- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Early IRA distribution under CARES act

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Early IRA distribution under CARES act

Soon to be March. Any word yet on when 8915-E will be incorporated?

-- Never mind, I see it's there already.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Early IRA distribution under CARES act

I've been told its been implemented. I haven't looked yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Early IRA distribution under CARES act

Form 8915-E is available in TurboTax CD/Download and Online versions

Please make sure your program is up-to-date. In TurboTax CD/Download, you will be prompted to download any updates available when you open the program. You can also update the program while you have it open by following these steps:

- Click on the Online link in the black bar at the top of the page.

- Click on Check for Updates.

- TurboTax will download and install any updates available. If there aren't any updates, you will receive the message "Your software is up to date."

TurboTax Online automatically updates the website when the forms become available.

Be sure you go through the 1099R entry screens again. In the screens following the 1099-R entry screen:

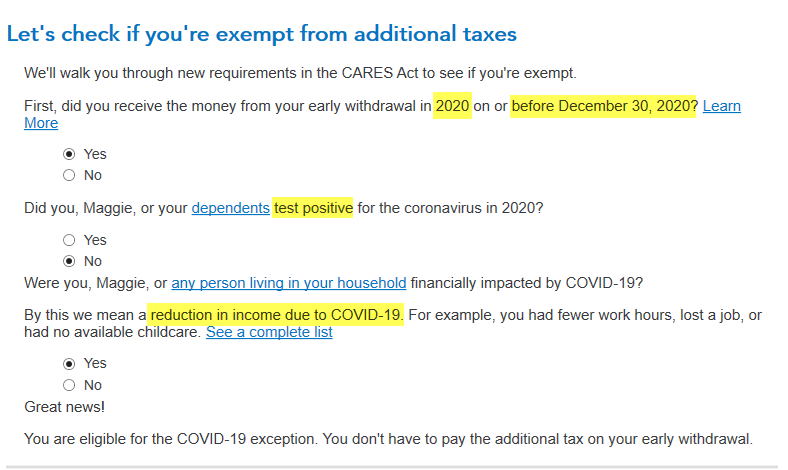

- You will see a series of questions to see if you are exempt from the additional taxes on early withdrawals [Screenshot #1, below]; and

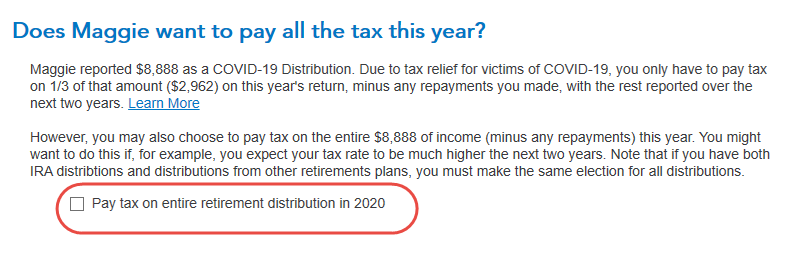

- You will be asked if you want to pay all the tax this year of just 1/3, with the rest reported over the next two years. [Screenshot #2] Check the box if want to pay tax on the entire retirement distribution in 2020.

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Early IRA distribution under CARES act

I received $20,000 as an early withdrawal from my SEP due to Covid hardship during 2020. After Jan 1, 2021 I repaid $10,000 of that early withdrawal. Where do I record this? It is not on my 1099 and I have been told I am not receiving anything from my SEP provider regarding the repayment. It appears that if I open up Form 8915-E, I can record the repayment on line 18. Does this seem correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Early IRA distribution under CARES act

You do not record any repayments made in 2021 on your 2020 tax return. Every year is separate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Early IRA distribution under CARES act

If that is true, why does line 18 say "Enter the total amount of any repayments you made before filing your 2020 tax return. But don’t include any repayments made later than the due date (including extensions) for that return. Don’t use this form to report repayments of qualified 2016, 2017, 2018, or 2019 disaster distributions." ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Early IRA distribution under CARES act

@pepper wrote:

If that is true, why does line 18 say "Enter the total amount of any repayments you made before filing your 2020 tax return. But don’t include any repayments made later than the due date (including extensions) for that return. Don’t use this form to report repayments of qualified 2016, 2017, 2018, or 2019 disaster distributions." ?

Any repayment made before the May 17 filing date or the extended filing date if an extension was filed or the 2020 tax return was timely filed (which is an automatic extension) is deemed to have been made in 2020, After that it is a 2021 repayment.

Per the form 8915-E rules for line 10 & 18.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Early IRA distribution under CARES act

I took $99k as an early distribution from my IRA due to COVID hardship. I had them withhold plenty of cash to cover the tax. Now, I don't have the second screen shot question appearing for me, asking if I want to pay all the tax this year versus spreading it out over three years. I'm getting $20k back in a refund but I don't want to have the extra tax hanging over my head for the next two years. How can I force that screen to appear?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Early IRA distribution under CARES act

@dealboyd wrote:

I took $99k as an early distribution from my IRA due to COVID hardship. I had them withhold plenty of cash to cover the tax. Now, I don't have the second screen shot question appearing for me, asking if I want to pay all the tax this year versus spreading it out over three years. I'm getting $20k back in a refund but I don't want to have the extra tax hanging over my head for the next two years. How can I force that screen to appear?

It should appear automatically.

If you are using the online version then: Try deleting the 1099-R and the 8915E form and re-enter the 1099-R?

If using the CD/download desktop version then switch to the forms mode and select the 8915E form and near the bottom of Part I you will find "Taxable 3 year spread Worksheet" Check the box to pay it all in 2020, uncheck to spread over 3 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Early IRA distribution under CARES act

Thank You! Thank You! That worked. 😀

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

emijoe

New Member

mustangwh

New Member

phoffman99

New Member

cmusers3

New Member

ktramo17

Level 2