- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 401K withdraw

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K withdraw

my husband withdrew several 401K accts and combined them into one at fidelity investments. Why do we pay taxes on the money withdrew? We invested the total amt back into another 401k

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K withdraw

You should not have to pay tax on a rollover.

You should post each of the 1099-R's and continue through the interview.

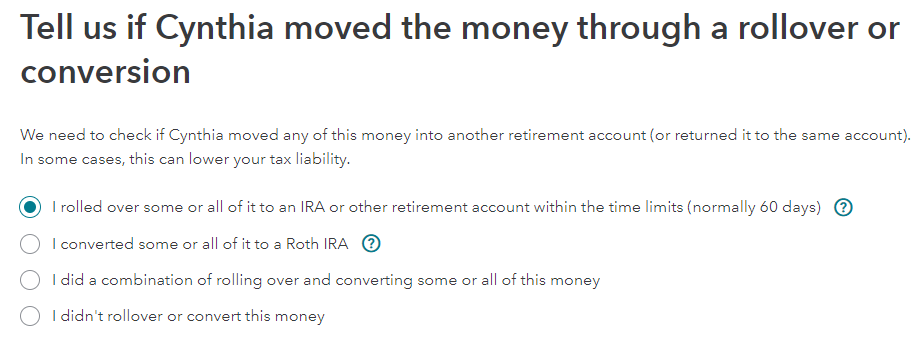

- For the rollover, there will be a question Tell us if (You) moved the money through a rollover or conversion.

- Select [I rolled over some or all of it to an IRA or other retirement account within the time limits (normally 60 days)]

- This will not be taxable.

You can preview your tax return by going to:

- On the menu bar on the left that shows.

- My Info

- Federal

- State

- Review

- File

- Select Tax Tools

- On the drop-down select Tools

- On the popup menu

- Select View Tax Summary

- On the left sidebar

- Select Preview my 1040.

- Schedules 1,2&3 are included if you scroll down past your 1040.

- To return to the entry screens press Back on the sidebar.

refer to Boxes 4 a&b and 5 a&b for your rollover information.

Some key numbers on your 1040 tax return are:

Line 15 - Taxable Income

Line 24 - Total Tax.

Line 25 - Withholdings.

Line 33 - Payments including Credits.

Line 34 - Overpayments.

Line 37 - Tax owed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17713371424

New Member

rperea99

New Member

mijesus1996

New Member

marcus-kendrick

New Member

user17713677228

New Member