- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- What should be reported for Code Z on box 20 of K-1 schedule?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should be reported for Code Z on box 20 of K-1 schedule?

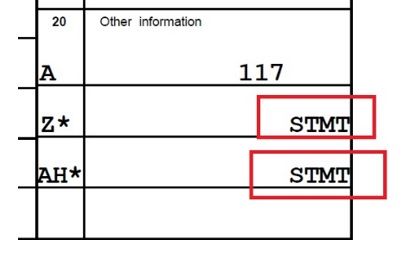

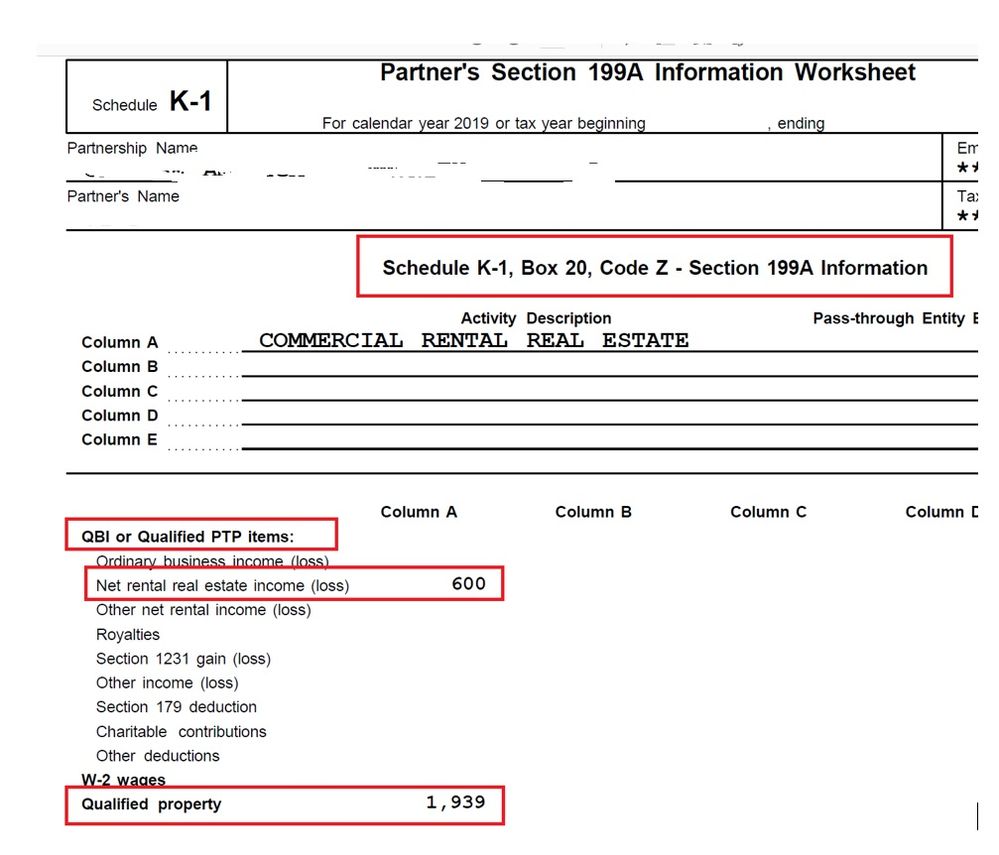

TT asked me to enter the value of Code Z (section 199A information). The K-1 form I received shows 'STMT' on Code Z value. I am not sure what it means, but it came with 'Partner's Section 199A information worksheet' for Code Z. See the attache screenshot. Should I just enter $600 (Net rental real estate income) for Code Z? or $2,539 ($600 + $1,939 qualified property) for Code Z?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should be reported for Code Z on box 20 of K-1 schedule?

@manbeing Typically, the deduction is applicable at the shareholder level.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should be reported for Code Z on box 20 of K-1 schedule?

Enter the total and then enter the individual figures in the subsequent 199A screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should be reported for Code Z on box 20 of K-1 schedule?

What if the CPA who prepared the K-1 schedule said the corporate rental income is not eligible to get QBI deduction. Should I still enter the total figure for Code Z?

What I found is if I enter total figure on Code Z, TT automatically apply QBI deduction for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should be reported for Code Z on box 20 of K-1 schedule?

@manbeing Typically, the deduction is applicable at the shareholder level.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should be reported for Code Z on box 20 of K-1 schedule?

What did you end up doing? Did you simply add up the amounts, and enter that for K1 Box 20 Code Z?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should be reported for Code Z on box 20 of K-1 schedule?

Please see this answer from KathrynG:

Re: K-1 box 20 z

Revisit your partnership interview.

For Box 20 Item Z: the 2019 IRS Instructions for Form 1065 Partnerships states:

- page 1: "Box 20—Codes Z through AD that were previously used to report section 199A information have been changed. Only code Z will be used to report section 199A information."

- page 47: "Partnerships should use Statement A—QBI Pass-Through Entity Reporting, or a substantially similar statement, to report information for each partner’s distributive share from each trade or business, including QBI items, W-2 wages, UBIA of qualified property, qualified PTP items, and section 199A dividends by attaching the completed statement(s) to each partner’s Schedule K-1. The partnership should also use Statement A to report each partner’s distributive share of QBI items, W-2 wages, UBIA of qualified property, qualified PTP items, and section 199A dividends reported to the partnership by another entity.

Please see screenshots below. You will be asked a series of questions that you can answer based on the Schedule K-1 you received. There should be a statement attached that will provide you with the information you need to answer the questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should be reported for Code Z on box 20 of K-1 schedule?

Thank you. That subsequent 199A screen did not pop up for me. How did you get there?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should be reported for Code Z on box 20 of K-1 schedule?

Yay, I found it. You have to enter a dollar amount in the first box to get it to open up a 199A detail screen a few clicks later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should be reported for Code Z on box 20 of K-1 schedule?

Dear Haleika,

Thanks for your help. Is it possible to call me when you are available? I have more question with my tax return.

Hongying Zhang

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rhartmul

Level 2

johntheretiree

Level 2

rpaige13

New Member

MeeshkaDiane

Level 2

CghLzh

Level 1