- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- For 2021, is the medical exception on early retirement distributions in excess of 7.5% or 10% of AGI? Turbotax says 7.5% but the IRS website says 10% for 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2021, is the medical exception on early retirement distributions in excess of 7.5% or 10% of AGI? Turbotax says 7.5% but the IRS website says 10% for 2021.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2021, is the medical exception on early retirement distributions in excess of 7.5% or 10% of AGI? Turbotax says 7.5% but the IRS website says 10% for 2021.

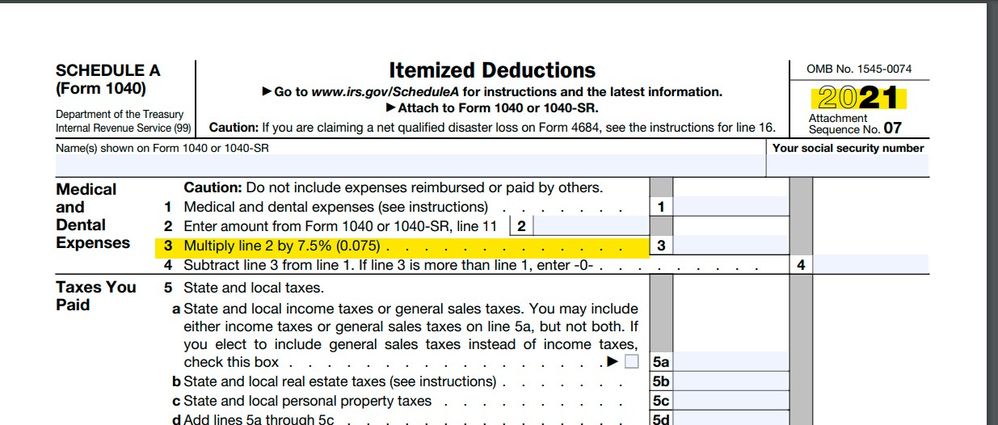

Best place to get the answer is on the form itself ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2021, is the medical exception on early retirement distributions in excess of 7.5% or 10% of AGI? Turbotax says 7.5% but the IRS website says 10% for 2021.

7.5% of AGI. It's defined in section 72(t)(2)(B) of the tax code to be the same as the amount of uncompensated medical expenses deductible on Schedule A determined without regard to whether or not one itemizes deductions. The percentage shown on Schedule A line 3.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2021, is the medical exception on early retirement distributions in excess of 7.5% or 10% of AGI? Turbotax says 7.5% but the IRS website says 10% for 2021.

Thank you. Can't argue with the form and the law itself. I wonder why they have this wrong on their website. They call out 2021 specifically vs the previous years. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distri...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2021, is the medical exception on early retirement distributions in excess of 7.5% or 10% of AGI? Turbotax says 7.5% but the IRS website says 10% for 2021.

See page 25 of 2021 IRS Pub 590-B for the correct information: https://www.irs.gov/pub/irs-prior/p590b--2021.pdf

That IRS web page is simply wrong because it has not been updated to reflect the law change provided in the Taxpayer Certainty and Disaster Tax Relief Act of 2020 which made 7.5% permanent. It was previously scheduled to revert to 10% in 2021.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

BillyWoolfolk

Returning Member

CRAM5

Level 2

kejjp00

Returning Member

fpho16

New Member

janak4x4

New Member