- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Can someone point me in the right direction for how to file a form 5329 on my taxes for a missed RMD?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone point me in the right direction for how to file a form 5329 on my taxes for a missed RMD?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone point me in the right direction for how to file a form 5329 on my taxes for a missed RMD?

change your age in personal info to 75 and see if the question comes up.

Don't forget to put it back to your correct age !

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone point me in the right direction for how to file a form 5329 on my taxes for a missed RMD?

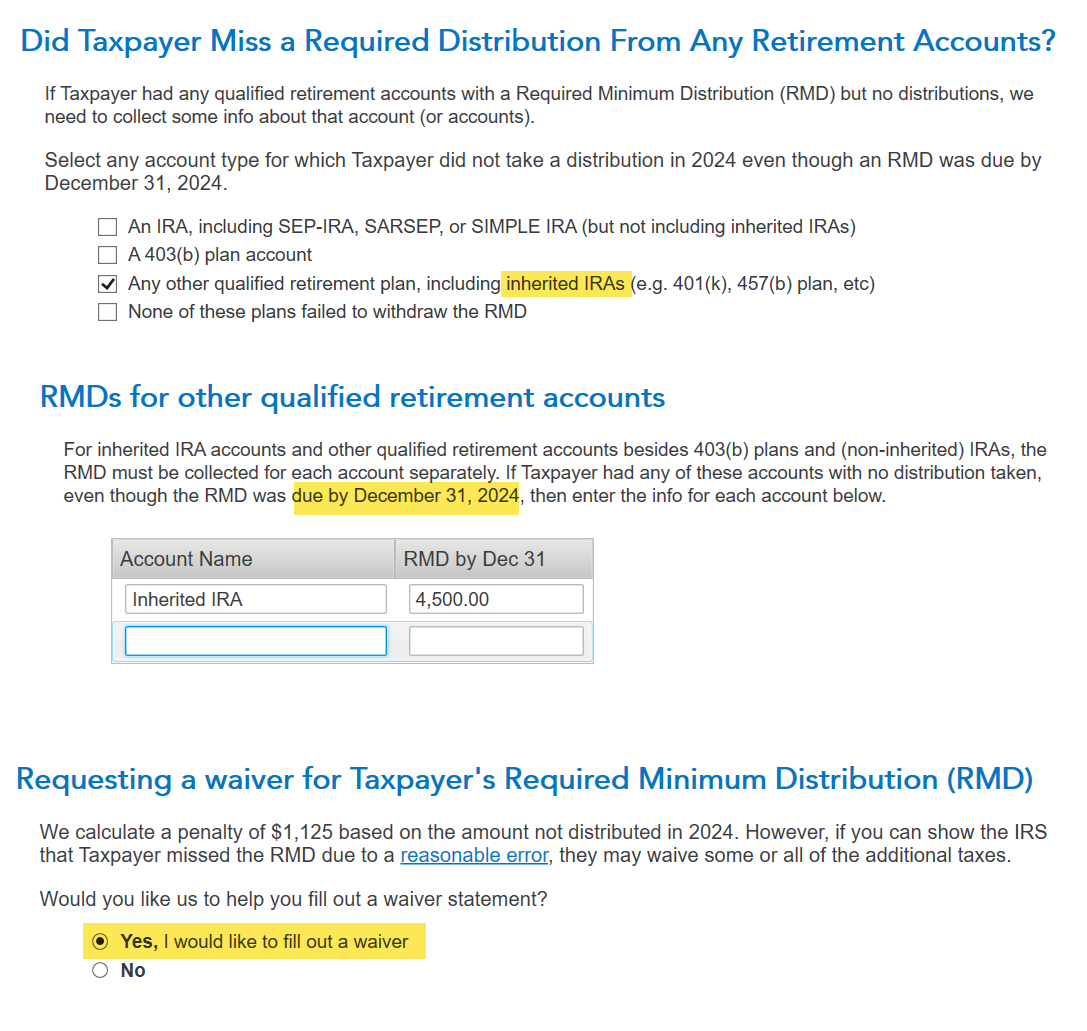

If you didn't take your RMD, TurboTax will fill out Form 5329 for you and attach it to your tax return. To do this, follow the steps below:

- Sign in to your return - Continue in Wages & Income.

- Search for 1099-R and use the Jump to link.

- Either answer NO - I do not have any 1099-R forms, or click on Continue and answer the disaster distribution question.

- On the Did You Miss a Required Distribution From Any Retirement Accounts? page, choose other qualified plan - inherited IRA.

- Enter the RMD amount you did not take by 12/31/24.

- We can help you file a waiver if you have a reasonable cause.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone point me in the right direction for how to file a form 5329 on my taxes for a missed RMD?

Thank you for this. Unfortunately when I don't seem to get to this step:

On the Did You Miss a Required Distribution From Any Retirement Accounts? page, choose other qualified plan - inherited IRA.

Like, after I click "no" on taking a disaster distribution and click on "continue," it just takes me back to the main wages & income page. I don't know if it's because I'm under the usual RMD age, but since this is an inherited IRA I need to be able to access that pathway...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone point me in the right direction for how to file a form 5329 on my taxes for a missed RMD?

If you do not get the "Did You Miss a Required Distribution From Any Retirement Accounts?" screen then you can only file Form 5329 by using the "forms" mode which is only available with the TurboTax Desktop software. You request a waiver of the penalty if you have reasonable cause. Please see Relief for Reasonable Cause for additional information.

Please follow these steps in TurboTax Desktop:

- Enter the forms mode and click on "Open Form" and type "5329".

- Scroll down to Part IX line 52a and enter the RMD amount that should have been taken. On line 53a enter the amount of the RMD that was actually taken (probably zero if it was missed).

- Then in the box right under line 53 "Waiver of Tax Smart Worksheet" enter the same amount as line 52 (the RMD amount) under A.

- Click the "Explanation" button and enter the reason for missing the RMD and your statement requesting a waiver.

If using the TurboTax Online version you will have to prepare the 5329 manually.

Download Form 5329 from the IRS website and fill it out the same as above. Print and mail your return with the 5329 form and explanation attached as described in the 5329 instructions.

The 2024 Form 5329 must be attached to your printed and mailed 2024 tax return and cannot be e-filed.

Please be aware that you can only use this method if you are requesting a waiver of the penalty and there is no taxable amount on Form 5329 form line 55 that must be transferred to Schedule 2 line 8.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone point me in the right direction for how to file a form 5329 on my taxes for a missed RMD?

change your age in personal info to 75 and see if the question comes up.

Don't forget to put it back to your correct age !

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone point me in the right direction for how to file a form 5329 on my taxes for a missed RMD?

Amazing! This was so simple and worked. Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

larryhowellsr9

New Member

littlemac716

New Member

SanDiego25

New Member

mrhackett

New Member

jkeefe0920

Returning Member