- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

It does not allow me to say "no I did not receive the 1099R"...i am using the online version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

@lashman1 wrote:

It does not allow me to say "no I did not receive the 1099R"...i am using the online version.

Did you already enter a 2021 Form 1099-R? If so, just continue past the screen Review your 1099-R info

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

I followed these directions to a T. When I complete the steps it still says needs review. I called TT and was told I had to upgrade to the live version.

Has anyone heard this before?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

I was able to do it.

I think a previous poster said when you do the review, at that point you say you do not have any more disaster withdrawals. I should still have recorded your other one you did. To check, print out or view .pdf and see.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

No, you do not get a new 1099-R. You did not have a distribution. No, you do not re-enter a 1099-R as it does not apply to this year. You will still go that section. When asked if you have a 1099-R, answer no. Then you will be asked if you made a disaster-related retirement distribution, answer yes.

Follow these steps to enter your information. It is taking a while to get the availability for the form.

Follow these steps to report any further tax to be paid:

- Login to TurboTax

- Click on the Search box on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2021 1099-R answer "No" to "Did you get a 1099-R in 2021?"

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2021?" screen.

You will be guided through the screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

What do we do if we initially selected 'no' to that question?

Can I go back and amend my choice during the 'review' segment?

I was not aware that a Disaster Withdrawal and a Cares Act Withdrawal were interchangeable since there was no verbiage specifically referencing the Cares Act.

I called TT and was told that Covid was 'not designated as a disaster', but that didn't sound correct to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

@MAH7 wrote:

What do we do if we initially selected 'no' to that question?

Can I go back and amend my choice during the 'review' segment?

I was not aware that a Disaster Withdrawal and a Cares Act Withdrawal were interchangeable since there was no verbiage specifically referencing the Cares Act.

I called TT and was told that Covid was 'not designated as a disaster', but that didn't sound correct to me.

Go back to the Wages & Income section, scroll to the bottom of the screen and click on Wrap up income

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

I successfully entered in the Cares Act Withdrawal last year, because I took it in December of 2020), in TurboTax.

(That's why I was confused about it asking me about it this year, because the Cares Act Withdrawal was already confirmed last year.)

So that information is still within the system and will essentially rollover? I don't need to select 'Yes' at all during my process this year? Is TurboTax automatically calculating that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

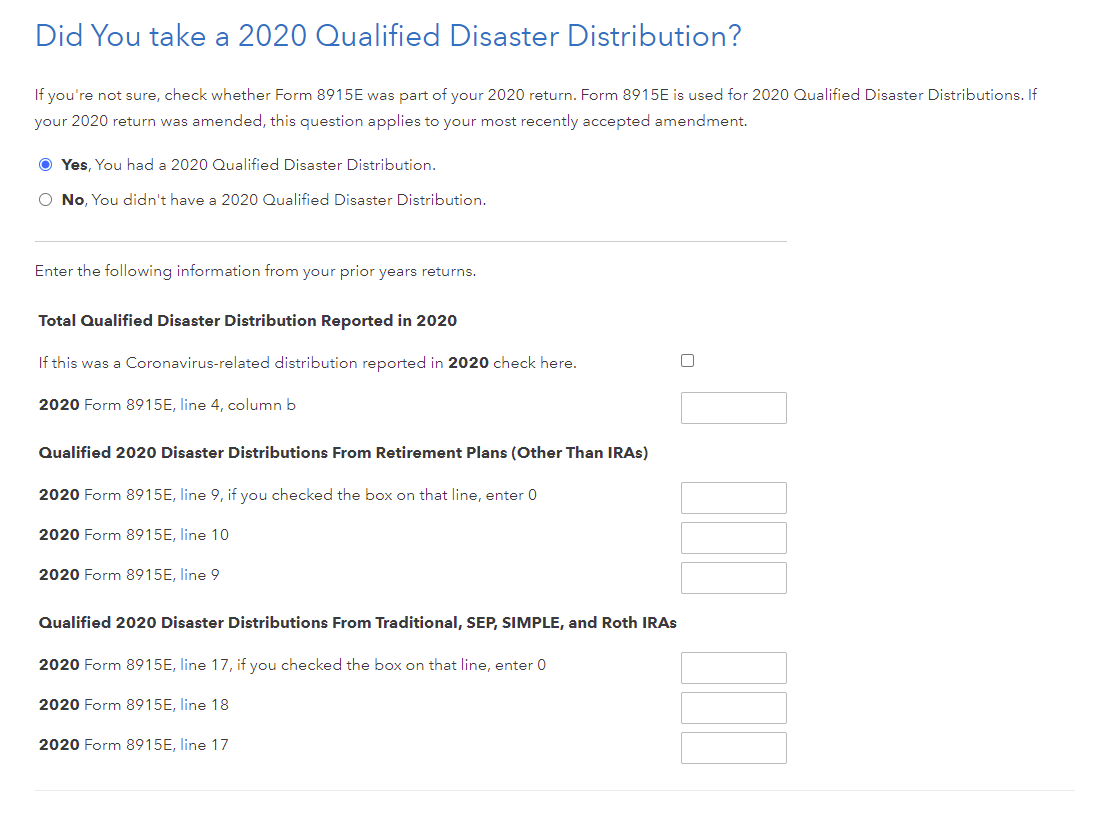

Or if you selected to have the 2020 Coronavirus-related distribution spread over three years then you need to follow this procedure -

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R in 2022

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Leave blank or enter a 0

This is not required on a Form 8915-F for a Coronavirus-related distribution

If the 2020 distribution was from an account that was Not an IRA

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

2020 Form 8915E, line 9, if you checked the box on that line, enter 0

2020 Form 8915E Line 9

If the 2020 distribution was from an IRA account

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

2020 Form 8915E, line 17, if you checked the box on that line, enter 0

2020 Form 8915E Line 17

Do not enter anything in the other boxes, leave them blank (empty)

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

NOTE - During Federal Review you may get a notice to check an entry. Clicking Check Entries takes you to the Check This Entry screen showing a box for entering a FEMA Disaster name. Put your cursor in the box (click in the box) and then click on the spacebar. Click on Continue On the following screen Run Smart Check Again click on Done.

The Form 8915-F you completed already has the box for the Coronavirus checked on Item D of the form.

As stated on the Form 8915-F -

If your disaster is the coronavirus, check this box ▶ Don’t list the coronavirus in item C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

Thank you so much. This was the exact information that I needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

The expected release date of 3/24/2022 has passed. Is there an updated release date?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

Uh, yes. If you read up a few replies, you can see that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

I did the exact same thing. But my taxable income or my tax return did not change after entering the distribution. Am I doing something wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

@vinay007 wrote:

I did the exact same thing. But my taxable income or my tax return did not change after entering the distribution. Am I doing something wrong?

You have to enter the 2nd year of the 2020 distribution in both boxes.

If the 2020 distribution was from an account that was Not an IRA

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

2020 Form 8915E, line 9, if you checked the box on that line, enter 0

2020 Form 8915E Line 9

If the 2020 distribution was from an IRA account

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

2020 Form 8915E, line 17, if you checked the box on that line, enter 0

2020 Form 8915E Line 17

Do not enter anything in the other boxes, leave them blank (empty)

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

However, if you entered a repayment amount for tax year 2021 then there will not be a taxable amount entered on either Line 4b or 5b if the repayment was equal to or greater than the 2nd year distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

I have a couple of questions:

How do I know that the 10% withheld for federal taxes in 2020 is accounted for? I don't think it was because TT since last year's return, is calculating based on exactly 1/3 of the gross amount. The amount withheld is on the 1099-R, however, I don't think TT is taking it into account. Would I have to amend my 2020 return?

My 8915-E has $100,000 listed under Part I column c, but my distribution was not over 100,000. Is this an error that is affecting the amount of taxes I owe? Line 5 is 0.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HollyP

Employee Tax Expert

navyas

Returning Member

Dawn20

Level 2

rmilling3165

Level 3

in Education

wremstedt

Level 2