- Community

- Topics

- Community

- :

- Discussions

- :

- Other financial discussions

- :

- Other finance talk

- :

- Re: Turbo Tax Stimulus Question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

When filling out the 2020 Turbo Tax forums/questions it gets to a part that asks about your 2020 stimulus payment and how you received it (I will file married filing jointly). We received one payment. Is this question referring to the "LAST" most recent payment when it asks how much the amount was since it says "one payment" or is it a total of BOTH stimulus payments? I'm just curious so I know to enter the corrupt amount.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

Enter the total received in early 2020. If you filed as Married Filing Jointly and did rot receive a payment for any dependents then the amount would have been $2,400.

The second stimulus payment would have been received between December 30, 2020 and January 15, 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

Once the program is updated, there will be 2 boxes, to enter your round 1 and round 2 payments separately. The desktop program was updated today, we think the online program may be updated over night but don't know for sure.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

there should be two places on the screen to report EXACTLY what you received

the first was received back in the spring

the 2nd would have been received in the last week. Suggest waiting a few weeks as if you had not received, you still could. The IRS is still sending out payments/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

I received both, but if the amounts are adjusted/based on 2020 income (instead of estimated off of 2019) then I'll be owed additional money pretty much... I haven't purchased the desktop software yet, I was just messing around today to get an idea of what my return would look like.. So, I'll wait for the update and enter both as I've received both, just they were reduced due to my income being higher in 2019 (because of a 401k withdrawal to pay for lawyer fees for a divorce/custody battle). But, 2020 income will be lower, so I believe if that's computed, it should increase where I'm owed around an additional 2-3k with dependents.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

@drivel2787 wrote:

I received both, but if the amounts are adjusted/based on 2020 income (instead of estimated off of 2019) then I'll be owed additional money pretty much... I haven't purchased the desktop software yet, I was just messing around today to get an idea of what my return would look like.. So, I'll wait for the update and enter both as I've received both, just they were reduced due to my income being higher in 2019 (because of a 401k withdrawal to pay for lawyer fees for a divorce/custody battle). But, 2020 income will be lower, so I believe if that's computed, it should increase where I'm owed around an additional 2-3k with dependents.

That is certainly possible, although I can't calculate it for you, you will have to wait to prepare your return. If you are eligible for a larger rebate than you received, such as due to decreased income, the difference will be added to your refund as a credit. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

Gotcha understood totally! I estimated (still waiting on one W2). But, I only see the one box online so that's what made me post this question. But, makes sense that it'll be updated to ask both, both I received reduced amount due to 2019 income being higher, so I should hopefully receive an adjustment/increase for the portion I didn't get since 2020 income will be within the guidelines for the "full" stimulus of both pay outs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

broadly speaking you are correct... if your income was high in 2018/2019 but is low in 2020, then that should result in more stimulus paid to you via the tax return....

broadly, the IRS takes your 2020 circumstance (income, filing status and dependents under 17) and determines how much stimulus that calculates to, then it subtracts what you have received and the difference is on line 30 of Form 1040 as a credit which increases your refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

Sweet! That's what I thought based on what I read online last night but figured I'd ask here. Thanks for being a great help everyone! Much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

@Opus 17 - saw from @VolvoGirl that the online software did update and now requires the two payments!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

@drivel2787 Both the TurboTax desktop software and the TurboTax online editions have been updated with the finalized Form 1040 which includes the stimulus payment questions for both EIP1 and EIP2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

Customers may need to log out, clear their history and then log in again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

The 2020 instructions are now out. See page 59 for the Recovery Rebate Credit Worksheet

https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

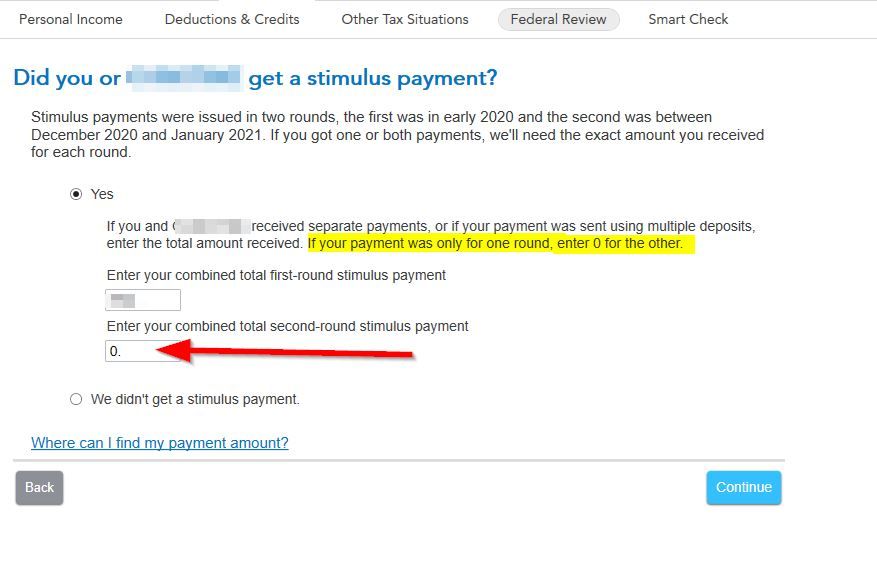

And here's a screen shot of the Desktop program

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

@NCperson No it wasn't me. I don't think I said Online was updated. I only checked my Desktop program so far.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Stimulus Question

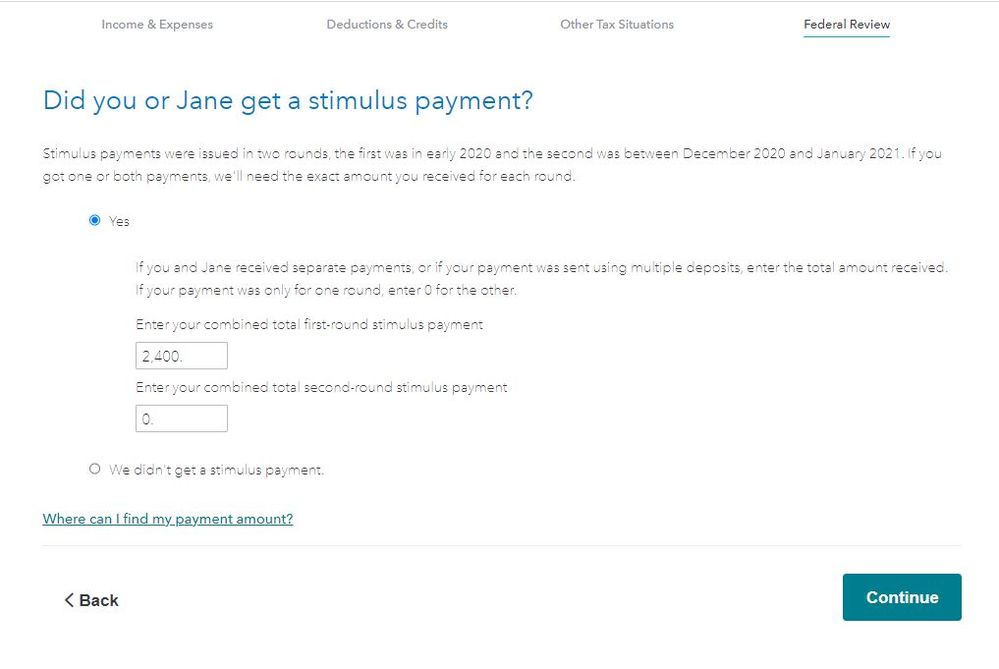

TurboTax online with Stimulus for EIP1 and EIP2

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

myowntaxes24

Level 1

ninelives

New Member

LmT2

Returning Member

krhoades

New Member

SLYKTAX

Level 5