- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 1099R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

I have recently retired and received a 1099R form. Federal Income tax has been withheld from my taxable amount on the 1099 R form. This is my pension that I am currently living on. When it asks what I did with the money, and I click on cashed out, it adds a couple thousand dollars to what I owe. Why would I owe more taxes on the money I'm expected to live on when taxes were already withheld from the taxable amount?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

The tax that was withheld was only an estimate --- just like when you had tax withheld from your paychecks and it went on a W-2. When your retirement income is combined with all of your other income--from whatever other sources-- your total income and total amount of withholdings are used to calculate whether you get a refund or owe additional tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

After I enter the 1099R form, the system says great you don't owe any more taxes on this money. But when I answer the following questions regarding what I did with the money, if the money didn't go back into a retirement account, I owe thousands more dollars. That doesn't make sense to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

What code is in box 7? It might mean you don't owe the extra 10% Early Withdrawal Penalty on it. Do you get Social Security? Entering income may make more of your SS taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

The number 2 is in box 7.

This is my retirement pension so there is no early withdrawal penalty. No, I do not get SS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

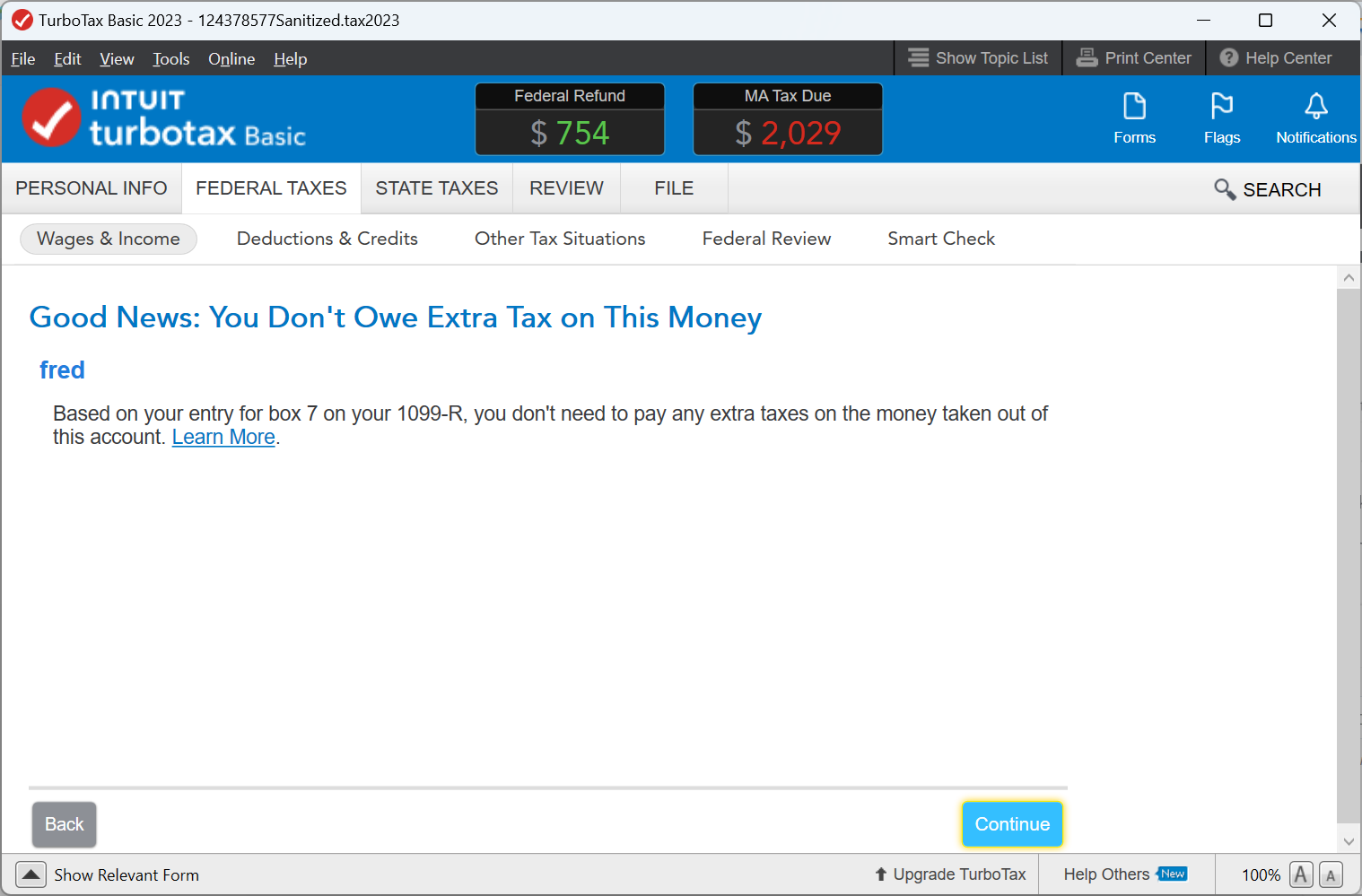

I assume that you are speaking about seeing this screen:

You see this screen because you have a code 2 in box 7, so there is no penalty on the early distribution from the pension.

However, you still owe tax on the distribution (i.e., the distribution is added to line 5b on the 1040), UNLESS you rolled it over to another retirement account - in which case the distribution would not be taxable (i.e., not on line 5b). That's why there is the difference in the refund.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

Yes Code 2 means.....Early distribution, exception applies (under age 59½). So are you under 59 1/2? Ask your retirement plan why it's code 2. Regular retirement usually is code 7.

You didn’t actually pay the tax or the 10% penalty (you pay a 10% early withdrawal penalty if you are under 59 ½). You had taxes withheld like from your paycheck. You still have to enter the whole gross amount (before taxes were withheld) with your other income to figure out the total tax (and it may put you into a higher tax bracket) and then the withholding is subtracted from the total tax to figure your refund or tax due. The Gross amount shows up on 1040 line 5a and the taxable amount on 5b. The withholding will show up on 1040 line 25b.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

Tater19

Level 1

NANCYHIRD46

New Member

elle25149

Level 1

Angel_eyes_4eva

New Member