- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Military Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military Income

I'm doing my daughter's and her husband's taxes . She's married to a man in the Army who is on active duty. They are legally residents of Florida, but they were assigned in Maryland for half of 2022. My daughter had $18,000 of income in Maryland. TurboTax shows a non-resident 505 form, and shows that their combined returned has the $18,000 of taxable income in Maryland. His military pay isn't being taxed (which I understand). Why is her income taxable in Maryland when she is legally a residnet in Florida?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military Income

She is taxed on the money she earned from physically working in Maryland (MD).. She is allowed to retain her residency with her military spouse but any income earned that is not military while residing in MD is taxable.

- Nonmilitary spouses can use their military spouse's resident state when filing their taxes. The Military Spouse Residency Relief Act (MSRRA) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse regardless of which state they live in.

If Florida (FL) had a personal income tax then a credit would be received. In this case since FL has no income tax then there is not a credit available. The good news is that the military pay is not taxable.

- See this chart for the MD rules: Filing Facts for Military Personnel and Their Families

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military Income

A bigger question....is whether MD taxes were withheld or not (for a W-2 form)

IF she is claiming FL residency under MSRRA, and she filed the proper forms with the MD employer, then no MD taxes would have been withheld on her W-2, and no MD tax return is required.

In tha case, a MD non-residnt tax reotur would only be required if

1) MD taxes were accidentally withheld, adn filing MD non-resident to recover the withholding ....by claimin zero MD income.

or

2) IF either spouse worked a self-employed job in MD, then that SE income does require a MD non-resident tax return and taxes paid on any net-gain

or

30 If the military spouse worked an off-duty W-2 job in MD, then those off-duty wages are MD-taxable....non-resident.

or

4) If the couple owns a Rental property in MD that they GET income from...then MD non-resident tax return us required for that

________

Make sure...in the My Info sectiojn....make sure that neither of you was entered as having "moved" to MD during 2022. For tax purposes, you didn't move out of FL.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military Income

No taxes were withheld from her income on the W-2

My daughter noted (example 5 is the one she thinks applies):

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military Income

This Maryland "Administrative Release" clearly explains the rules:

You will see that your daughter's W-2 income is NOT subject to Maryland state income tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military Income

You referenced "Pewrsonal tax tip #55". It provides a link to "Administrative Release 1 - Military Personnel and

Civilian Spouses - Both Residents and Nonresidents of Maryland". Although that link goes to a Maryland General Tax page, My daughter found the web link to the specific page we think you are trying to reference.

Page 1, Paragraph C.1 is about a Military servicemember's civilian spouse.

Page 1, Paragraph C.1.a specifically says "Is not subject to Maryland taxation on income for services performed within this State (e.g. wages, salaries or tips) .

Paew 2, Paragraph III.B.2.b (last paragraph on page 2, continuing on page 3) is for a military member with a nonresident spouse (which they are). They did file a joint federal return with TurboTax electronic filing. They have the MD TurboTax form ready, but it includes my daughter's "service" income which was from a health care provider.

My daughter's W-2 form shows income, and it does not have any taxes withheld.

TurboTax shows on Form 505 paragraph B that she has a Maryland adjusted gross income before subtraction of non-maryland income of about $18000. If this is exempt, why is it listed here? Her husband's income from the military is listed on line 22. That isn't MD taxable, which we undersatand, but line 25, shows all $18000 as taxable. Why?

The references that you sent me seem to contradict the way TurboTax is calculating her taxable income.

[PII removed]

[phone number removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military Income

It is more complicated than it seems. First of all, MD does require that a return be filed (pages 1 & 2 of the instructions). However, both the military pay and the wages of the spouse are subtracted from income. The wages of the spouse are code gg for the subtraction. This is seen on page 9 of the MD instructions for nonresidents.

You need to enter the wage subtraction in the program. Unfortunately, it seems to be through the Forms mode of the desktop program rather than the online version. It is an easy switch, see how to switch to desktop.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military Income

Here you go:

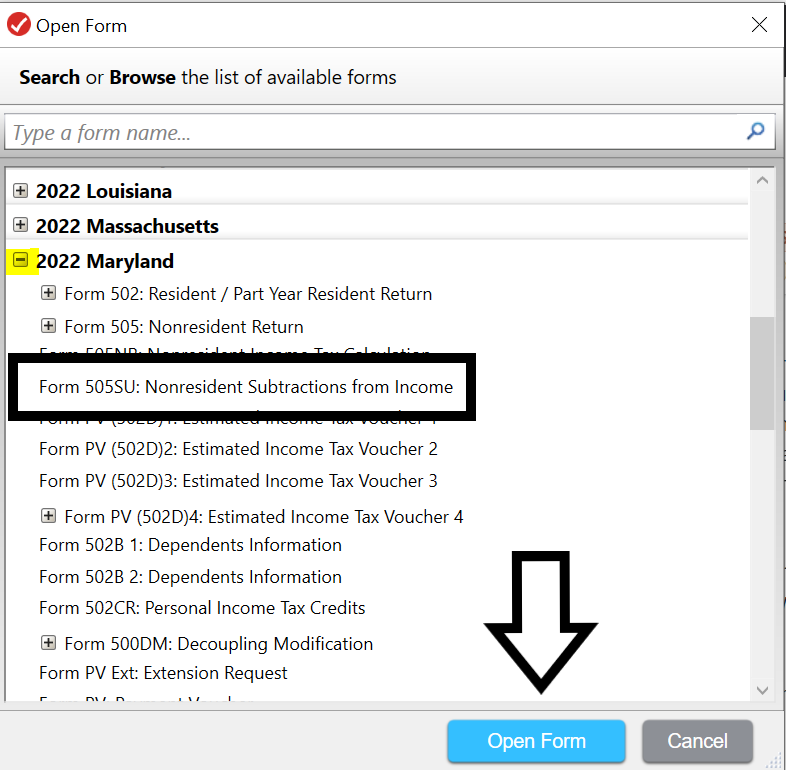

- Click on Forms mode in the top right.

- In Forms mode, click Open Form on the top left

- Select the plus button beside MD

- Select the 502SU

- Select Open Form

- Scroll down the form to line gg

- Enter the income

- Then scroll up to Form 502 and select it

- Locate line 13 for subtractions

- Right click in the little box and select Override

- Enter gg

- Click in the amount, enter the wages - may need Override again

- Check that the forms are correct.

- Go back to step by step in the top right and finish filing or select print for the forms and mail.

This voids the accuracy guarantee for the state but it is the only way to get to those lines.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military Income

We're close... I don't have a form 502SU listed in TurboTax... 502 is for Maryland Residents, and the 505 is for non-residents. I suspect I can do it with form 505SU (Nonresident Subtractions From Income) . 505SU does have a line gg. I think it all worked out. Thank you for your help!!!

George Brungot

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scott-ag

Level 1

SpartyOn1521

Returning Member

laura_borealis

Level 3

RDC6

Level 2

joestokely-yahoo

New Member