- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- what to put for box 1e cost basis - inherited stock in 2020 sold some some in 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put for box 1e cost basis - inherited stock in 2020 sold some some in 2022

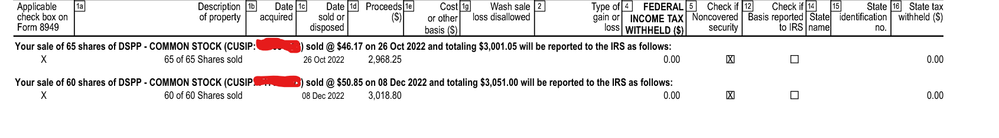

hello , I inherited stock in 2020 and sold some in 2022. I had turbo tax auto import from computershare. turbo tax is asking for box 1e cost basis.. what do i put in here? On the 1099b it was blank. Do i have to figure out the price it was the day when i inherited the stock or do i leave it at zero? also the sales section was auto selected as unkown term not reported , is that correct or do i need to do longterm not reported (non covered) like the 1099b says?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put for box 1e cost basis - inherited stock in 2020 sold some some in 2022

@alpaca cats the cost basis is based on the price of the stock on the date the person passed. Take the closing price on the trading day prior to death and the closing price on the same business day of death (or the first one after the date of death if it occured on a non-trading day). Average two two figures.

You can normally find historical prices on Yahoo Finance for publically traded firms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put for box 1e cost basis - inherited stock in 2020 sold some some in 2022

For date of sale use the drop down menu and choose inherited. The program will automatically make it long term. The cost basis is the value of the asset at the time of the decedent’s death.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put for box 1e cost basis - inherited stock in 2020 sold some some in 2022

@alpaca cats the cost basis is based on the price of the stock on the date the person passed. Take the closing price on the trading day prior to death and the closing price on the same business day of death (or the first one after the date of death if it occured on a non-trading day). Average two two figures.

You can normally find historical prices on Yahoo Finance for publically traded firms.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

tianwaifeixian

Level 4

brian94709

Returning Member

justine626

Level 1

MeeshkaDiane

Level 2