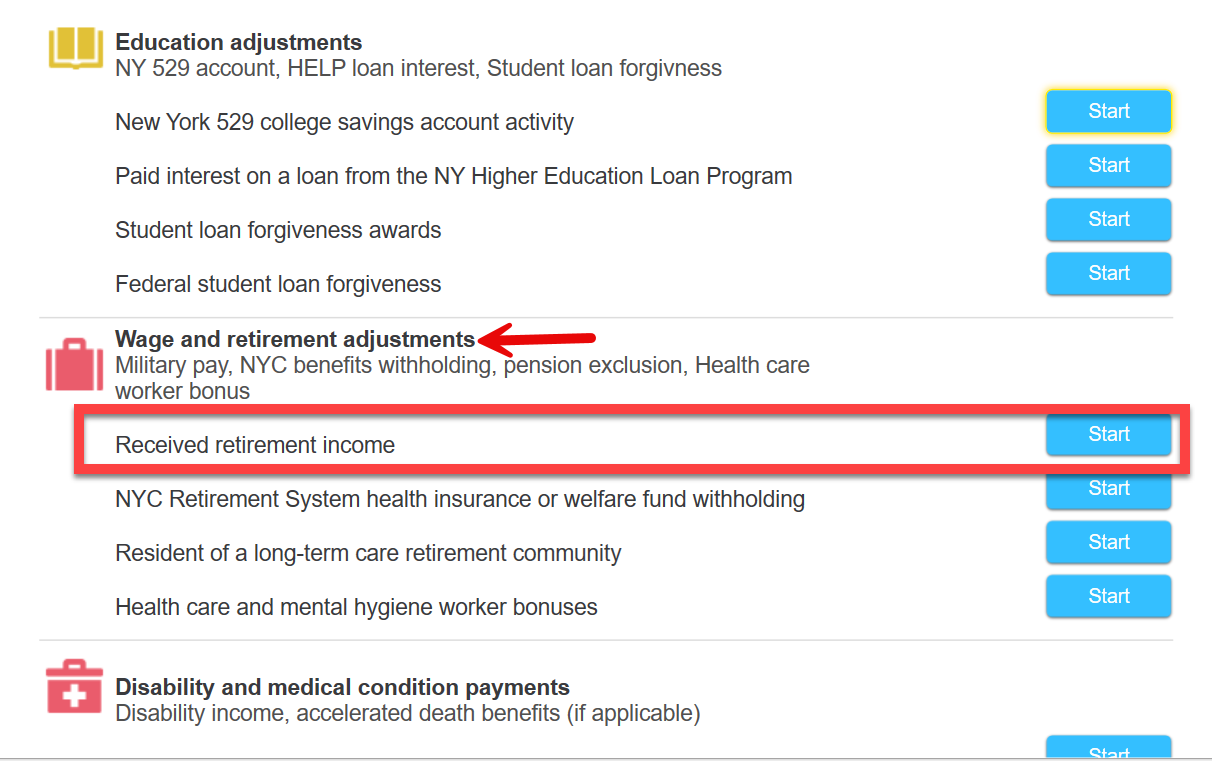

In the NY program, go thought until you reach Changes to Federal Income.

Select Received Retirement Income

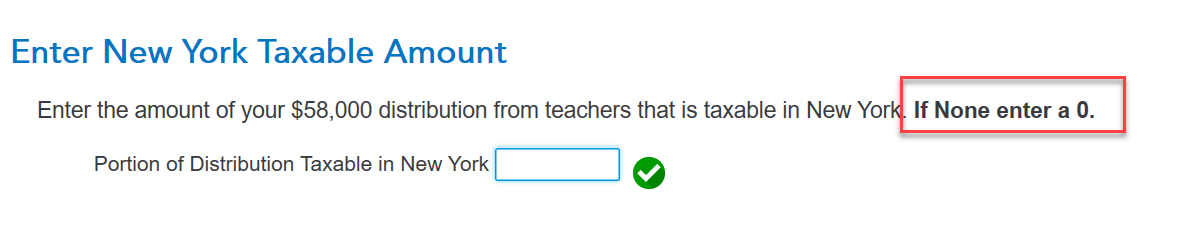

You have to select Edit to your retirement distribution

Enter the taxable portion. If all of it is nontaxable, enter zero.

Select Done

@Rostron1

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 7, 2025

9:40 AM