- Community

- Topics

- Community

- :

- Discussions

- :

- Other financial discussions

- :

- Other finance talk

- :

- Re: Stimulus Check for "Your Spouse as a dependent"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

Efiling for all kinds of returns closed for the switch to the 2020 tax year and that includes amendments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

Annie , I would recommend the following :

1. File the 1040x amended for 2018 just for the record . You can use TT Amend feature that does it pretty much automatically . Now on page 1 remember the numbers really don’t change . You are only amending an erroneous box that was checked by the TT software error . Page 2 in the narrative section just describe ... “ This amended return is to correct a box that was checked in error by the Turbo Tax software . When I filed Married Separate , the software check the box “spouse can be claimed as a dependent “ This amended return is to accordingly correct the record . In conjunction with this , my stimulus was check of $1200 was never issued because of this software error . I ask the Service to please issue my entitled payment . Thank you for your kind attention to this important matter . PS please note my address has since changed from my original 2018 filing . Please us this updated address . “

2. So use your current address on the 1040x as noted above .

3. If a 2nd stimulus is used I’m sure they will use 2019 as the basis so this 2018 problem goes away .

4. Also remember that when you file 2020 next year the IRS provides a new form to claim the $1200 if it wasn’t received . So even if nothing happens with the 1040x there will be a way to get it I’ve seen the drafted form and it’s fairly simple . I’m sure TT will have it in their 2020 software .

Ok hope this helps . Jim

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

Yes , I read somewhere , 153,000 dead people got checks ... or something to that effect

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

The IRS did the best they could in a very short time using antiquated equipment with limited staffing during a pandemic situation ... I would cut them a break if there were a few unintended glitches.

To handle the stimulus checks the IRS had to divert personnel from income taxes which has put them way way behind in processing them and now those resources had to be redirected again so the stimulus handling has been put on the back burner.

They have not had a major system update in 7 years which in computer time is ancient and the IRS budget has been cut every year for more than a decade so complain to your congresspersons and insist they fund the IRS properly so they can do their jobs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

When did it close for amendments? They just got it up and running for the first time (ever) in August. I don’t see anything on the IRS page regarding that.

https://www.irs.gov/newsroom/now-available-irs-form-1040-x-electronic-filing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

The IRS shuts down efiling for the switch to the next year's program ... TT closes it a couple of weeks earlier. You missed both deadlines.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

The IRS didn’t allow for direct e-filing of amendments, so I don’t understand what you’re saying. They only started allowing it on the 17th of August. You’re saying TT shut it down several weeks before the IRS did, which seems to imply TT only allowed e-filing of amendments for, what...a month, maybe?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

The IRS didn’t allow for direct e-filing of amendments, so I don’t understand what you’re saying. They only started allowing it on the 17th of August. You’re saying TT shut it down several weeks before the IRS did, which seems to imply TT only allowed e-filing of amendments for, what...a month, maybe two?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

Dates of note ...

10/15 last day to file an original return to be considered timely filed

10/20 last day to fix a rejected efiled return to be considered timely filed

10/31 closing of the TT online 2019 program systems which includes the amendment

11/21 IRS closes the efile system for all individual returns

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

@Tobakett following as well because I will definitely joint the class action lawsuit when one happens. TurboTax screws a lot of people in very vulnerable time and is taking no responsibility for it despite the mounting evidence that it is absolutely their fault and their glitch.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

So looks like we will be missing out on this second round of stimulus? Since there's been nothing done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

Yeah.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

@Mjsoliz07 wrote:

So looks like we will be missing out on this second round of stimulus? Since there's been nothing done.

If you were eligible for and did not receive the advance 2020 credit as a stimulus payment based on the 2018 or 2019 tax returns, you can apply for the stimulus payment on your 2020 tax return.

IRS website for the Recovery Rebate Credit - https://www.irs.gov/newsroom/recovery-rebate-credit

The Recovery Rebate Credit is entered on the 2020 federal tax return Form 1040 on Line 30.

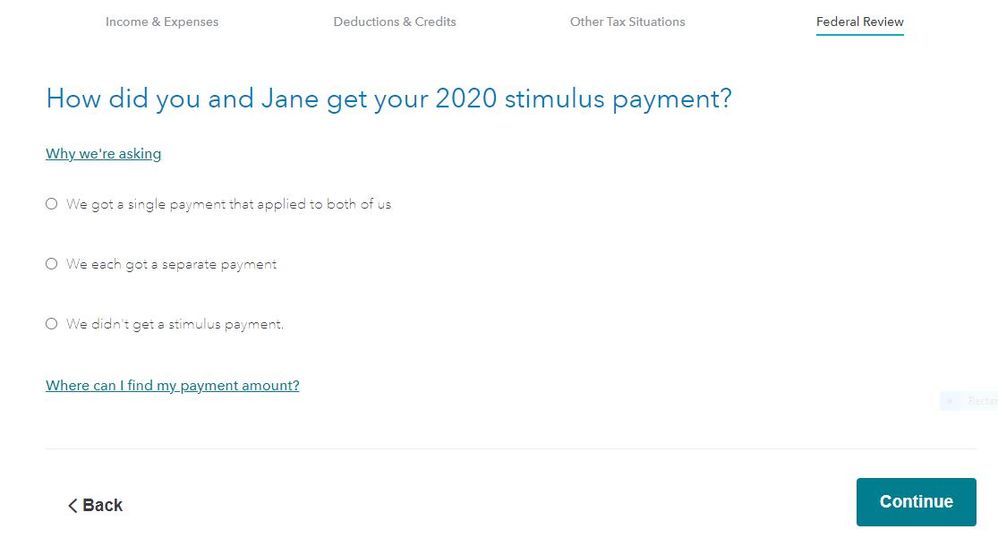

Using TurboTax the program asks about the stimulus payment in the Federal Review section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

OMG it isn't that we "haven't received it", it's that THEY HAVE DEEMED US INELIGIBLE. THAT'S THE ISSUE HERE.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus Check for "Your Spouse as a dependent"

The problem that occurred with your 2018 or 2019 return that made you ineligible for the stimulus in 2020 can be resolved on your 2020 return. The stimulus people received in 2020 was an ADVANCE for a credit that you can still receive when you file a CORRECT 2020 tax return in 2021.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dierings

New Member

ninelives

New Member

brt1895

Level 1

chrissmithgl

New Member

bbPrescott

Level 2