- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Do I need to modify anything to enter amounts listed as "Non-STTB" from my K-1 box 20 with code Z? Also a second line labeled Section199A unadjusted basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to modify anything to enter amounts listed as "Non-STTB" from my K-1 box 20 with code Z? Also a second line labeled Section199A unadjusted basis?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to modify anything to enter amounts listed as "Non-STTB" from my K-1 box 20 with code Z? Also a second line labeled Section199A unadjusted basis?

You are entering information that may qualify you for the Qualified Business Income Deduction.

"Non-STTB" sounds like qualified business income (that is not from a specified service trade or business).

"Section 199A unadjusted basis" is the unadjusted basis of qualified property held by the corporation.

Enter both figures as reported on the K-1. Hopefully, you will qualify for a deduction from your taxable income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to modify anything to enter amounts listed as "Non-STTB" from my K-1 box 20 with code Z? Also a second line labeled Section199A unadjusted basis?

My question is very similar...

On my K-1 (Form 1065), I have a second page called a K-1 Statement. The following is listed...

Section 199A Information (Code Z)

Income Items

Rental Real Estate Income $-1,314 (Non-SSTB)

Additional Information

Section 199A unadjusted basis $70,951 (Non-SSTB)

When using the "Easy Step" for box 20, do I enter both numbers? In other words, it would look like this...

Enter Code Enter Amount

Z - Section 199A information -1,314

Z - Section 199A information 70,951

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to modify anything to enter amounts listed as "Non-STTB" from my K-1 box 20 with code Z? Also a second line labeled Section199A unadjusted basis?

@WinterRain2, thank you for posting your follow-up question. I have the same problem as @daniel-e-peters and never considered simply entering the information for code Z twice on two separate lines. While I don't know if it's right, it sure is reasonable.

@JamesG1, do you know if this is how you're supposed to handle it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to modify anything to enter amounts listed as "Non-STTB" from my K-1 box 20 with code Z? Also a second line labeled Section199A unadjusted basis?

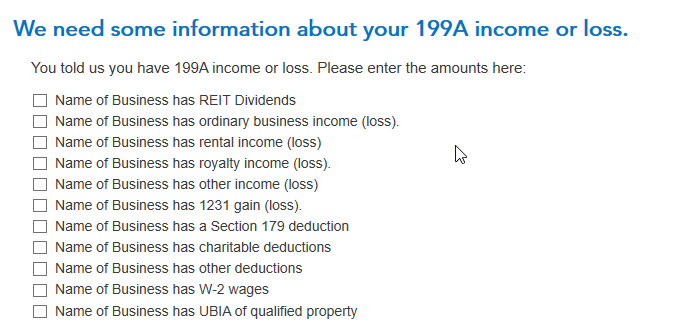

Enter the code Z when you enter the K-1 box 20 screen, but you don't necessarily need to enter an amount here. Continue on, and you'll find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

Note that an "unadjusted basis" amount goes on the "...UBIA of qualified property" line.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

grgarfie

New Member

dinhtran-jd

Level 1

tc32

Level 2

vjohnson44

Level 1

JR500

Level 3