- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

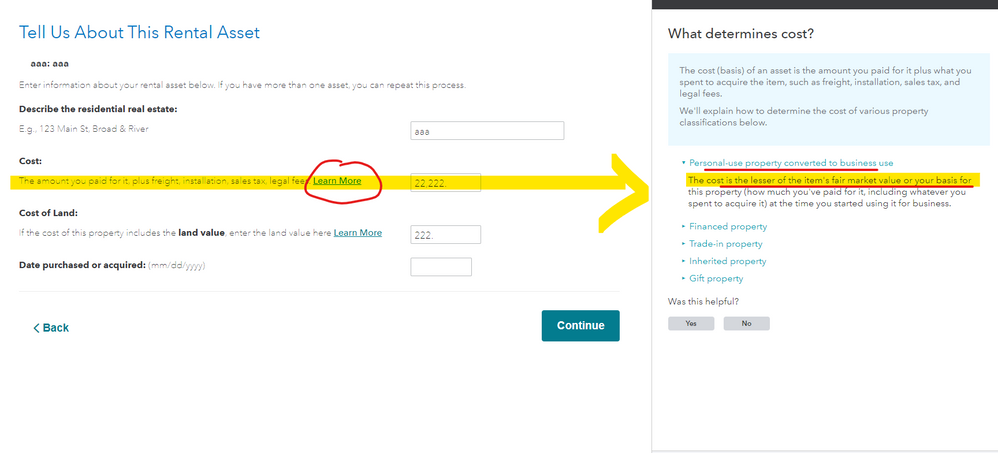

Your cost basis in the property is generally the amount that you paid for the property (your acquisition cost plus any expenses), including any money you borrowed to buy the place.

If you are converting your property from personal use to rental use, your tax basis in the property is calculated differently. Your basis is the lower of these two:

- Your acquisition cost

- The fair market value at the time of conversion from personal to rental use

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

So if there was a lag of five years between ownership and conversion of the property than the value used for depreciation is the lesser of the two? there is a $100K difference in today's price.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

Yes ... there will be a difference. The program will ask for both amounts and automatically take the lower of the 2 for depreciation and you WANT this to happen as it is better for you in the long run.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

How do you figure its best in the long run?

1) If you initially paid $300K and sell at $600K (without considering recapture) than you have a gain of $300K

2) If you have property conversion at $400K and sell at $600K that is a gain of $200K

(in my book that is an increase of $100K more ?)

3 ) Secondly MACRS at 27.5 would be less with the smaller amount vs the new amount during converstion.

4) and where do you see on Asset Entry Worksheet the opportunity to add both prices

line 4.enter total cost when asset was acquired ? so asset was acquired in 2015 at a LOW PRICe.

where do you see the FMV at conversion what line???

Mjb

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

You never want to depreciate anything any faster than required... the depreciation taken now must be recaptured later at rate possibly higher than the capital gains rate so you may make out better in the short term but lose overall. And rentals rarely show a profit on the Sch E so the extra deduction is useless especially if your income is over the exclusion amount of $150K.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

1) If you initially paid $300K and sell at $600K (without considering recapture) than you have a gain of $300K

2) If you have property conversion at $400K and sell at $600K that is a gain of $200K

(in my book that is an increase of $100K more ?)

For both 1 & 2 ... it is the rule ... you must take the lesser of when converting.

3 ) Secondly MACRS at 27.5 would be less with the smaller amount vs the new amount during converstion.

Correct ... as it should be ... as explained in my other post this is desireable.

4) and where do you see on Asset Entry Worksheet the opportunity to add both prices

line 4.enter total cost when asset was acquired ? so asset was acquired in 2015 at a LOW PRICe.

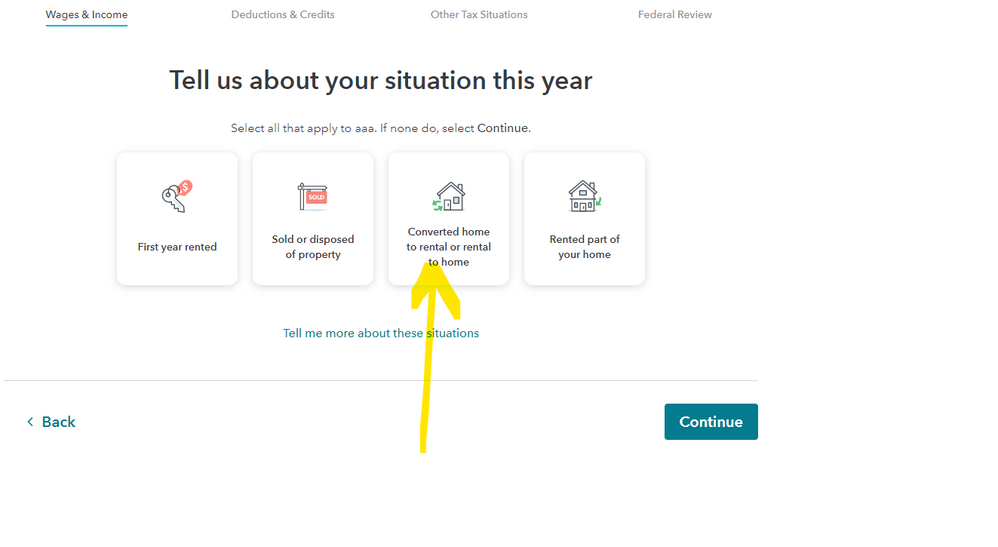

where do you see the FMV at conversion what line??? As you entered the rental you should have indicated it was CONVERTED then the question of the FMV and cost basis would have been addressed.

If you have these kinds of questions I highly recommend you either upgrade to LIVE or seek out local professional guidance to be educated in the ways of the Sch E ... or read the IRS Publication 527.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

As you entered the rental you should have indicated it was CONVERTED then the question of the FMV and cost basis would have been addressed.

Where did you find this? I have schedule E open , schedule E worksheet and Asset Worksheet for the property? The only mention I see is Asset Entry worksheet line 2, 3 , and line 4, which only relates to date placed in service. and total cost of when assets was acquired.

Secondly,

If you have these kinds of questions I highly recommend you either upgrade to LIVE or seek out local professional guidance to be educated in the ways of the Sch E ... or read the IRS Publication 527.

I have tried a few weeks ago but unable to go to Live since I purchased the disk and they indicated no help unless I purchased the download .

Thirdly

Seriously, I question your financial acumen, since I very familiar with recap although this is my first vacation home/conversion to income property. I don't understand your statement: you want as much depreciation as possible, you don't need income, you want expenses not to exceed $25K, and as long as you can improve the property and writing off your income, than its the best of both worlds. Also it means the opportunity to purchase another home without worrying about qualifying with a vacation home properties for a new mortgage. And as to my original statement how on earth do you think with the cost basis at purchase price is a better deal than the cost basis of during conversion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

Stop entering data in the FORMS mode and use the STEP BY STEP interview instead ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

You misread my posting ... recaptured income is taken at a higher tax rate that is why you don't want to depreciate things more than required so you would pay more in taxes later by getting a deduction now. And the IRS rules say you MUST use the lower of the cost basis or the FMV at the time of conversion so you really don't have a choice on which value to use.

Care to weigh in ???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

I'm just looking at the root question in the first post of this thread.

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at the time of conversion?

Doubtful, but possible, IRS Publication 527 at https://www.irs.gov/pub/irs-pdf/p527.pdf#en_US_2020_publink1000219151 page 15 column three, section titled, Basis of Property Changed to Rental Use clearly states:

The basis for depreciation is the lesser of

:•The fair market value of the property on the date you changed it to rental use; or

•Your adjusted basis on the date of the change—that is, your original cost or other basis of the property, plus the cost of permanent additions or improvements since you acquired it, minus deductions for any casualty or theft losses claimed on earlier years' income tax returns and other decreases to basis.

Nowadays it is becoming more common for the adjusted basis to be the lesser value.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

The basis for depreciation is the lesser of

:•The fair market value of the property on the date you changed it to rental use; or

•Your adjusted basis on the date of the change—that is, your original cost or other basis of the property, plus the cost of permanent additions or improvements since you acquired it, minus deductions for any casualty or theft losses claimed on earlier years' income tax returns and other decreases to basis.

Now as indicated the house has appreciated from 2015 to 2020 (conversion) somehow I have to justify to get the highest cost possible, so in the future now am I wrong on the statement Adjusted basis on the date of the change (than isn't the change the same as the change from home to income property?) or am I missing something. Ideally the delta should be nill , but if I read from the purchase price we are in trouble to over $100K, (certainly not at this stage, it does affect MACRS, depreciation / 27.5yrs but also future capital gains.

Thanks for the help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

Your adjusted basis is what you paid for the property when you originally purchased it, plus what you paid for any property improvements since the date your originally purchased it.

The part that reads, "that is, your original cost or other basis of the property," takes into account that you very well could have initially acquired the property without actually buying it. (the "or other basis" part) For example, if you inherited the property then your "original cost" is the FMV of the property on the date the person you inherited it from, passed away.

If you acquired this property in 2015, then I seriously doubt (though can't rule it out of course) that it was worth less in 2020, than it was in 2015.

But overall if you have a mortgage on the property then most likely (more than 99% probable) you're going to find that come tax time, you will never show a taxable profit from residential rental property. This may not be true for commercial rental property as much.

Typically, when you account for the deductions of mortgage interest, property taxes, property insurance and then throw the depreciation in that you're required to take each year, those four items alone will commonly exceed the total rental income you get for the tax year. Add to that the other allowed rental expenses (repairs, maint, etc.) and you're practically guaranteed to operate the rental endeavor at a loss every single year. Trying to increase cost basis just so you can take more depreciation each year really doesn't help as much each year, nearly as much as it can hurt with you have to recapture it later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I converted my primary residence to a rental property, my cost basis for the home will be the fair market value at time of conversion?

Thank you appreciate , previously we had owned a condo that we outgrew and turned it into a successful rental. The small loss every year still helped and with 18 year SL managed to keep the property without a Starker exchange. I worry about the future capital gains especially the recap, although its a different world today with inflation and very high demand for FL. property. My son actually owns the house and we are renting (FMV rent on lease) but its tough to keep up with 8-10% per year appreciation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chinyoung

New Member

SB2013

Level 2

tianwaifeixian

Level 4

tianwaifeixian

Level 4

gagan1208

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill