- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Turbo Tax Not Correctly Calculating Depreciation for First Year of Rental Property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Not Correctly Calculating Depreciation for First Year of Rental Property

There appears to be a Turbo Tax error when determining the first year's depreciation amount of a primary home converted to a rental property in 2021.

If you enter the information to calculate the cost basis, then you'll get a message like this: "The $255,446 cost of your building will be depreciated over the next 27.5 years." Thus the house depreciates $9288.95 per year.

If the conversion from primary home to rental occurred in August 2021, I'd then expect the depreciation value for 2021 to be 9/24 * 9288.95 = $3483.36. Here the 9/24 comes from using the mid-month convention where the first month counts as half a month so the middle of August leaves 9/24 of the year when it was a rental property. Instead of seeing a depreciation deduction of $3483.36 for 2021, I'd see a value of $1306.26. Took me awhile to make sense of this value, but it turns that out this value is 9/24 * $3483.36. In other words, as far as I can tell, Turbo Tax is pro-rating (multiplying by 9/24) the yearly depreciation value twice! If I simply go through the pages and questions for the "New rental property" asset, I encounter this error which leads to significantly more taxable income.

This doesn't seem like the right way to fix the error, but this worked for me: I selected "Add expense or asset" and then checked "Improvements, furnishings, and other assets". I then went through these pages and truthfully answered that I didn't make any improvements. Your cost basis and cost of land should already be filled in from the "New rental property" section. If the property was used 100% as a rental after the conversion date, then you answer that you've always used the asset for business purposes 100% of the time. This isn't referring to time before the conversion date. Completing his series of questions calculates the first year's depreciation amount correctly to be $3483.36. But beware, if I revisit and complete the "New rental property" questions again, Turbo Tax recalculates the depreciation amount to be the original lower and incorrect value.

Hope this is helpful to others.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Not Correctly Calculating Depreciation for First Year of Rental Property

Yes, if you convert a personal home to a rental home, it is considered used 100% for rental use from the date it was converted, i.e., 'placed in service'. Placed in service date tells TurboTax how much depreciation you are allowed in the current year for the first year of conversion. Each year after that will be a full year of depreciation assuming it continues to be a rental property.

The question can be confusing in the first year of the conversion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Not Correctly Calculating Depreciation for First Year of Rental Property

In the year of conversion to rental, there's quite a bit that the program really does not provide enough clarity for. So here's the scoop.

Rental Property Dates & Numbers That Matter.

Date of Conversion - If this was your primary residence or 2nd home before, then this date is the day AFTER you moved out, or the date you decided to lease the property – whichever is later.

In Service Date - This is the date a renter "could" have moved in. Usually, this date is the day you put the FOR RENT sign in the front yard.

Number of days Rented - the day count for this starts from the first day a renter was contracted to move in, and/or "could" have moved in. That would be your "in service" date or after if you were asked for that. Vacant periods between renters do not count for actual days rented. Please see IRS Publication927 page 17 at https://www.irs.gov/pub/irs-pdf/p527.pdf#en_US_2020_publink1000219175 Read the “Example” in the third column.

Days of Personal Use - This number will be a big fat ZERO. Read the screen. It's asking for the number of days you lived in the property AFTER you converted it to a rental. I seriously doubt (though it is possible) that you lived in the house (or space, if renting a part of your home) as your primary residence, 2nd home, or any other personal use reasons after you converted it to a rental.

Business Use Percentage. 100%. I'll put that in words so there's no doubt I didn't make a typo here. One Hundred Percent. After you converted this property or space to rental use, it was one hundred percent business use. What you used it for prior to the date of conversion doesn't count.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Not Correctly Calculating Depreciation for First Year of Rental Property

Hello,

I am having the same issue! Converted my primary residence to a rental property on July 8 2022. My cost basis is 211,000, so therefore straight line depreciation over 27.5 years would be $7672.

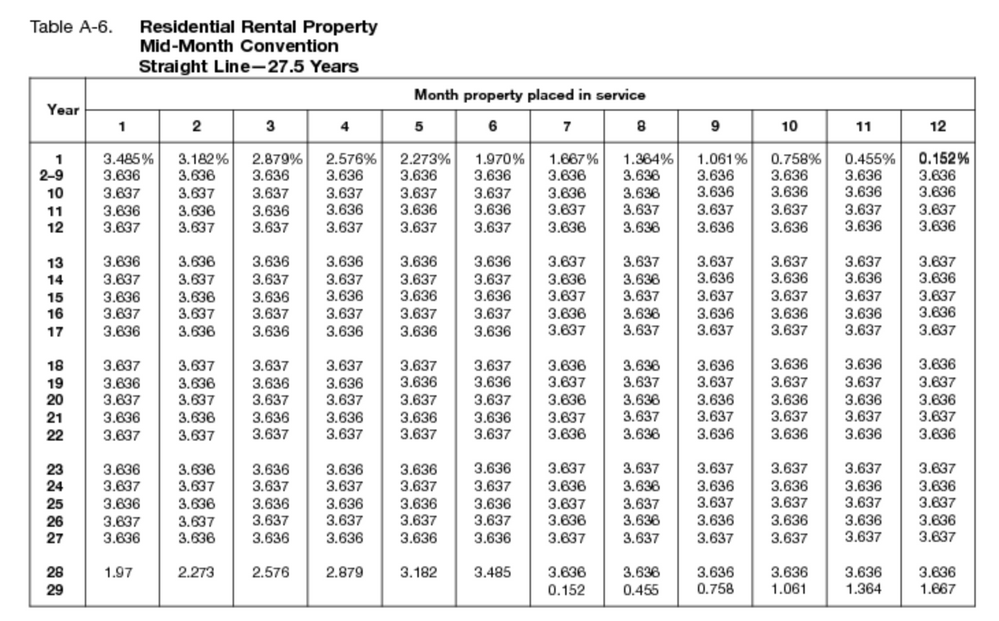

Using the IRS Publication 946 Table A-6 Mid-Month convention below, I should depreciate 1.667% for the first year since my property went into service in July. This would equal $3517. However, TurboTax is calculating only $1709. They've cut my depreciation in half a second time! This makes no sense.

Any help? Am I misunderstanding something, or how do I get this corrected in the system?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Not Correctly Calculating Depreciation for First Year of Rental Property

Go back through your property profile and make sure you enter 100% for business use. In the first year of conversion, some want to prorate that, but it is asking for the business use percentage after you converted it. Also, make sure you entered 0 personal use days - same issue here, TurboTax is asking for personal days after you converted it. Days Rented should be the number of days left in the year from the 'placed in service date' (the date it was available to rent). Most of the time, the depreciation calculation issue in the year of conversion stems from one of those entries. @samantha28

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Not Correctly Calculating Depreciation for First Year of Rental Property

Thank you so much @DawnC!. That corrected the issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Not Correctly Calculating Depreciation for First Year of Rental Property

Am I misunderstanding something,

Yep. I see it in these and other forums almost every year. The problem is business use percentage. The program is asking you the business use percentage *AFTER* you converted it to a rental. I seriously doubt there was any personal use after the conversion date. So the business use percentage would be 100% and nothing less.

If you put 50% business use, then you get a first year depreciation amount of half what it should be. That's what happened to you. Glad you got it fixed though.

Now there are other possible issues that you may not have caught yet. So confirm you answered all the questions right and made all the correct selection with the guidance I'm providing below. There are some areas of the program that in my personal opinion (and we all know what opinions are like!) the necessary clarity is not provided to the user, to ensure they fully understand what information is being asked for. This lack of clarity usually results in the user providing a wrong answer or incorrect data, and they don't even know it. Some screens the clarity *is* provided. But it's provided in the small print. I see a lot of situations where the user just flat out did not read the small print. That hurts them down the road.

Rental Property Dates & Numbers That Matter.

Date of Conversion - If this was your primary residence or 2nd home before, then this date is the day AFTER you moved out, or the date you decided to lease the property – whichever is later.

In Service Date - This is the date a renter "could" have moved in. Usually, this date is the day you put the FOR RENT sign in the front yard.

Number of days Rented - the day count for this starts from the first day a renter was contracted to move in, and/or "could" have moved in. That would be your "in service" date or after if you were asked for that. Vacant periods between renters do not count for actual days rented. Please see IRS Publication927 page 17 at https://www.irs.gov/pub/irs-pdf/p527.pdf#en_US_2020_publink1000219175 Read the “Example” in the third column.

Days of Personal Use - This number will be a big fat ZERO. Read the screen. It's asking for the number of days *YOU* lived in the property AFTER you converted it to a rental. I seriously doubt (though it is possible) that you lived in the house (or space, if renting a part of your home) as your primary residence, 2nd home, or any other personal use reasons after you converted it to a rental.

Business Use Percentage. 100%. I'll put that in words so there's no doubt I didn't make a typo here. One Hundred Percent. After you converted this property or space to rental use, it was one hundred percent business use. What you used it for prior to the date of conversion doesn't count.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alvin4

New Member

girishapte

Level 3

iqayyum68

New Member

hijyoon

New Member

Jeff-W

Level 1