- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where do I enter mortgage points for a rental? I see that you enter them under asset/depreciation but do I re-enter them again when it asks to input info on 1098?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter mortgage points for a rental? I see that you enter them under asset/depreciation but do I re-enter them again when it asks to input info on 1098?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter mortgage points for a rental? I see that you enter them under asset/depreciation but do I re-enter them again when it asks to input info on 1098?

You would enter all mortgage interest and points reported on your Form 1098 under Rental section once. The program will allocate and pro-rate the mortgage points between rental and personal based on the information you provide. It will place them correctly on your tax returns. ( Schedule E for rental and schedule A for personal)

You do not re-enter it under Schedule A Form 1098 again.

To enter mortgage interest and point information on your rental ( schedule E), here are the steps:

In TurboTax online,

- After sign into your account, select Pick up where you left off

- At the right upper corner, in the search box, type in schedule e and Enter

- Select Jump to schedule e

- Follow prompts

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter mortgage points for a rental? I see that you enter them under asset/depreciation but do I re-enter them again when it asks to input info on 1098?

Hi Lina

When entering a room rental, we can say the room is say, 25 % of the square footage and then when entering the property tax and mortgage interest, it notes to enter the full amount) and does the split correctly: in the schedule E worksheet, i see the columns "reported on schedule E" and "allocated to personal use" for real estate taxes and mortgage interest.

However for the points, when entering those intangible assets, it specifies:

"Since you're only renting out a portion of this property, you shouldn't enter the full amount of this asset. Instead, you need to multiply the full amount of this asset by your rental percental to find out the cost you should enter for this asset." and in the schedule E worksheet 19h, I see the full amount (divided by duration of amortization and pro rated from the date of refinance to dec 31), not the 25% of it only.

Also although my loan was over 30 years, it seems rental property depreciation is 27.5 years.

It seems we would need to do the split manually and have amortization of the portion of the square footage dedicated to rental in schedule E, then in deductions, enter a mortgage for $0 (so it's not counted twice) check the box for points and enter the fraction of the square footage not rented (here 75%) times the actual points paid.

It would show in schedule A worksheet 10 "total points originally paid on a loan for which the points must amortized"

In case of rental, it seems we should also be able to count as expense the closing costs and fees.

Is it the correct way to handle this?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter mortgage points for a rental? I see that you enter them under asset/depreciation but do I re-enter them again when it asks to input info on 1098?

I'm renting out a room

Careful. You may be double-dipping, which is a no-no.

If the property was originally purchased as your primary residence, then your points were fully deductible in the tax year you purchased the property. You can't claim them again when you convert the property or any portion of it to a rental.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter mortgage points for a rental? I see that you enter them under asset/depreciation but do I re-enter them again when it asks to input info on 1098?

Thanks Carl, i thought one had to amortize. There are rules to be able to deduct the points fully on the tax year I purchased the property as per https://www.irs.gov/taxtopics/tc504

I need to check but I may not qualify : I refinanced and included the point to the balance and it reads "You can't have borrowed the funds from your lender or mortgage broker in order to pay the points."

Whether I amortize it or deduct it fully, I may still need to be split for the part that is rented out .

Or maybe I could just put it fully under deduction and not bother to amortize in schedule E.

The tax amount seems like it would be the same though there may be some details I missed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter mortgage points for a rental? I see that you enter them under asset/depreciation but do I re-enter them again when it asks to input info on 1098?

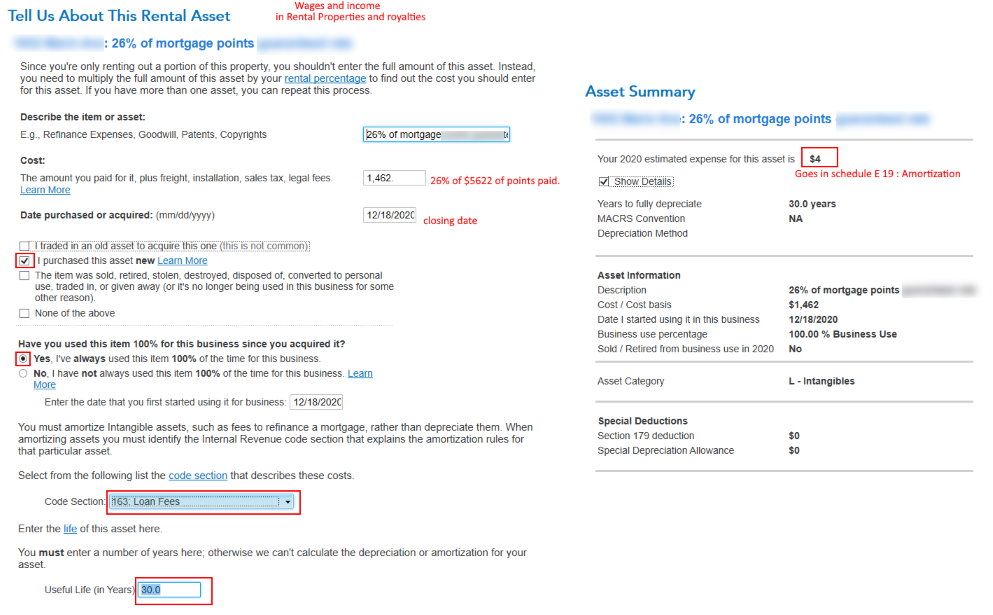

Yes, you should split the rental portion manually and use the rest on your Schedule A for itemized deductions. The rental portion should be amortized over the life of the loan (not the recovery period of the house-27.5 years).

Follow the steps below to add this asset for the appropriate outcome.

- Sign into your TurboTax Account > Search (upper right) > Type rentals > Press enter > Click on the Jump to .... Link

- Edit beside the rental you want to work on > Scroll to Assets > Edit

- Select Yes to go directly to the asset summary >

- Add or Edit the asset for the closing costs and or points > Select Intangibles, Other Property > Continue

- Select Amortizable intangibles > Continue > Enter the details about your costs including the refinance date

- Continue > Select the Code Section 163 for loan fees > Enter the useful life (number of months of the loan)

- The final screen will show the deduction.

- See the images below.

Notice the end result is what you want to see, the date the refinance began in this example is 01/05/2020. The date the refinance began will alter the deduction if it was not a full year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter mortgage points for a rental? I see that you enter them under asset/depreciation but do I re-enter them again when it asks to input info on 1098?

Thank you Diane for spending the time and writing a long answer with step by step and screenshots.

I am using the desktop version of turbo tax.

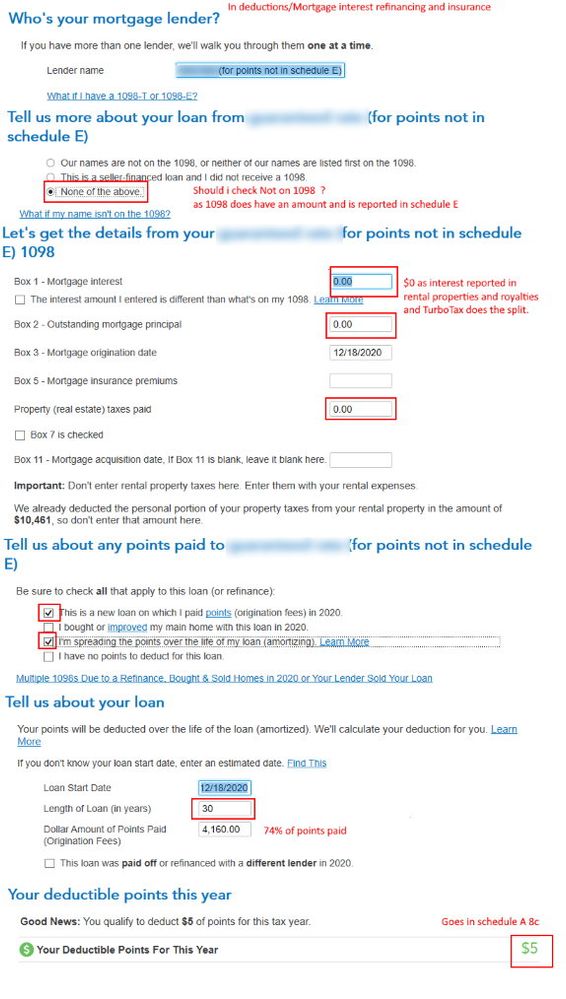

Here is what I did.

Closing date 12/18/2020; points paid $5622;

I use 26% of the house as rental, the rest for my own use.

I split the amount : $1462 for the rental and $4160 for my use.

The part I am not too sure is about the 1098. Our name is on the 1098 but the interest amount I entered ($0) differs as the interest paid has already been entered when filling questionnaire for rental; the point amount also differs as I am reporting only 74% of it here.

The final result is as follows:

(for deduction)

Home mortgage interest worksheet:

10a : total points paid paid on a loan for which the points must be amortized: $4160

10b: length of loan 30 years

10d Amortized points allowable this year: $5

10e Amortized points deducted this year: $5

Tax and Interest Worksheet

7 Points not reported on form 1098

7a: Amortizable points from the home mortgage interest worksheet $5

Schedule A

8c Points not reported to you on form 1098 $5

(for rental)

Depreciation report

Cost $1462

life 30 years

current depreciation $4

Asset worksheet

11 Depreciation deduction $4

Schedule E worksheet

19h Amortization $4

Schedule E

19 Amortization $4

This year the deduction is minimal as I closed in December but next year it should be $49+ $138 total.

See the questionnaires below for how I entered it.

Feel free to comment.

For schedule A

For schedule E

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter mortgage points for a rental? I see that you enter them under asset/depreciation but do I re-enter them again when it asks to input info on 1098?

You're welcome. Since your lender did pay the points with part of the loan proceeds as you indicated previously, amortization is the correct action for your personal expenses on Schedule A as well.

If you have other mortgage interest for 2020, besides the points, that should also be prorated between personal and rental portion, then enter the full amount for each part of the return. Only the points for the rental (and the home portion) need to be amortized in your situation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter mortgage points for a rental? I see that you enter them under asset/depreciation but do I re-enter them again when it asks to input info on 1098?

The other mortgage interest (as well as the property tax) is entered when filling the questionnaire for rental. I specified it was using 26% of my home, and turbo tax split it automatically in personal use and business. It appears correctly in Schedule A and E.

The issue was with the points where it does not seem to be able to do it automatically.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter mortgage points for a rental? I see that you enter them under asset/depreciation but do I re-enter them again when it asks to input info on 1098?

For your amortized asset (points)

here's how to enter the points in the Assets/Depreciation section.. (does not apply to entering the property itself, or any other property assets.)

- Select the Add and Asset button. (go straight to the asset summary if presented that option)

- Select Intangibles/Other Property, then continue.

- Select Amortizable Intangibles, then continue.

- Describe it as something like "2020 Financing Fees". Then enter the amount, and the closing date of the loan. Then continue.

- Select "purchased new", then "100% business use", enter the closing date of the loan (again), then continue.

- Code section is 163:Loan Fees, then continue.

- Useful LIfe in Years is the length of the loan, then continue.

- You can "show details" if you like. Then continue, and that does it

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

billvans

New Member

wilfsdad1965

Level 3

foleys

Level 1

ismaelrd

New Member

ng

New Member