- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Thank you Diane for spending the time and writing a long answer with step by step and screenshots.

I am using the desktop version of turbo tax.

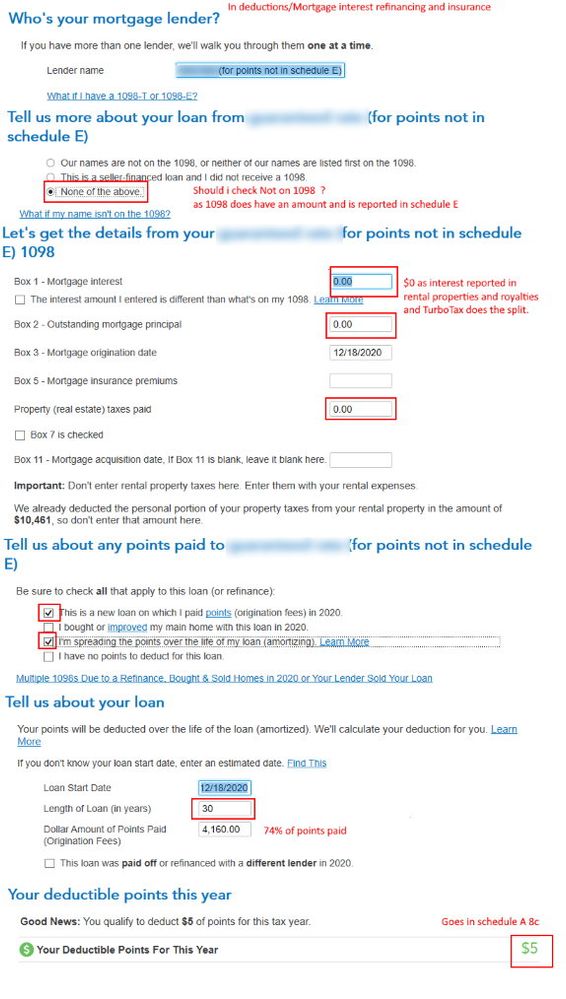

Here is what I did.

Closing date 12/18/2020; points paid $5622;

I use 26% of the house as rental, the rest for my own use.

I split the amount : $1462 for the rental and $4160 for my use.

The part I am not too sure is about the 1098. Our name is on the 1098 but the interest amount I entered ($0) differs as the interest paid has already been entered when filling questionnaire for rental; the point amount also differs as I am reporting only 74% of it here.

The final result is as follows:

(for deduction)

Home mortgage interest worksheet:

10a : total points paid paid on a loan for which the points must be amortized: $4160

10b: length of loan 30 years

10d Amortized points allowable this year: $5

10e Amortized points deducted this year: $5

Tax and Interest Worksheet

7 Points not reported on form 1098

7a: Amortizable points from the home mortgage interest worksheet $5

Schedule A

8c Points not reported to you on form 1098 $5

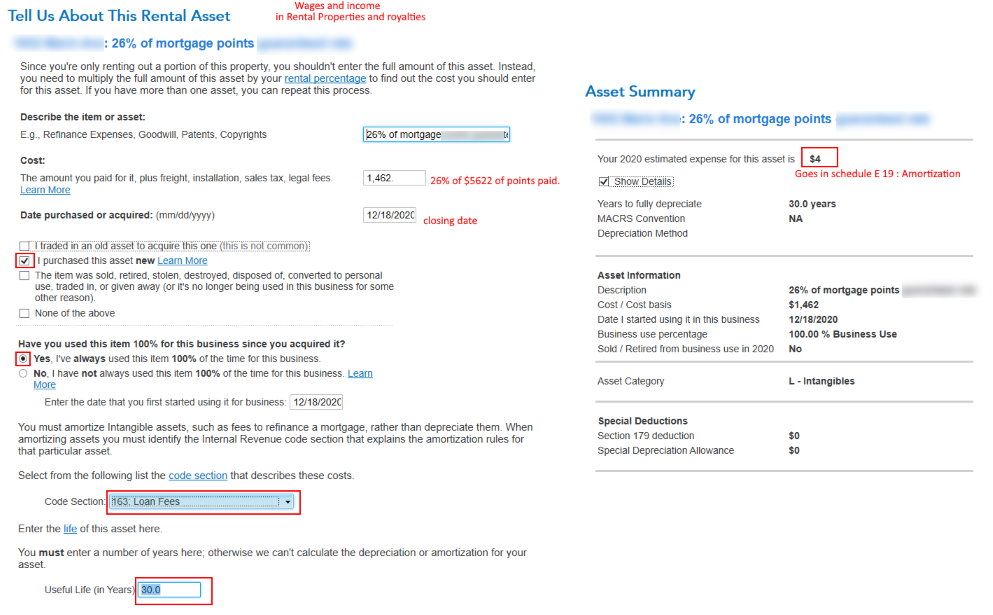

(for rental)

Depreciation report

Cost $1462

life 30 years

current depreciation $4

Asset worksheet

11 Depreciation deduction $4

Schedule E worksheet

19h Amortization $4

Schedule E

19 Amortization $4

This year the deduction is minimal as I closed in December but next year it should be $49+ $138 total.

See the questionnaires below for how I entered it.

Feel free to comment.

For schedule A

For schedule E