- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Back door IRA help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

As a beginner, I made a mistake from the very beginning. And it tends to mess up my tax return for 2020. Need your experts' kind help here!

In 2019, I made 2* $6000 contribution to a traditional IRA by mistake on 12/24 and 12/26, respectively. After I realized it, I requested to withdraw the excess amount of contribution which was $6000.

In 2020, Jan 2rd, the withdraw was successful. So I made 2020 traditional IRA contribution of $6000 and convert the total $12000 to a roth IRA.

Then I got two 1099-R froms for 2020, one form has $6000 in box1, $0 in box 2a, unchecked in box2b, code P1 in box 7 and IRA/SEP/SIMPLE box checked. The other has $12000 in box1, $12000 in box 2a, checked in box2b, code 2 in box 7 and IRA/SEP/SIMPLE box checked.

When I input the first 1099-R form, there is no tax penalty added, but when I input the second one, it adds up a few thousands which I know it is not correct. All the money I contributed to the traditional IRA is after-tax and I have never got any tax deduction from IRA, so why turbotax calculates so much extra tax for the second 1099-R?

I followed the step-by-step guidance from this thread: https://ttlc.intuit.com/community/entering-importing/help/how-do-i-enter-a-backdoor-roth-ira-convers..., but it just added up the tax.

Please kindly help!!! Thanks very much!

(p.s. I'll never put myself to this hard situation, just doing the contribution/conversion for the same tax year.)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

Did you report the 2019 contribution as non-deductible on yiur 2019 tax return with an attached 8606 form with the $6,000 on line 1?

If not, then yiu need to amend and enter the contribution in the IRA contribution interview and if you are eligible for a deduction the interview will ask if you want to make some or all non-deductible. Make it all non-deductible. That will produce the 2019 8606 with the $6,000 on line 1,3 and 14.

Enter the 2020 nondeductible contribution the same way.

Use that 2019 8606 line 14 when you enter the 2020 1099-R and are asked for your prior years non-deductible contributions.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

Thanks! I did report 8606 for 2019 and it does show $6000 in line 1, 3, 14.

I did the same thing for the 2020 1099-R, still confused why this time it leads to tax penalties, although box 2b "taxable amount not determined" is checked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

Where do you see penalties? What is on the 1040 form line 4a and 4b?

What on on the 2020 8606 form line 3 and 15-18?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

I found the tax penalty mainly comes after I input $12000 in box 2a, if I leave it blank, everything is fine.

Those $12000 are totally after-tax, and it should NOT be taxed again.

For the 1099-R which summarizes the distribution of $12000 ($6000 from 2019 & $6000 from 2020 traditional IRA to Roth IRA conversion).

It has $12000 in box1, $12000 in box 2a, checked in box2b, code 2 in box 7 and IRA/SEP/SIMPLE box checked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

What is on the 2020 8606 form line 3 and lines 14-18?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

Hi, we were married filing jointly. My spouse did the back door IRA conversion in 2019 as well (contribution/conversion done within the same year 2019), so our total distribution in 1040 4a is $6000, and 4b is 0. I guess that is correct, because from my side, I only made the distribution but not conversion in 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

@crystalPP wrote:

Hi, we were married filing jointly. My spouse did the back door IRA conversion in 2019 as well (contribution/conversion done within the same year 2019), so our total distribution in 1040 4a is $6000, and 4b is 0. I guess that is correct, because from my side, I only made the distribution but not conversion in 2019.

I am confused now. Your original post said you had a 1099-R with $12,000 in box 1. Now you say that it was $6,000 for the other spouse? What happened to the $12,000 code 2 1099-R?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

So far, 2020 form 8606 shows:

line 3: 6000

line 14: 3

line 16: 12000

line 17: 5997

line 18: 6003

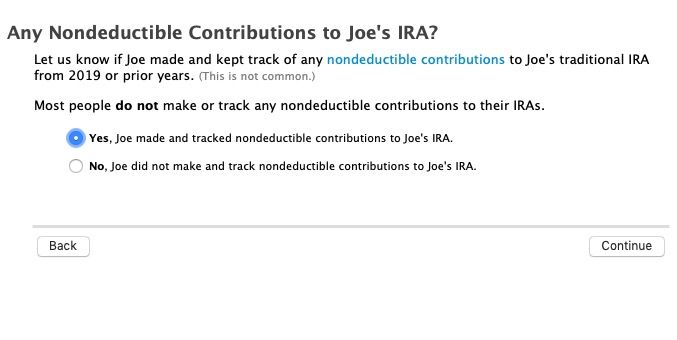

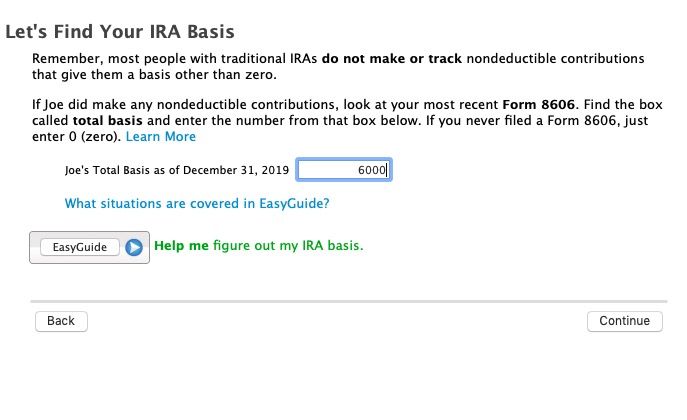

I did put IRA basis as of Dec 31, 2019 as 6000 (because the money sits in traditional IRA and was not converted), is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

Hi there,

The original post is just questions for my self only.

I have two 1099-R forms myself. The first one $6000 is for excess amount withdraw, the second one $12000 is for roth IRA conversion.

(My spouse had one 1099-R form in 2020, and that one has no problem when I add it to turbotax.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

@crystalPP wrote:

So far, 2020 form 8606 shows:

line 3: 6000

line 14: 3

line 16: 12000

line 17: 5997

line 18: 6003

I did put IRA basis as of Dec 31, 2019 as 6000 (because the money sits in traditional IRA and was not converted), is that correct?

I should have asked for lines 1 & 2 also. $6,000 on line 3 indicates that either line 1 is blank and you did not enter the 2020 non-deductible contribution or line 2 is blank and you did not enter line 14 form the 2019 8606 in the 1099-R interview when it asked for the past years non-deductible contributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

In my 2020 form 8606, line 1 is $6000, line 2 is 0.

"When it asked for the past years non-deductible contributions", I didn't have that question when I input the 1099-R for $12000. I was only asked about the IRA basis.

So what shall I put for the non-deductible contributions for the past years? I just started saving in 2019, made $12000 after-tax traditional IRA contribution in 2019 ($6000 withdrawal in 2020), shall I just write down as $6000?

Maybe I should start the section all over again?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

@crystalPP wrote:

In my 2020 form 8606, line 1 is $6000, line 2 is 0.

"When it asked for the past years non-deductible contributions", I didn't have that question when I input the 1099-R for $12000. I was only asked about the IRA basis.

So what shall I put for the non-deductible contributions for the past years? I just started saving in 2019, made $12000 after-tax traditional IRA contribution in 2019 ($6000 withdrawal in 2020), shall I just write down as $6000?

Maybe I should start the section all over again?

Delete the 1099-R and reenter. You should get these questions in the 2nd part of the interview after the 1099-R summary screen. (It asks about all 1099-R's so it will probably asks for the spouses 1099-R so pay attention for which spouse it is asking about.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

Hi Joe,

Thanks for your screenshots and explanation.

I tried to re-do it, but it's still adding up tax due. Interestingly, after I input the 1099-R, although the next screen says "Good news: You won't owe extra Tax on This Money", but in fact, the federal tax owe number got increased for more than $1k. Looks like TurboTax still treats this (or part of this) as taxable.

I haven't solved my problem yet, it should be very straightforward, but something got wrong here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

If you entered the $6,000 like my screenshot then it should be on the 8606 line 2 so line 3 should be line 1+2 = $12,000.

Unless the total 2020 Dec 31 Traditional IRA value was zero (on the next screen) then it will be partly taxable.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tatertxgem71

New Member

JaydonMcConathy

New Member

Section108

New Member

Huntertheisen2

New Member

abigailroland73

New Member