- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

To clarify, is this for New York State purposes? Because New York State exempts any New York State state or local government pension from income.

Your pension income is not taxable in New York State when it is paid by:

- New York State or local government

- the federal government, including Social Security benefits

- certain public authorities

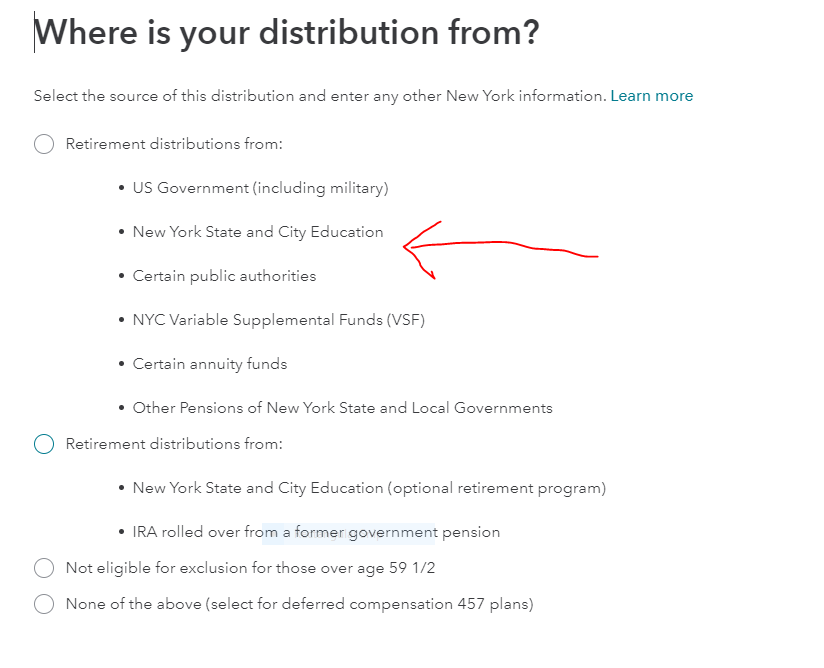

When you initially entered the Form 1099-R in the Income Section (federal return), after you enter the 1099-R, you need to select the right category as to where the 1099-R was issued from, to get it to flow to your NYS return properly and be tax-exempt.

This will be one of the subsequent questions that will come up right after you enter your Form 1099-R.

When you select this (see below), it will flow properly to your NYS return as nontaxable.

If you initially missed this question, go back to your Form 1099-R in your Income section. Try to edit it. You may have to delete and re-enter your Form 1099-R to get this question to pop back up.

Click here for information on deleting your Form 1099-R in TurboTax.

For more information on the pension exclusions and other benefits for retired people, see Publication 36, General Information for Senior Citizens and Retired Persons.

**Mark the post that answers your question by clicking on "Mark as Best Answer"