- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put for box 1e cost basis - inherited stock in 2020 sold some some in 2022

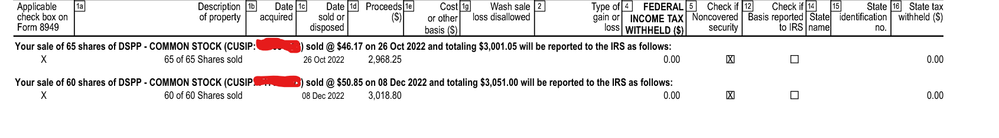

hello , I inherited stock in 2020 and sold some in 2022. I had turbo tax auto import from computershare. turbo tax is asking for box 1e cost basis.. what do i put in here? On the 1099b it was blank. Do i have to figure out the price it was the day when i inherited the stock or do i leave it at zero? also the sales section was auto selected as unkown term not reported , is that correct or do i need to do longterm not reported (non covered) like the 1099b says?

Topics:

October 16, 2023

2:40 PM