- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 1099-R NYS Police & Fire

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R NYS Police & Fire

I am having trouble entering my 1099-R from NYS Police & Fire Retirement .

It is defaulting to a federal pension or asking me if I rolled over the money to another retirement plan.

Any help would be appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R NYS Police & Fire

To clarify, is this for New York State purposes? Because New York State exempts any New York State state or local government pension from income.

Your pension income is not taxable in New York State when it is paid by:

- New York State or local government

- the federal government, including Social Security benefits

- certain public authorities

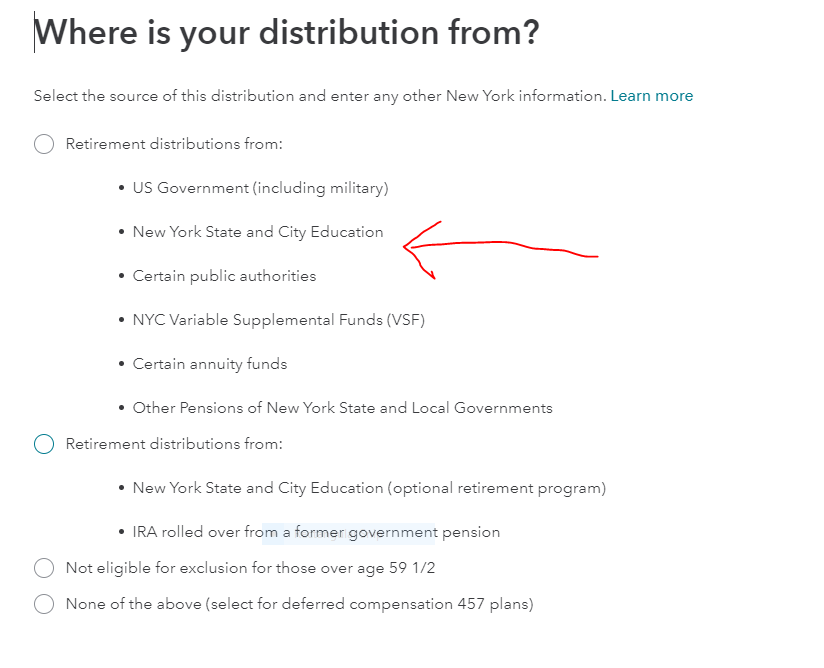

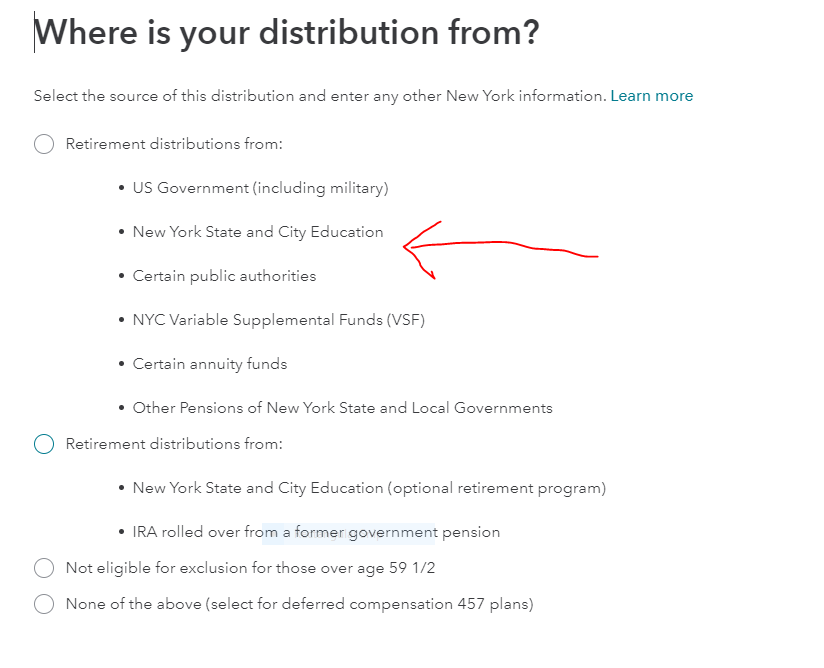

When you initially entered the Form 1099-R in the Income Section (federal return), after you enter the 1099-R, you need to select the right category as to where the 1099-R was issued from, to get it to flow to your NYS return properly and be tax-exempt.

This will be one of the subsequent questions that will come up right after you enter your Form 1099-R.

When you select this (see below), it will flow properly to your NYS return as nontaxable.

If you initially missed this question, go back to your Form 1099-R in your Income section. Try to edit it. You may have to delete and re-enter your Form 1099-R to get this question to pop back up.

Click here for information on deleting your Form 1099-R in TurboTax.

For more information on the pension exclusions and other benefits for retired people, see Publication 36, General Information for Senior Citizens and Retired Persons.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R NYS Police & Fire

1. How do you know it is defaulting to a federal pension?

2. Did you indicate that you lived in NYS before entering this 1099-R?

3. Generally in the 1099-R interview after you enter the data off the form, TurboTax notices what state you live in and asks you follow-up question like, what is the source of this pension? Did you see that?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R NYS Police & Fire

I am trying to enter it manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R NYS Police & Fire

To clarify, is this for New York State purposes? Because New York State exempts any New York State state or local government pension from income.

Your pension income is not taxable in New York State when it is paid by:

- New York State or local government

- the federal government, including Social Security benefits

- certain public authorities

When you initially entered the Form 1099-R in the Income Section (federal return), after you enter the 1099-R, you need to select the right category as to where the 1099-R was issued from, to get it to flow to your NYS return properly and be tax-exempt.

This will be one of the subsequent questions that will come up right after you enter your Form 1099-R.

When you select this (see below), it will flow properly to your NYS return as nontaxable.

If you initially missed this question, go back to your Form 1099-R in your Income section. Try to edit it. You may have to delete and re-enter your Form 1099-R to get this question to pop back up.

Click here for information on deleting your Form 1099-R in TurboTax.

For more information on the pension exclusions and other benefits for retired people, see Publication 36, General Information for Senior Citizens and Retired Persons.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R NYS Police & Fire

Got it . Thank you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

glm2342

New Member

Zasu

Level 1

FLperson14

New Member

pammby33

Level 2

RMEh2o

New Member