- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Dont see a box 10 anything on my 1099-g. only boxes 1 through 4. State refund went down when i just left it blank and continued.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dont see a box 10 anything on my 1099-g. only boxes 1 through 4. State refund went down when i just left it blank and continued.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dont see a box 10 anything on my 1099-g. only boxes 1 through 4. State refund went down when i just left it blank and continued.

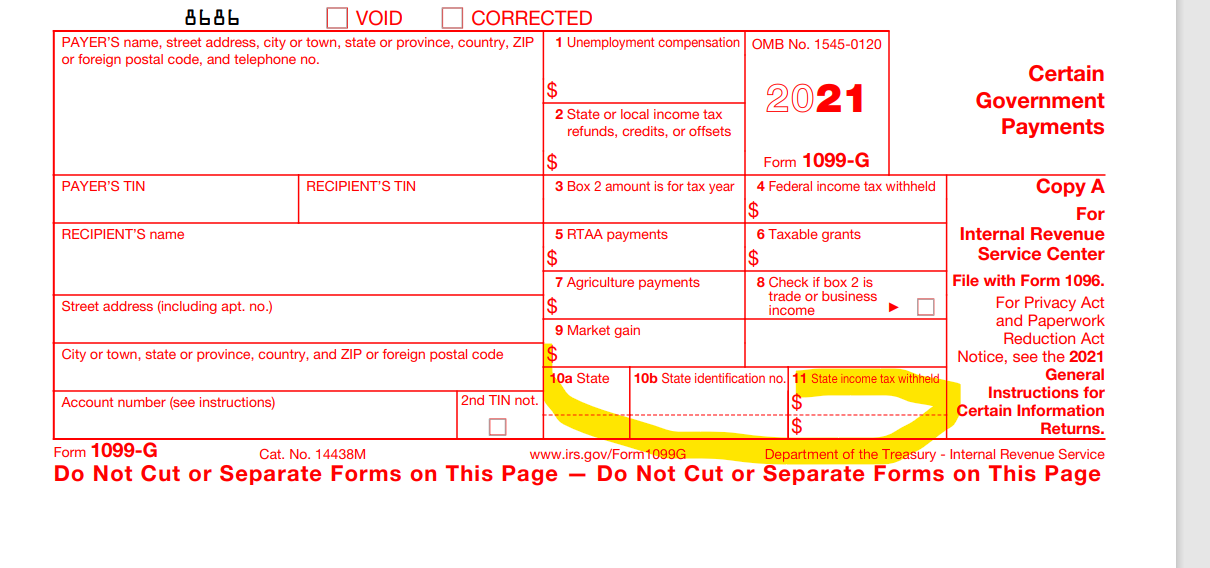

Box 10 shows the amount of state withholding for the 1099-G.

If you had state income tax withheld for the 1099-G, you could enter that into the program. The refund would go down when you enter the income if there was no withholding.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dont see a box 10 anything on my 1099-g. only boxes 1 through 4. State refund went down when i just left it blank and continued.

Okay perhaps I was not clear. Ther is only boxes 1 through 4 on mine. In both table a and table b. Boxes 5 and up aren't just blank. They don't exist. At all. California edd if it makes a difference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dont see a box 10 anything on my 1099-g. only boxes 1 through 4. State refund went down when i just left it blank and continued.

Yes, you are correct that the 1099-G for CA does not have box 10. Box 10 is for state withholding. Since this is a 1099-G for state refund, you do not need to be concerned with Box 10. The state refund would be reported in Box 2.

Typically, state refund is not reported as income on your 2021 return unless you itemized in 2020. If you took the standard deduction in 2020, then you do not have to report the 1099-G for a state refund.

If you did itemize in 2020, you need to enter the 1099-G as income in the Wage and Income section of TurboTax.

Just leave all the boxes blank in TurboTax except for the boxes that are amounts entered on the 1099-G.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dont see a box 10 anything on my 1099-g. only boxes 1 through 4. State refund went down when i just left it blank and continued.

Thank you I figured as much and left it blank. The preview of the state refund was slashed by a pretty significant amount.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

regena767lott

New Member

regena767lott

New Member

iamdanielameri

New Member

Raph

Community Manager

in Events

gjgogol

Level 5