- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- State taxes, active duty military, Michigan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State taxes, active duty military, Michigan

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State taxes, active duty military, Michigan

If Michigan is your Home of Record and your state of legal residence on your LES, you are required to file a Michigan resident income tax return MI-1040, regardless of where your income is earned. Military pay is exempt from Michigan tax. However, most interest, dividends, capital gains and other income received is subject to Michigan income tax. You should file an MI-1040, Schedule 1 and Schedule W and subtract your military pay, to the extent it is included in federal adjusted gross income (AGI).

The Michigan exclusion is taken in the Federal section of TurboTax by marking your military W-2 as active duty income:

- Once in your tax return, click on Federal Taxes tab

- Click on Wages & Income

- Click Edit next to your military W-2

- Click Continue on the W-2 entry screen to get to the screen titled "Do any of these uncommon situations apply to this W-2?

- Click the box to the left of Active duty military (see screen shot below)

Michigan return:

As you walk through your Michigan return, watch for a screen titled "Deduction for Military Pay". It should state that your military income is not taxable. (see screen shot)

Once simple way to check that your military wages have been subtracted from Michigan taxable income (if you don't have any other subtractions) is to click on My Account on the blue dashboard and choose Tools. Under Other helpful links.... click View Tax Summary. Click MI Tax Summary (in gray) under My Account. Your military wages should show next to Michigan Subtractions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State taxes, active duty military, Michigan

Is this still applicable for the 2021 version of TurboTax? TurboTax is currently not deducting my income from military sources. (I don't see the "deduct military income" with this version)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State taxes, active duty military, Michigan

Yes. The instructions are still applicable in 2021 TurboTax @dann144.

For TurboTax to deduction military pay, "Active duty military" needs to be checked on the screen "Do any of these uncommon situations apply to this W-2?" You will see this after entering all the numbers from your DFAS W-2. If your military pay is not being subtracted, verify that this box has been checked.

Michigan will confirm the deduction by showing you the screen "Deduction for Military Pay". There is no input on this screen.

Thank you for your service.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State taxes, active duty military, Michigan

Thank you for the quick response. This was checked at the beginning, but for some reason on my MI state taxes it was not taking me to the "Military Pay Deduction" page. I was able to enter this info in on my Michigan Schedule 1 on line 14 though to correct the calculations. Unsure if TurboTax was getting thrown off as I was only a MI resident for part of the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State taxes, active duty military, Michigan

Yes. You do need to manually enter the amount of part-year active duty military pay in TurboTax for the Michigan subtraction.

I'm glad you were able to make the adjustment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State taxes, active duty military, Michigan

Hi Dan, I'm running into the same issue. One spouse MI resident for part of the year (MFJ). How did you get to the Michigan Schedule 1 screen to correct the calculations?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State taxes, active duty military, Michigan

Hello,

I am also having the same issue. Full year resident of Michigan, stationed in California. I can't get the Michigan State Taxes portion to recognize my pay as military and exempt (even triple checked that I selected military pay under the W2 portion. There was no option to select it was military pay within the Michigan Taxes part either. Any news?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State taxes, active duty military, Michigan

Check your Residency Status in the MY INFO section to be sure you indicated Michigan and Military.

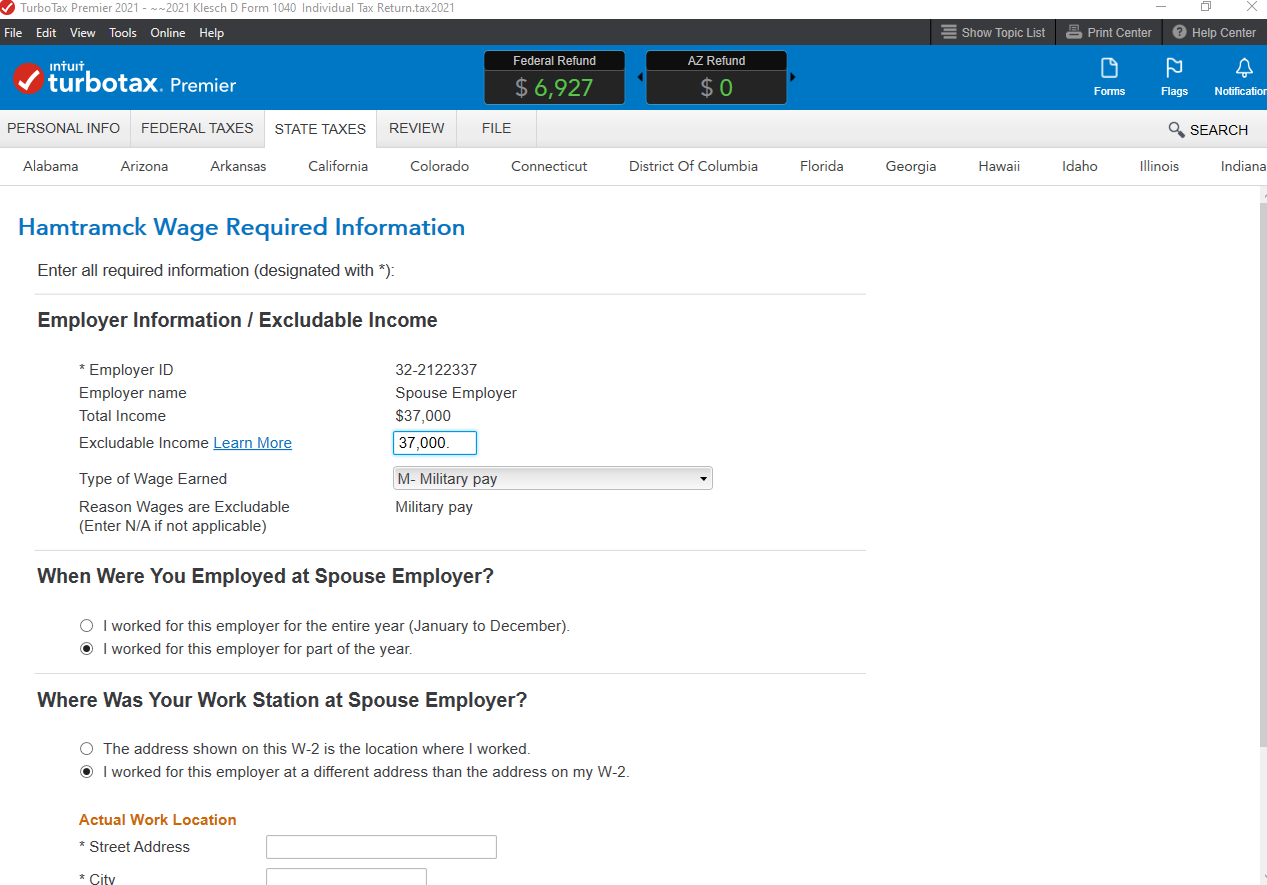

There is a screen in the Michigan interview that asks about Michigan Exclusion for Military Pay. You will see a summary of Wages page first; choose EDIT next to your military W-2.

The next screen allows you to enter the excludable income amount and Reason (screenshot).

If this doesn't resolve your issue, though, you may want to Contact TurboTax Support, since we can't see your return in this forum.

Thank you for your service!

@maybekanskje

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

smfwalker

Level 2

Anobikit

New Member

lram40153

New Member

afields21

New Member

texasarah

New Member