- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where should enter QBI Loss Carryforward Prior Year 2023 Turbo tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should enter QBI Loss Carryforward Prior Year 2023 Turbo tax

Didn't use Turbo Tax last year. I had a net loss on my Sch C and therefore a net loss on the OBI worksheet. Where do I enter OBI net loss carry forward from prior year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should enter QBI Loss Carryforward Prior Year 2023 Turbo tax

Here is where you include your qualified business income deduction (QBID) loss from last year. You can carry it forward to offset any future qualified business income (QBI) for a business or investment K-1 profit or positive qualified business income (QBI).

To include your QBID carryforward loss so that it is not lost you can use the steps below.

- TurboTax CD/Download or TurboTax Online

- Business Income and Expenses > Less Common Business Situations > Net Operating Loss/QBI Carryforward Loss

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should enter QBI Loss Carryforward Prior Year 2023 Turbo tax

Dianne,

I am seeing different on my end. This is Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should enter QBI Loss Carryforward Prior Year 2023 Turbo tax

I can't read your attachments.

The page @DianeW777 is referring to has a heading that says Let's gather your business info.

You may need to work through your self-employment income and expense entries to get to the part where it asks you if the business income is eligible for QBI treatment. When you indicate that it is and finish the business section, go back in and you should see the QBI carryover option under Less Common Business Situations. You may not see the QBI loss carryover option until you indicate that the business is eligible for the QBI deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should enter QBI Loss Carryforward Prior Year 2023 Turbo tax

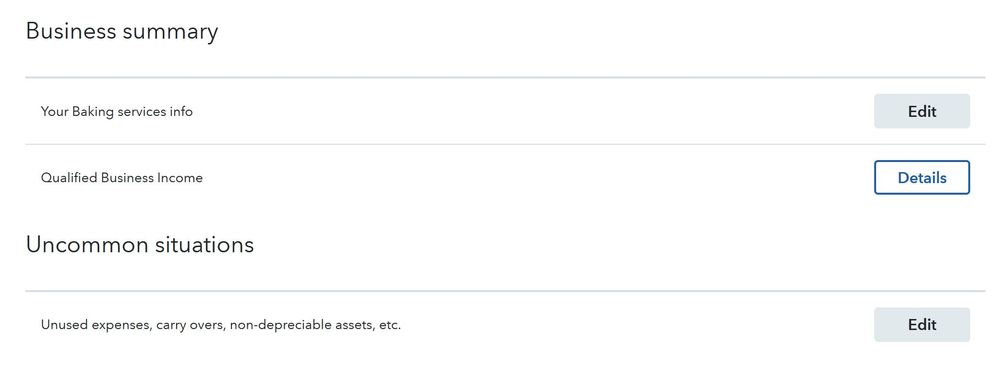

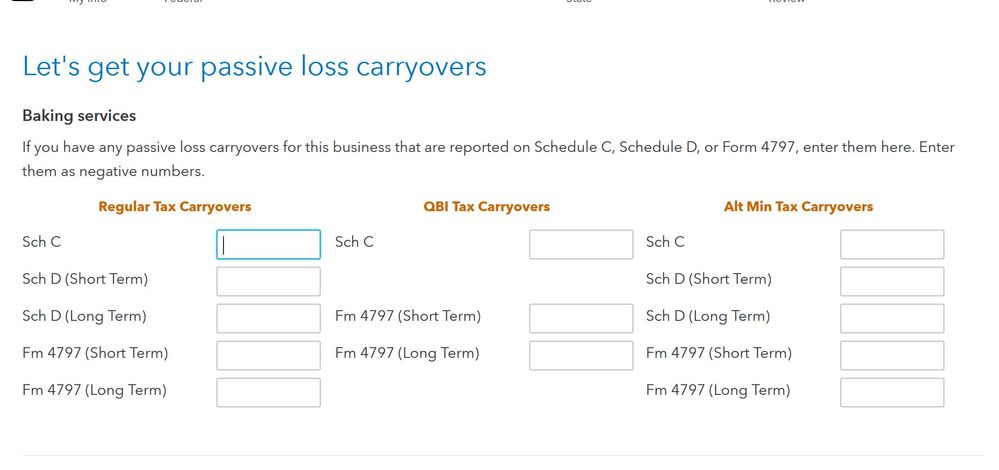

I saw what @DianeW777 was referring to I entered by QBI loss carry forward but my tax due is increasing.

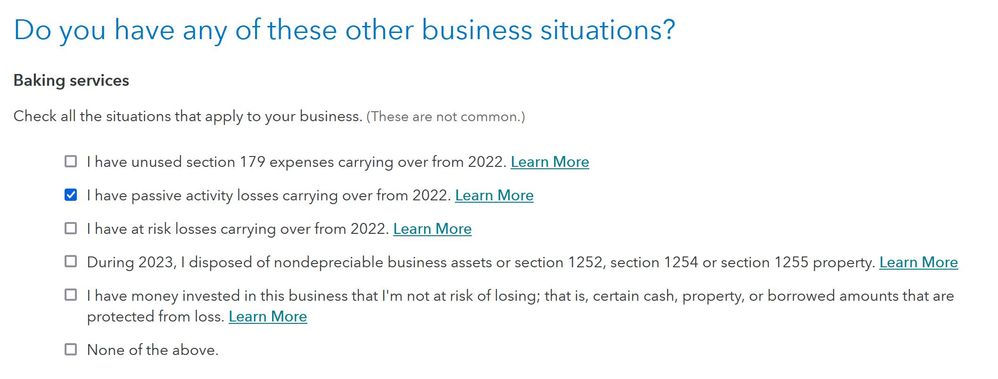

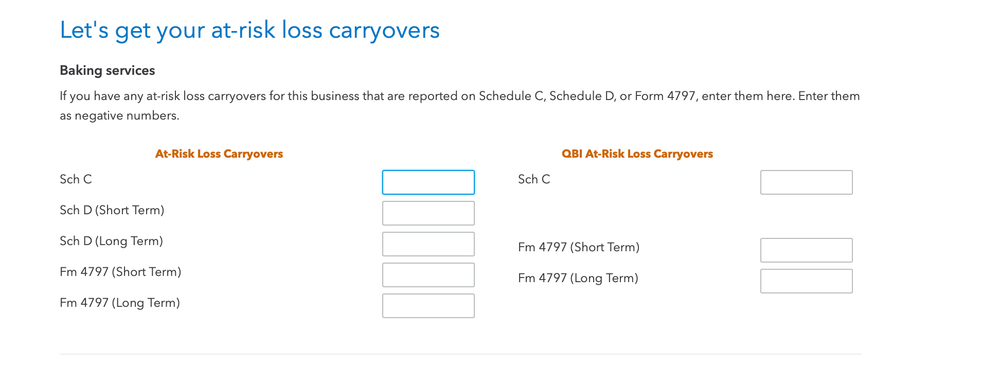

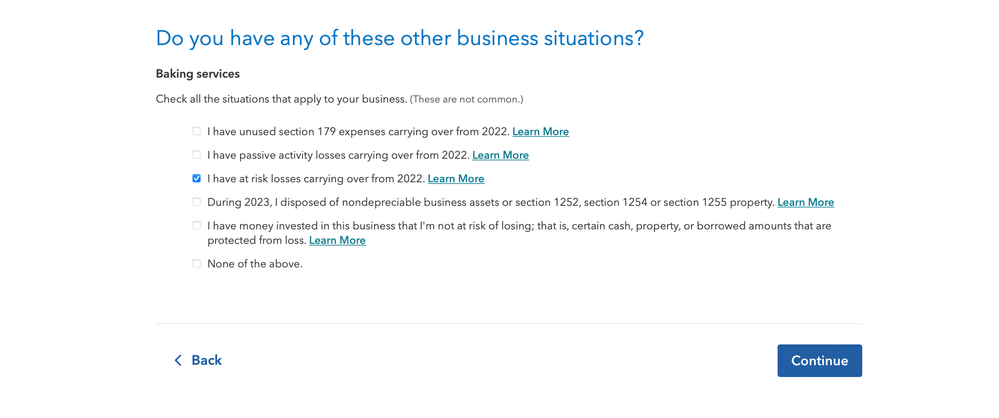

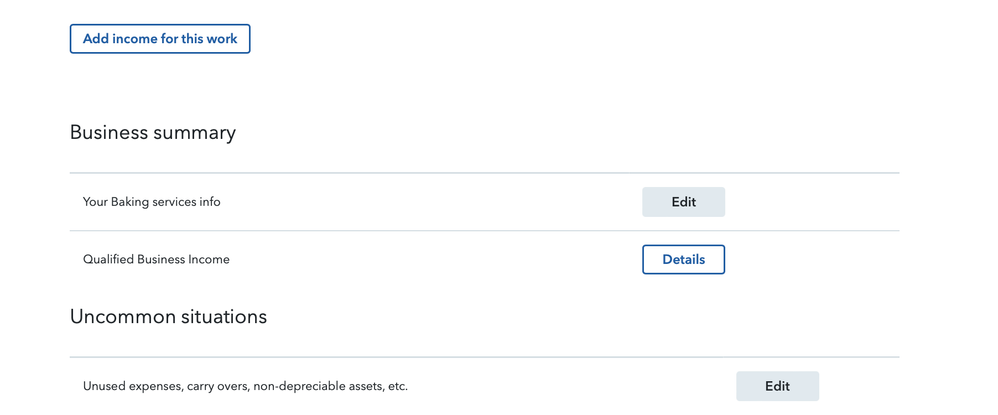

There is also another one on Income and Expenses I edit my expenses and below that is a business summary Uncommon situations, Unused expenses, carry overs, non depreciable assets, etc. I chose then it will prompt me to do you have any of there other business situations? I chose I have at risk losses carrying over from 2022.

Which one should I use? Greatly appreciate your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should enter QBI Loss Carryforward Prior Year 2023 Turbo tax

QBI loss in 2022 was showing on Form 8995 Line 2 & 16

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should enter QBI Loss Carryforward Prior Year 2023 Turbo tax

1-First things first, delete all you qbi carryover loss input that you have entered up until now.

2- Then, in your upper right hand corner in the search bar, type in QBI loss carryover

3- Then, hit Jump to QBI loss carryover

4- You'll come up with a screen NOL Carryover; don't enter anything in there.

5-Next screen will say Delete confirmation, hit yes

6-Then on the next screen, it will ask 2022 Qualified Business Income Loss Carryovers, put in the amount.

The reason why your tax is increasing is because your qbi "deduction" has decreased due to the overall

decreased qbi income figure in 2023 which was reduced by your qbi carryover.

This resulted in reducing your overall qbi thereby lowering your qbi deduction; line 13 on your 1040 which comes

from the 8995 and thereby increasing your line 15 which is your taxable income consequently increasing your tax liability.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should enter QBI Loss Carryforward Prior Year 2023 Turbo tax

Abraham,

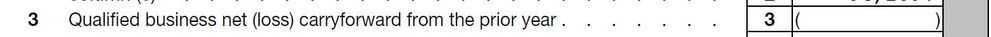

I did the instructions below. However, after reviewing the from 8995 Line 3 Qualified business net (loss) carryforward from the prior year was showing blank on turbo tax premium 2023?

The QBI loss carryforward should be on this line, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should enter QBI Loss Carryforward Prior Year 2023 Turbo tax

Yes, it should.

If you are using TurboTax Home and Business, Select

Business

Less Common Business Situations

Net Operating Loss/QBI Carryforward Loss

Start or Update

Skip the first screen unless you have NOL

ON THE SECOND SCREEN enter Qualified Business Loss carryforward and Continue

The Carried Forward loss should be listed on Form 8995 Line 3

Please verify that it was not entered as a Net Operating loss or that you did not continue and finish that section of the interview.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hasalaph

New Member

smileyj

New Member

jeanneshowler

New Member

grgmalone

New Member

Sarmis

New Member