- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@crystalPP wrote:

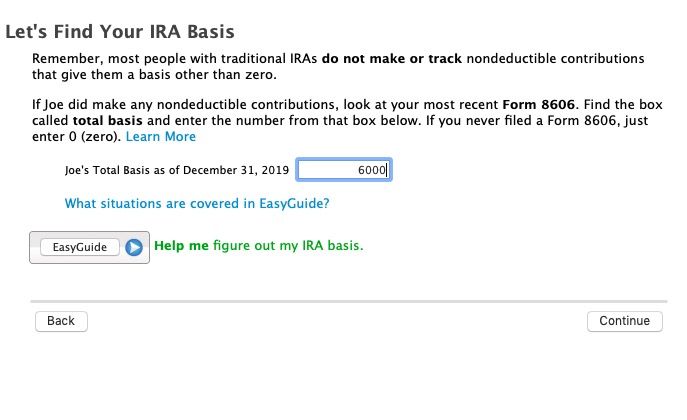

In my 2020 form 8606, line 1 is $6000, line 2 is 0.

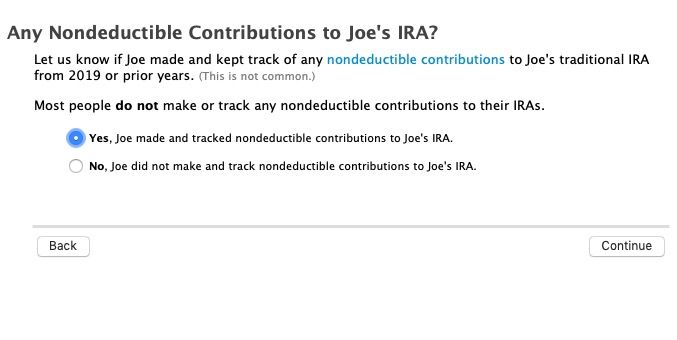

"When it asked for the past years non-deductible contributions", I didn't have that question when I input the 1099-R for $12000. I was only asked about the IRA basis.

So what shall I put for the non-deductible contributions for the past years? I just started saving in 2019, made $12000 after-tax traditional IRA contribution in 2019 ($6000 withdrawal in 2020), shall I just write down as $6000?

Maybe I should start the section all over again?

Delete the 1099-R and reenter. You should get these questions in the 2nd part of the interview after the 1099-R summary screen. (It asks about all 1099-R's so it will probably asks for the spouses 1099-R so pay attention for which spouse it is asking about.)