- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Form 8915-E is available in TurboTax CD/Download and Online versions

Please make sure your program is up-to-date. In TurboTax CD/Download, you will be prompted to download any updates available when you open the program. You can also update the program while you have it open by following these steps:

- Click on the Online link in the black bar at the top of the page.

- Click on Check for Updates.

- TurboTax will download and install any updates available. If there aren't any updates, you will receive the message "Your software is up to date."

TurboTax Online automatically updates the website when the forms become available.

Be sure you go through the 1099R entry screens again. In the screens following the 1099-R entry screen:

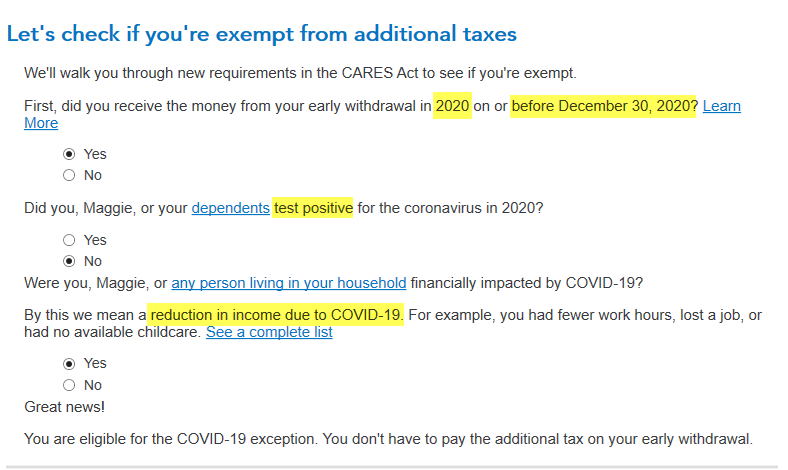

- You will see a series of questions to see if you are exempt from the additional taxes on early withdrawals [Screenshot #1, below]; and

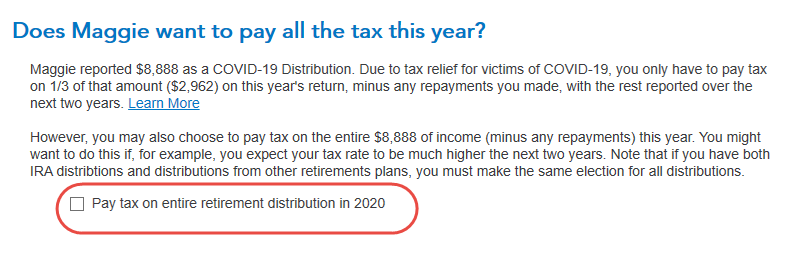

- You will be asked if you want to pay all the tax this year of just 1/3, with the rest reported over the next two years. [Screenshot #2] Check the box if want to pay tax on the entire retirement distribution in 2020.

Screenshot #1

Screenshot #2

March 1, 2021

8:42 AM