- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

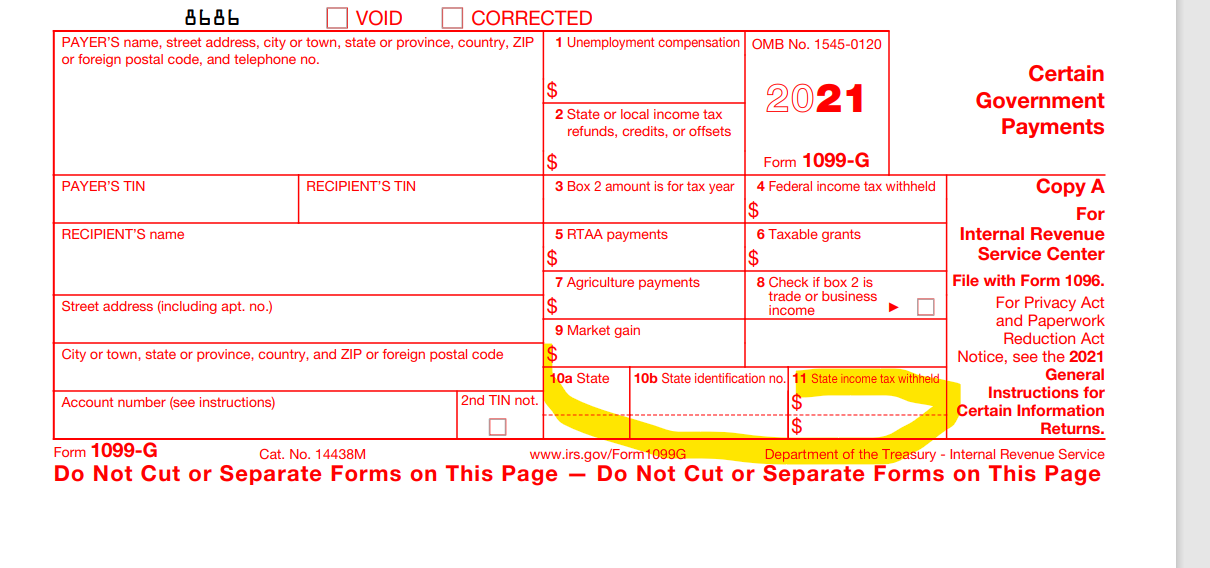

Box 10 shows the amount of state withholding for the 1099-G.

If you had state income tax withheld for the 1099-G, you could enter that into the program. The refund would go down when you enter the income if there was no withholding.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 13, 2022

1:24 PM