- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where do I enter short term capital gains from my K-1? Form states 1040 Schedule D line 5

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter short term capital gains from my K-1? Form states 1040 Schedule D line 5

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter short term capital gains from my K-1? Form states 1040 Schedule D line 5

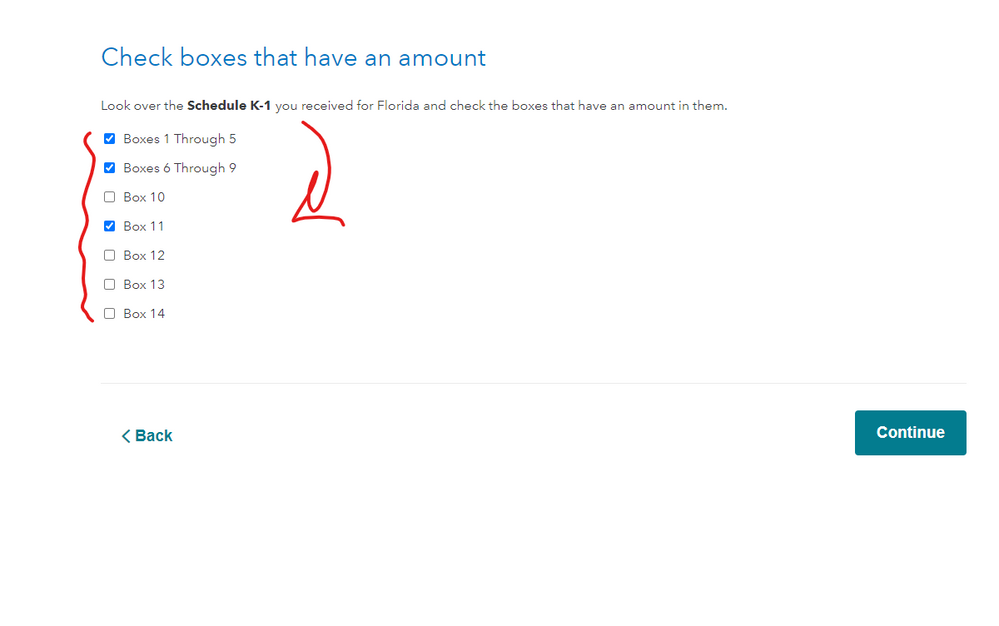

Yes, the short-term capital gains will end up on Schedule D, but you will want to enter all the activity that is reported on your K-1 in the K-1 entry section of TurboTax (see below for steps on how to do this). Then, from the K-1 entry, TurboTax will determine the correct placement of where the amounts need to be reported on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter short term capital gains from my K-1? Form states 1040 Schedule D line 5

like the original poster, i don't see how to enter this in the k1 interview. i have 3 items in line 11 code i. one goes to schedule e and turbotax allows me to check a box and enter that. another goes to 1040 line 3b and the one in question goes to sched d line 5 (per the notes on the k1). there a choice for this in the turbotax interview. how do i enter this? thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter short term capital gains from my K-1? Form states 1040 Schedule D line 5

more detail: my k1 doesn't have an amount in box 8. its all in box 11. its these amounts i need to enter.

BOX 11, CODE I: OTHER INCOME (LOSS)

NET ORDINARY INCOME FROM TRADE OR BUSINESS ACTIVITY BEFORE DIVIDEND INCOME (SEE SEPARATE FOOTNOTE BELOW FOR DETAILS)

(1040 FILERS ENTER ON SCHEDULE E, PART II, INCOME COL. K, (LOSS) COL. I)

TOTAL ORDINARY TRADE OR BUSINESS DIVIDENDS

(1040 FILERS ENTER ON FORM 1040, LINE 3B) (SEE SUPPLEMENTAL FOOTNOTE)

TRADE OR BUSINESS CAPITAL GAINS (LOSSES): NET SHORT-TERM CAPITAL GAIN (LOSS)

(1040 FILERS ENTER ON SCHEDULE D, LINE 5, COL. H) TOTAL OTHER INCOME (LOSS)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter short term capital gains from my K-1? Form states 1040 Schedule D line 5

@swilson50 I have the same questions. Could you please share what you did in 2020 to fill in those numbers? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter short term capital gains from my K-1? Form states 1040 Schedule D line 5

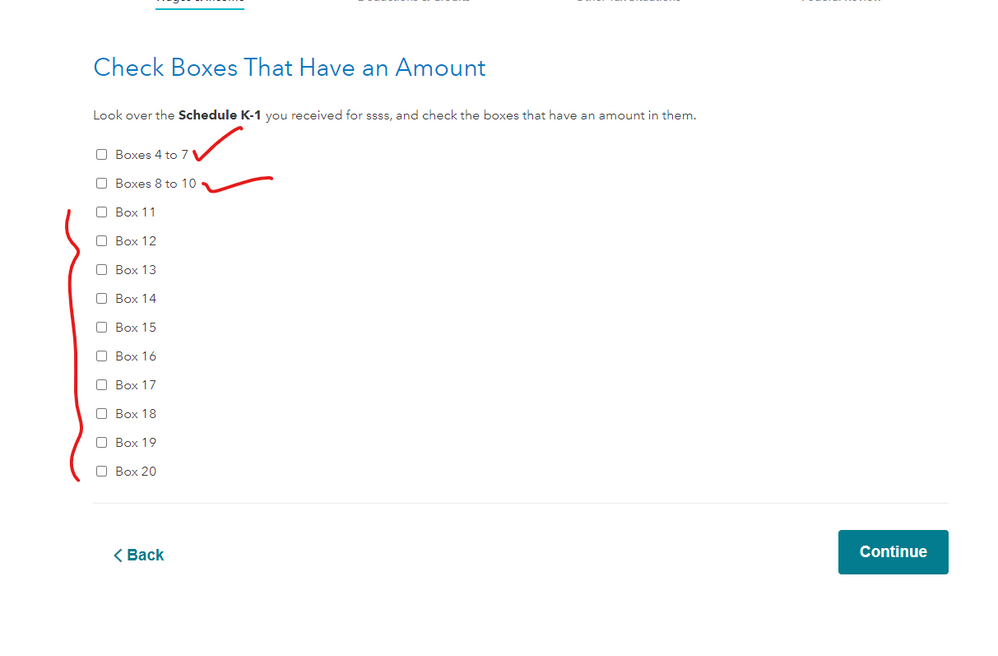

hi, i looked back on my notes. i just moved the 11i values to different boxes on the k1, then tt populated the correct forms. here is the answer i got from a cpa last year regarding their professional software. its a good workaround:

"Our software does not accommodate those items in box 11i. We simply add those to the correct boxes, like box 8 for STCP, box 1 for ord inc, and box 6a for the ordinary dividends."

hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter short term capital gains from my K-1? Form states 1040 Schedule D line 5

Sounds like the issuer of the K-1 needs to put the correct information in the correct boxes and not in box 11 ... make a comment to them so that they do it right in the future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter short term capital gains from my K-1? Form states 1040 Schedule D line 5

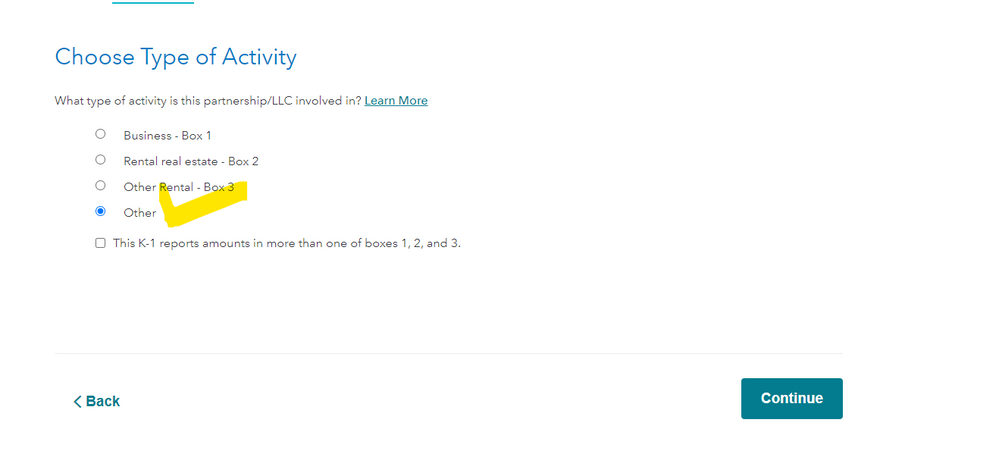

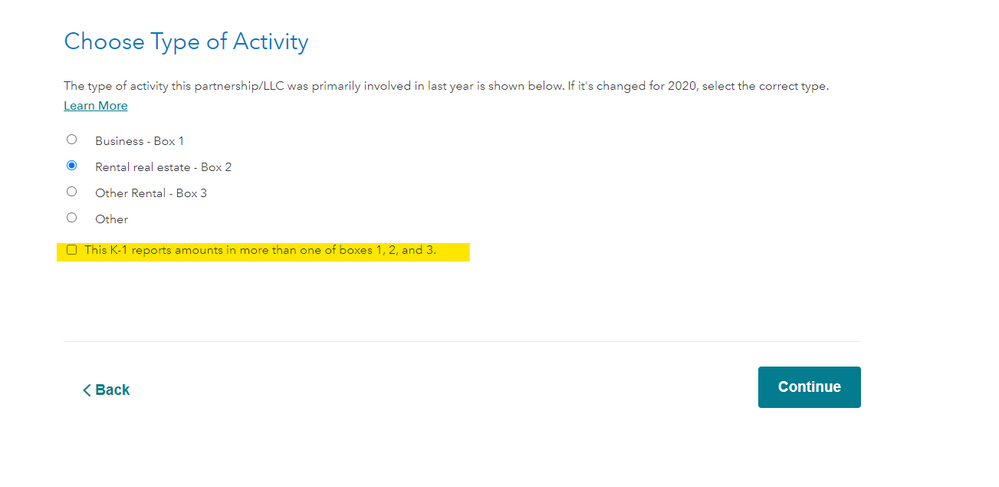

@swilson50 Thanks for your reply. I am using Turbo tax online. It only lets me to select Box 1, Box 2, Box 3 or other boxes for K1. It seems impossible to fill in both Box 1 and Box 8 at the same time. Did you remember how you resolved this? Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter short term capital gains from my K-1? Form states 1040 Schedule D line 5

in my version a subsequent dialog asks if i have amounts in boxes 4-9.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter short term capital gains from my K-1? Form states 1040 Schedule D line 5

Make sure you picked the right K-1 form ... for a 1041 ...

Or for an 1120-S ...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17555332003

New Member

scatkins

Level 2

bees_knees254

New Member

yingmin

Level 1

VAer

Level 4