- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

If you didn't take your RMD, TurboTax will fill out Form 5329 for you and attach it to your tax return. To do this, follow the steps below:

- Sign in to your return - Continue in Wages & Income.

- Search for 1099-R and use the Jump to link.

- Either answer NO - I do not have any 1099-R forms, or click on Continue and answer the disaster distribution question.

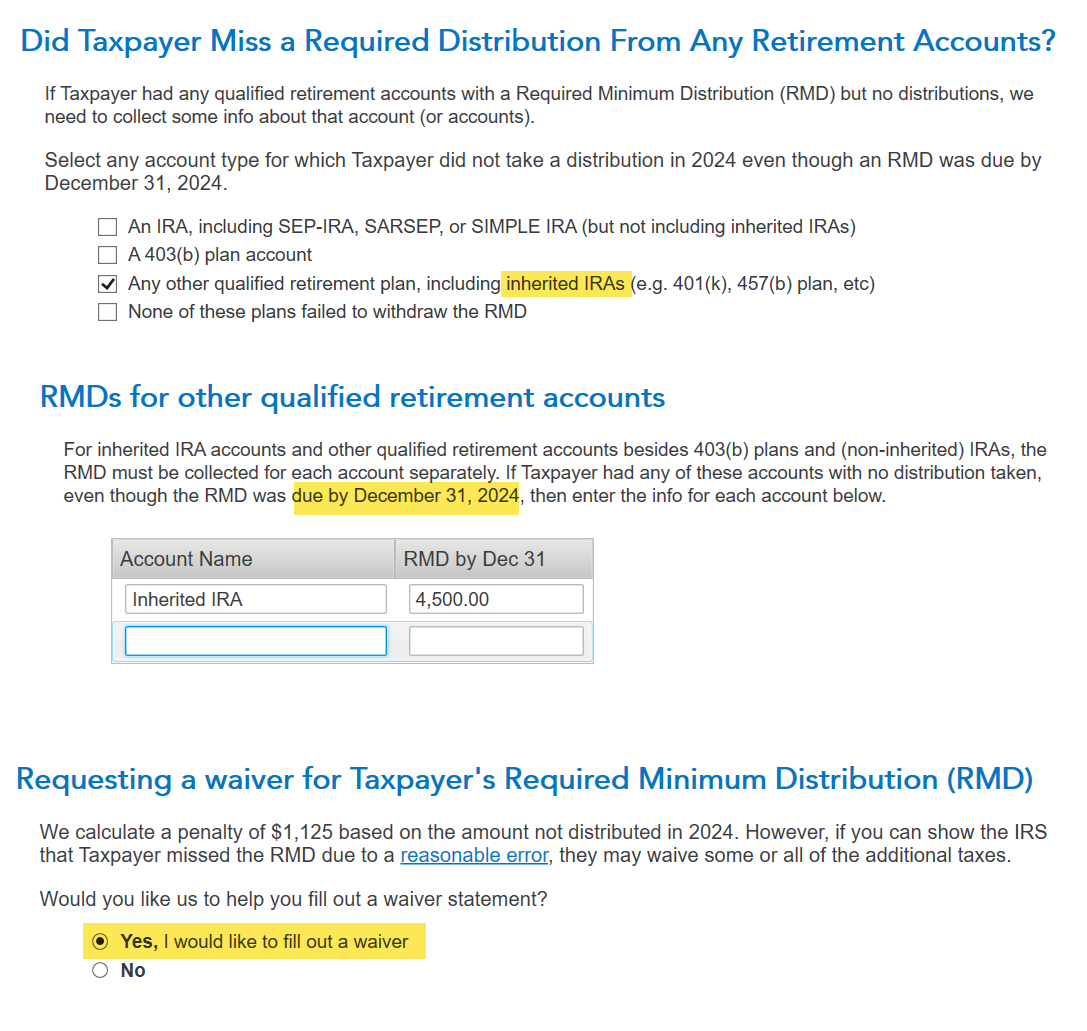

- On the Did You Miss a Required Distribution From Any Retirement Accounts? page, choose other qualified plan - inherited IRA.

- Enter the RMD amount you did not take by 12/31/24.

- We can help you file a waiver if you have a reasonable cause.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 10, 2025

4:03 PM