- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Do I include a 1099-R with codes J in box (7) and also with federal and state tax withholding in both the 2017 and 2018 tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I include a 1099-R with codes J in box (7) and also with federal and state tax withholding in both the 2017 and 2018 tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I include a 1099-R with codes J in box (7) and also with federal and state tax withholding in both the 2017 and 2018 tax return?

Code J indicates that there was an early distribution from a ROTH IRA. The amount may or may not be taxable depending on the amount distributed and your basis in the ROTH IRA. TurboTax will walk you through some questions to determine if your distribution is taxable or not.

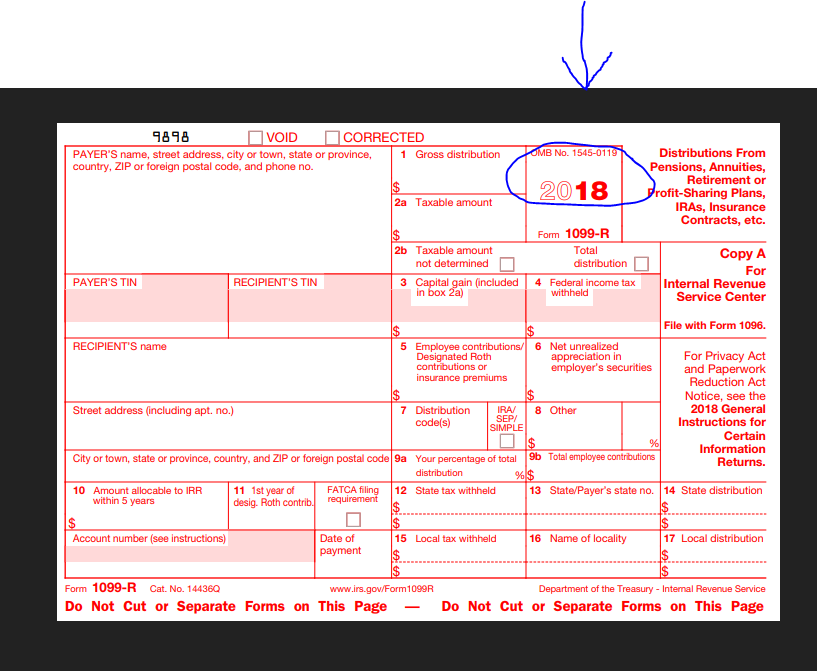

You should only include the Form 1099-R on your Tax Return for the year indicated on the actual Form 1099-R. The year is indicated in the upper right-hand corner of your Form 1099-R. Please click on the screenshot below for reference:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I include a 1099-R with codes J in box (7) and also with federal and state tax withholding in both the 2017 and 2018 tax return?

The only Forms 1099-R that would need to be reported on tax returns for two consecutive years are those with code P in box 7 and that have nonzero amounts in both box 2a and box 4. This would include a Form 1099-R from a Roth IRA that includes both code J and code P in box 7. A Form 1099-R that has no code P in box 7 is only reportable on the tax return that corresponds to the year of the Form 1099-R.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

brendavillafane1

New Member

hjw77

Level 2

HollyP

Employee Tax Expert

HollyP

Employee Tax Expert

abhijaypatne

Level 2