- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where to deduct points paid on a mortgage loan to purchase an investment property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to deduct points paid on a mortgage loan to purchase an investment property

I paid points to lower my mortgage interest rate when purchasing an investment property. Can I deduct those points in one year or do I need to depreciate the points over the life of the loan? Where do I enter it in Turbo Tax?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to deduct points paid on a mortgage loan to purchase an investment property

You can deduct the points currently if they were fully paid in 2019 as an Interest Expense. If the amount for the points was part of your loan you need to depreciation the amount of the points over the life of the loan.

You enter all of the information under

- Wages & Income

- Rentals, Royalties, and Farm

- Rental Properties and Royalties (Sch E)

You can deduct also deduct all costs associated with obtaining a new mortgage for your rental property. Typical loan-related expenses include:

- Points

- Loan origination and loan assumption fees

- Mortgage insurance premiums

- Application fees

- Credit report fees

- Appraisal fees (if required by the lender)

The costs associated with obtaining a mortgage on rental property are amortized (spread out) over the life of the loan.

For example, if it cost you $3,000 to refinance your 30-year mortgage, you'd be able to deduct $100 per year for the next 30 years.

Other refinance-related expenses not directly related to the mortgage may also be deductible. Generally, if the cost is associated with operating the property (like real estate taxes or hazard insurance) they're deducted as expenses, whereas costs associated with purchasing the property (like title search fees or recording fees) are added to the property's cost basis, which means they get depreciated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to deduct points paid on a mortgage loan to purchase an investment property

I fully paid the points in the year I purchased the property. Im not exactly sure where in TurboTax I should enter this amount? Just as an interest expense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to deduct points paid on a mortgage loan to purchase an investment property

Yes, you enter this amount as interest expense for your rental property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to deduct points paid on a mortgage loan to purchase an investment property

I entered the points paid as a Depreciable / amortizing asset under my rental building. Looks like I will have to amortize it over the life of the loan. In my case 30 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to deduct points paid on a mortgage loan to purchase an investment property

Could you please comment on a question I asked?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to deduct points paid on a mortgage loan to purchase an investment property

I entered the points paid as a Depreciable / amortizing asset under my rental building.

That is correct for an investment (rental) property mortgage. However, make sure you "amortized" them and did not "depreciate" them.

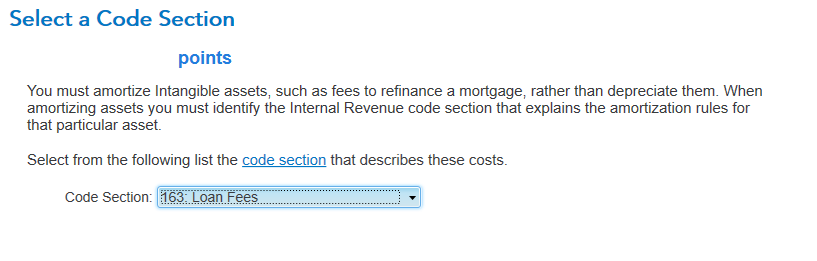

If you didn't get the below screen and select "Code Section: 163 Loan Fees", then you are not amortizing the cost. You are incorrectly depreciating it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

VJR-M

Level 1

alincicum

New Member

s d l

Level 2

erwinturner

New Member

atn888

Level 2