- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Hello,

I am having the same issue! Converted my primary residence to a rental property on July 8 2022. My cost basis is 211,000, so therefore straight line depreciation over 27.5 years would be $7672.

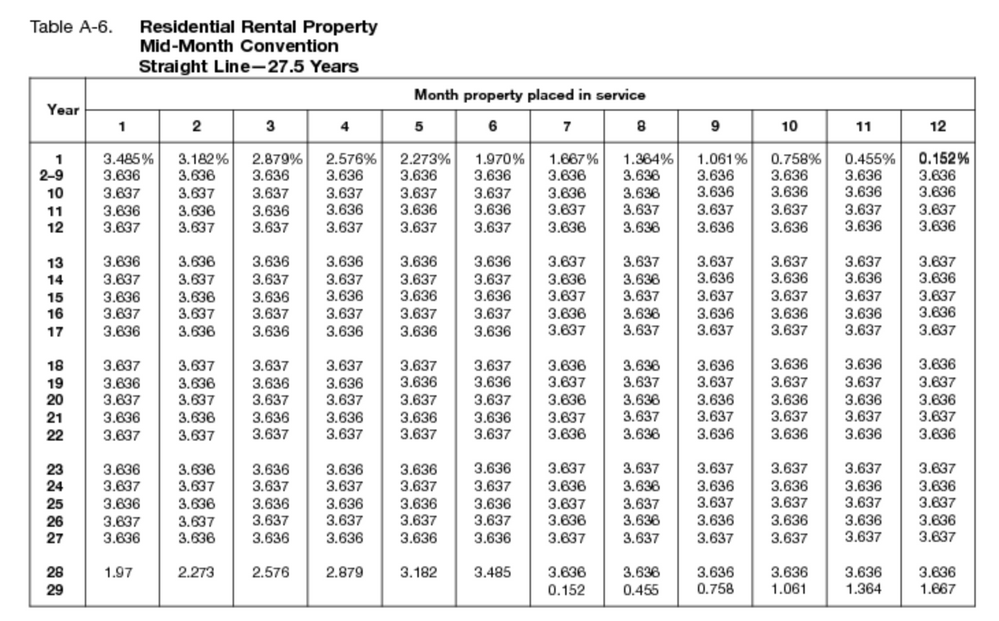

Using the IRS Publication 946 Table A-6 Mid-Month convention below, I should depreciate 1.667% for the first year since my property went into service in July. This would equal $3517. However, TurboTax is calculating only $1709. They've cut my depreciation in half a second time! This makes no sense.

Any help? Am I misunderstanding something, or how do I get this corrected in the system?

February 9, 2023

7:30 PM