- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

You should not have to pay tax on a rollover.

You should post each of the 1099-R's and continue through the interview.

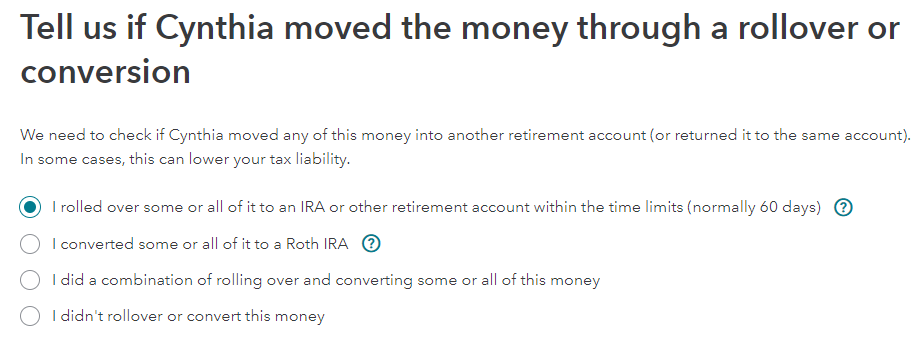

- For the rollover, there will be a question Tell us if (You) moved the money through a rollover or conversion.

- Select [I rolled over some or all of it to an IRA or other retirement account within the time limits (normally 60 days)]

- This will not be taxable.

You can preview your tax return by going to:

- On the menu bar on the left that shows.

- My Info

- Federal

- State

- Review

- File

- Select Tax Tools

- On the drop-down select Tools

- On the popup menu

- Select View Tax Summary

- On the left sidebar

- Select Preview my 1040.

- Schedules 1,2&3 are included if you scroll down past your 1040.

- To return to the entry screens press Back on the sidebar.

refer to Boxes 4 a&b and 5 a&b for your rollover information.

Some key numbers on your 1040 tax return are:

Line 15 - Taxable Income

Line 24 - Total Tax.

Line 25 - Withholdings.

Line 33 - Payments including Credits.

Line 34 - Overpayments.

Line 37 - Tax owed.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 5, 2023

9:51 AM