- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Can this message be wrong? "It looks like some of your tax forms aren't ready Federal Forms 8606-T Nondeductible IRAs." My 401K plan said I don't need this form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can this message be wrong? "It looks like some of your tax forms aren't ready Federal Forms 8606-T Nondeductible IRAs." My 401K plan said I don't need this form.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can this message be wrong? "It looks like some of your tax forms aren't ready Federal Forms 8606-T Nondeductible IRAs." My 401K plan said I don't need this form.

If you have no IRAs, you have no need for Form 8606.

Examine your Forms 1099-R. If any have the IRA/SEP/SIMPLE box marked or have code J, T or Q in box 7, you do have an IRA (or at least had one at some point in 2019). If none of the Forms 1099-R indicate that you have an IRA, revisit your 1099-R entries to make sure that you have not mistakenly marked the IRA/SEP/SIMPLE box on TurboTax's 1099-R form.

If you made no contributions to IRAs, make sure that you have made no entries under Deductions & Credits -> Retirement and Investments -> Traditional and Roth IRA Contributions. If your TurboTax tax file includes the IRA Contributions Worksheet you can simply delete that worksheet to eliminate any IRA contribution entries that you previously made.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can this message be wrong? "It looks like some of your tax forms aren't ready Federal Forms 8606-T Nondeductible IRAs." My 401K plan said I don't need this form.

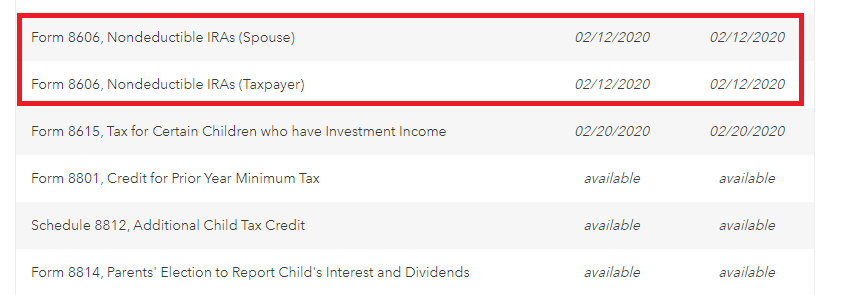

On the file page it says "The IRS hasn't finalized one or more of your forms. Once forms are finalized, you will be able to access this section." So I suppose I need to wait for the IRS? What is the ETA for this form to finalize? Thank you so much for your help! 😅

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can this message be wrong? "It looks like some of your tax forms aren't ready Federal Forms 8606-T Nondeductible IRAs." My 401K plan said I don't need this form.

If you have no IRAs, you have no need for Form 8606.

Examine your Forms 1099-R. If any have the IRA/SEP/SIMPLE box marked or have code J, T or Q in box 7, you do have an IRA (or at least had one at some point in 2019). If none of the Forms 1099-R indicate that you have an IRA, revisit your 1099-R entries to make sure that you have not mistakenly marked the IRA/SEP/SIMPLE box on TurboTax's 1099-R form.

If you made no contributions to IRAs, make sure that you have made no entries under Deductions & Credits -> Retirement and Investments -> Traditional and Roth IRA Contributions. If your TurboTax tax file includes the IRA Contributions Worksheet you can simply delete that worksheet to eliminate any IRA contribution entries that you previously made.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can this message be wrong? "It looks like some of your tax forms aren't ready Federal Forms 8606-T Nondeductible IRAs." My 401K plan said I don't need this form.

Yes, you'll have to wait for the IRS to give us the form and approved us to use the form. See the IRS forms availability for the status of the form.

Please remember, this is only an estimated date.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can this message be wrong? "It looks like some of your tax forms aren't ready Federal Forms 8606-T Nondeductible IRAs." My 401K plan said I don't need this form.

Thank you so much for your reply. I was second guessing myself. As a financial professional, I *know* that I don't have any IRAs. I double checked the sections you specified under 1099r, and this time it allowed me to file without this error. I did not change any information, but maybe going over the 1099rs and the deductions and credits under retirement again was enough for it to clear up. Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kac42

Level 1

rtoler

Returning Member

bees_knees254

New Member

larrylovesnicky

New Member

yingmin

Level 1