- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- .

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

All e-filed, already.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

This is wrong. As per lower down where they say it's 30 years. Why did you keep the wrong info? I know I should read all of the article. That's my fault. But why continue to include bad information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

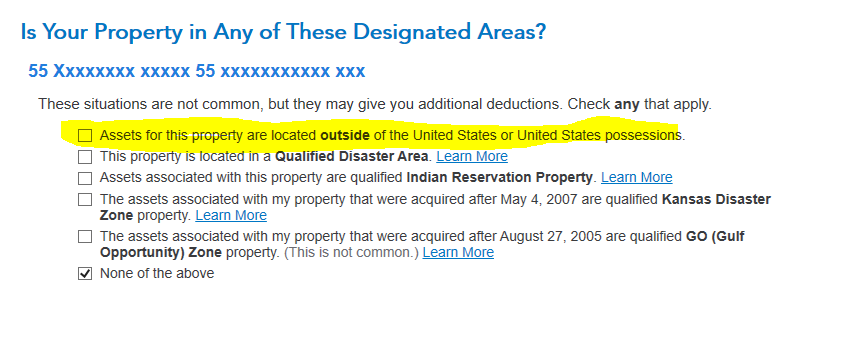

In the Property Profile section under Rentals, after entering the Foreign Rental Property address, continue to a screen where you indicate 'Assets for this property are located outside the US' (screenshot).

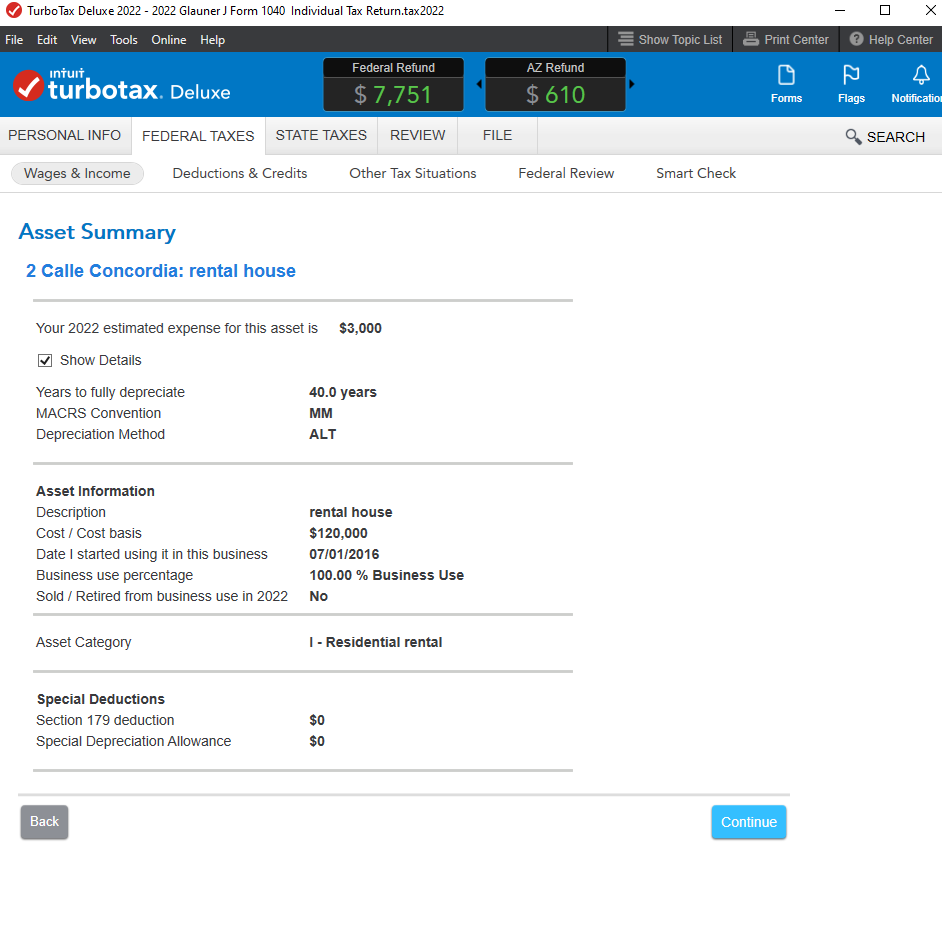

Then, in the Rental Assets section, at the Asset Summary page, click on 'Show Details' and you should see a 40-year depreciation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

Make sure that not only the address is correctly entered as Foreign you also want to make sure that this option is selected as well to ensure the 30-40 year depreciation. (dependent on when placed in service).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

Your overseas property is depreciated over a 30-year or 40-year period, depending on when it was first rented, instead of the 27.5 years for domestic residential properties. *Prior to 2018, depreciation of foreign residential property was limited to 40-years. New assets placed in service now get the lower 30 year period. If Turbo Tax is calculating your foreign rental property considering 27.5, you need to review your Foreign Rental Description, change the "Address type" to Foreign address, once it had been established that the assets are used predominantly out of United States, the depreciation will be automatically changed to 30 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

Thanks for the discussion! I have the opposite issue:

- For 17 years, my CPA has used 27.5 years/SL depreciation on our Rental property in Canada

Now TurboTax enforces the 40 year depreciation life on it.

Is there a way to change from 40 years to 27.5 years?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

@sandra88 wrote:

Is there a way to change from 40 years to 27.5 years?

TurboTax is not designed for you to use an incorrect method of depreciation.

For this year, you should go to a new tax professional that is familiar with how to fix accounting errors like this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

It's possible for you to use TurboTax Full Service, and the link will explain how it works. The property is required to be depreciated for a longer period so most importantly you need to keep a record of the depreciation you have already used.

For 2024, you can and need to change it as it should be over the 40 or 30 year life, depending when you placed it in service.

Your property in a foreign country is depreciated over a 30-year or 40-year period, depending on when it was first placed in service for rental use. Instead of the 27.5 year for US residential properties the period is different.

- Prior to 2018, depreciation of foreign residential property was limited to 40-year period.

- 2018 and Future: New assets placed in service now get the lower 30 year period.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

Thank you! Will definitely checkout TurboTax Full Service.

I was trying to replicate the 2023 Tax Return from our CPA in TurboTax, and found the issue.

Should I provide my 2023 tax packet during the Welcome Call, and/or havethe 2024 data ready at the same time?

-Sandra

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

Thanks for the advice!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

.

Yes, the more information you have available for them, the better, including your 2023 tax packet. Having prior year tax returns available when you have depreciation or carry over credits will make everything go smoother.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ridhamjoshi36

New Member

mMIK45

New Member

cj5

Level 2

jtidwell010

New Member

sonny.angeles

New Member