- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should be reported for Code Z on box 20 of K-1 schedule?

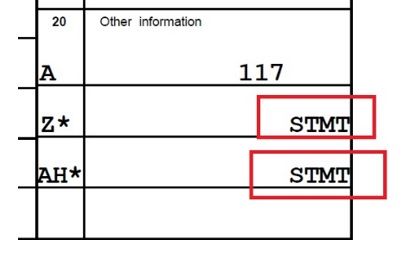

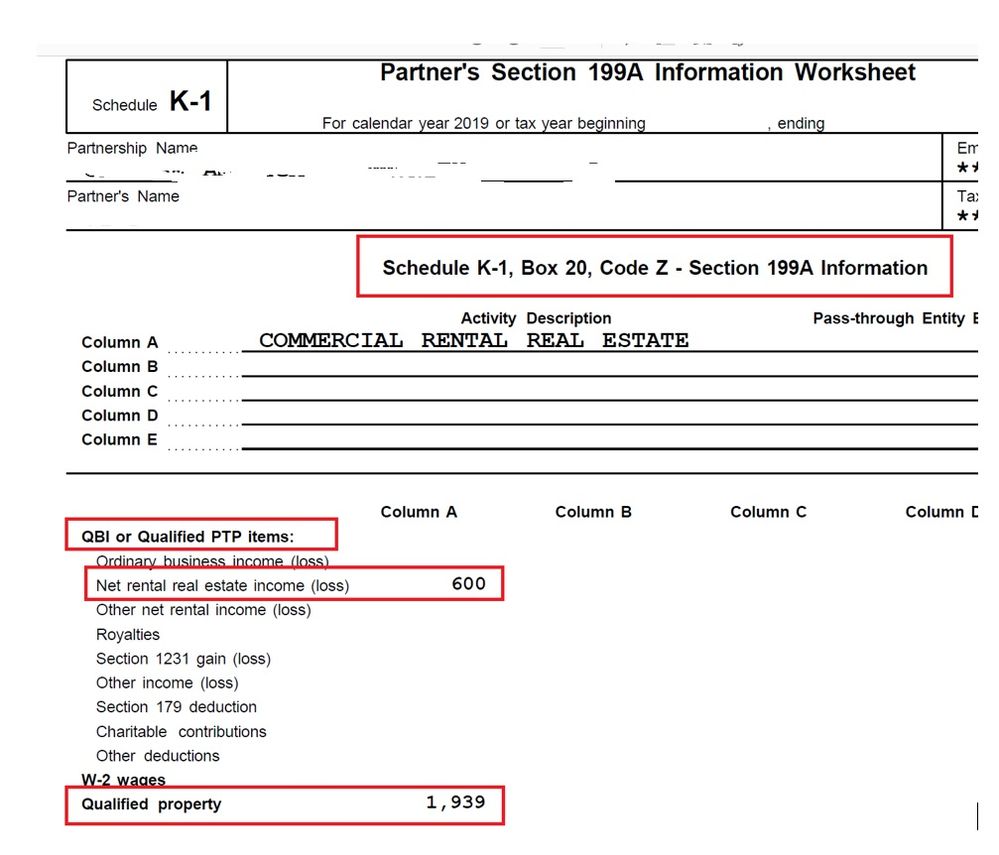

TT asked me to enter the value of Code Z (section 199A information). The K-1 form I received shows 'STMT' on Code Z value. I am not sure what it means, but it came with 'Partner's Section 199A information worksheet' for Code Z. See the attache screenshot. Should I just enter $600 (Net rental real estate income) for Code Z? or $2,539 ($600 + $1,939 qualified property) for Code Z?

February 27, 2020

12:33 PM