- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 401K withdrawal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K withdrawal

Hello,

Question: I retired from my previous employer and I left my 401K with them which is currently held at Prudential Retirement and I am 55 yrs old. I withdrew some funds from my 401K and I was told by one of the Prudential rep that because I retired from my employer and that I am 55 yrs old that the 10% tax penalty does not apply? Is that accurate? Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K withdrawal

The age at which early penalties for retirement plan distributions end is 59 1/2, not 55. You would have to have a special circumstance to avoid the early withdrawal penalty.

One way to avoid the penalty would be to make substantially equal payments over a period of 5 years, ending no later than when you turn 591/2.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K withdrawal

Yes, I am aware and the Prudential Rep is aware of the 59 1/2 rule but since I retired from my Employer, he said there's no 10% tax penalty. Hmm....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K withdrawal

He may be assuming you will make equal withdrawals as is typical for a pension plan, in which case you would not be subject to the penalty.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K withdrawal

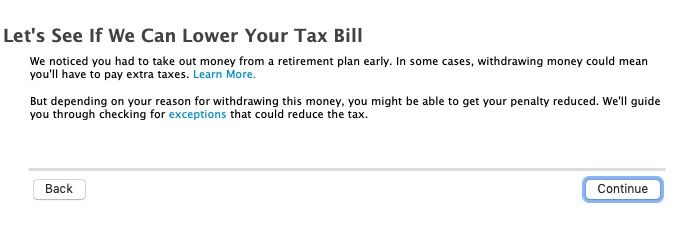

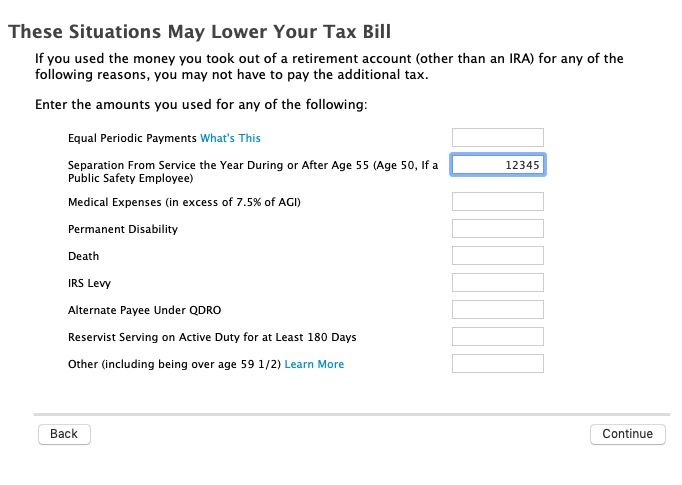

TurboTax asks "If we can lower yiur tax bill", then enter the box 1 amount from the 1099-R in the separation of service box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K withdrawal

The 55 rule is if you left the job that the 401K is attached to in the year you turned 55 ... but you left that job sometime ago and are now taking out a distribution so that exception doesn't apply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K withdrawal

Correct - as the box on the form says - you must have been 55 in the year, or before the year, of separation.

It does not apply if you left employment before the year you reach age 55.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pbmcgrath

New Member

Gussey

Level 1

idsacooper2

New Member

Irish456

New Member

kenwbailey

New Member