- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

I entered all of my individual stock capital gains and losses into Turbo Tax (I do not use the summarize method). The Turbo Tax software correctly totaled all of them on Schedule D, but it did not generate a form 8949 listing them individually.

In past years of using Turbo Tax, the form 8949 was generated with no problems.

If I switch to "forms" mode, I can see a worksheet with all of my capital gain/loss entries, but the 8949 form is empty (except for my name and SSN).

How can I get the 8949 to generate/print?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

If all Forms 1099-B (or all substitute statements) you received show basis was reported to the IRS and no correction or adjustment is needed, you may not need to file Form 8949. Please see here for the IRS instructions for Form 8949.

Individuals use Form 8949 to report the following:

- The sale or exchange of a capital asset not reported on another form or schedule.

- Gains from involuntary conversions (other than from casualty or theft) of capital assets not used in your trade or business.

- Nonbusiness bad debts.

- Worthlessness of a security.

- The election to defer capital gain invested in a qualified opportunity fund (QOF).

- The disposition of interests in QOFs.

If the rest of your sale transactions, not shown on Form 8949, are correctly reported on Schedule D, then you should not have an issue with the IRS. Be sure to keep your supporting data in case you ever receive an inquiry from a tax agency.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

It sounds like you are not required to fill out and file Form 8949.

If you're e-filing, you only need Form 8949 (along with Form 8453) if you entered sales section totals for one or more sales categories (instead of each individual sale) and one of the following is true:

- The sales category for one or more summaries is something other than box A (short-term covered) or box D (long-term covered), or

- The box A or box D summary includes adjustments (typically listed in boxes 1f or 1g on your broker statement)

If you also entered each transaction in previous years and Form 8949 was produced, it could be because there was some kind of adjustment reported. In this case, even thought you entered them individually, you would need to file Form 8949.

Here is more info on Form 8949: Do I need to fill out or mail in Form 8949?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

All of my sales are either box A or box D. I don't see any adjustments, either in last years (2021) brokerage information or this years (2022).

If it matters, I also don't e-file. I'm an old fashioned print and mail kind of guy.

So, I'm still a bit concerned that I didn't get a form 8949 generated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

As long as you entered everything correctly from your 1099-B into TurboTax, you should be ok without Form 8949.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

This is recently new undocumented behavior of TurboTax.

The program is stymieing your intention to list all transactions for Box A and D, which is your allowed option.

Complain to Customer Support.

Detail Reporting Exception: if you aggregate Category A or Category D, Form 8949 is not needed for transactions without adjustments. No attachment is necessary. No mailing is necessary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

So, I did call customer support about this. I was on the phone for about an hour - being advised to delete various forms in hopes that Turbo Tax would recreate them along with the missing 8949.

When none of that worked, I was advised to update my Windows (which was already up to date, just some various drivers needed an update) and the the representative would call me back in 1 hour. I was never called.

I'm a little miffed. Even though I may not actually *need* to file the 8949, I spent time entering in all of my individual sales into Turbo Tax, and am not getting the expected 8949. Had I know that, I could have skipped all of that data entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

sorry you should have just registered your complaint and hung up.

Sometime the "crew member" doesn't even know what you are talking about.

Did you try this?

Open Form 8949 in Forms mode,

click Print on the bottom of the page.

Probably no help but you might be lucky.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

If your Schedule D shows aggregation on Line 1a or Line 8a, courtesy of TurboTax, then details for those transactions should not be listed. if you want details you have to use Line 1b or Line 8b.

I'm not aware of any way to force that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

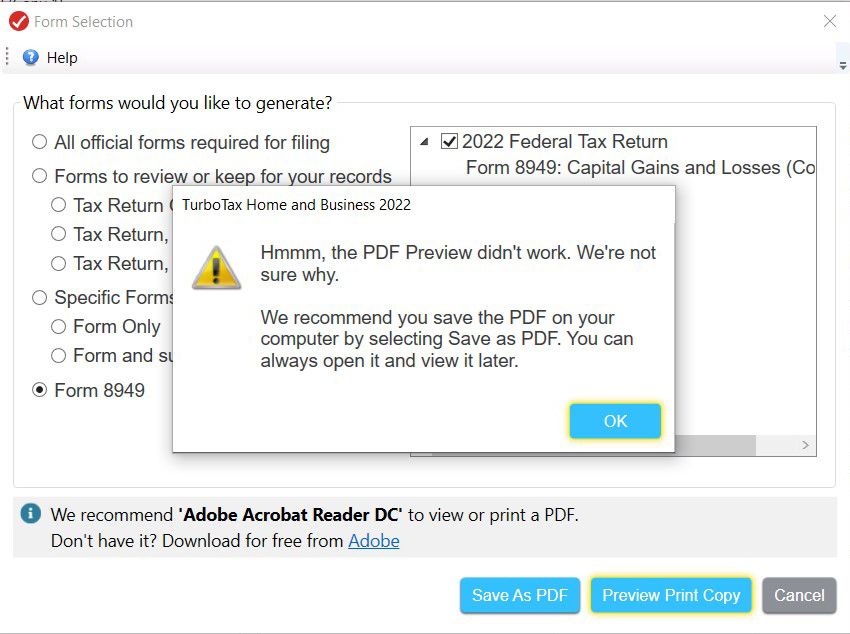

When I try to print the empty 8949, as suggested in hopes of being lucky and getting a completed 8949, I am unable to do so. Turbo Tax gives me an error popup.

If I try to save the PDF on my computer, it appears to do so, but the PDF file is nowhere to be found.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

I hope I read your response correctly.

I checked my 2021 8949 return forms from TT based on what you said, and sure enough only the Sch D box 1b and 8b items were listed (There were also items on 1a and 8a and no 8949 to support these.)

But, I had multiple 8949 pages for reported for Sch D line 1b items, when only 1 transaction listed on the 8949 had an adjustment. If what you say is true, then seems like only the one transaction would have had to be reported on the 8949 and on Schedule D, line 1b.

For Box D sales, I had multiple pages for Box D sales, line 8b and NO adjustments but they were all reported on 8949. Again, why weren't they all reported on line 8a of Sch D?

This all seems inconsistent.

So, for 2022, I had Box A sales (all line Sch D line 1b) unreported on an 8949 as you noted. And for Box D, only those sales reported on Line 8b ended up on an 8949 (there were only 2 transactions in 8b). More consistent with your explanation than 2021. But in the forms view for Schedule D, there is a section labeled "Form 8949 Reporting Exception Transactions" which is supposed to show "Any transactions that are eligible to be reported directly on Schedule D, bypassing form 8949, may be summarized here." I emphasize MAY because the boxes they have to list that summary are empty.

Confusing.

Thanks for reading.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

Your consolidated 1099-B gives you subtotals for all of Box A or Box D.

(they should break out wash sales but they don't)

If you have wash sales, it gets more complicated since those adjusted transactions have to be itemized on Form 8949 and the summary totals adjusted accordingly.

Enter the wash sales on Form 8949, then use the subtotal results on the bottom of that form (Line 2) to know how much to subtract which gives you the Schedule D line 1a totals

"Any transactions that are eligible to be reported directly on Schedule D, bypassing form 8949, may be summarized here."

This would be the place to enter the result of your calculation.

( In earlier versions of TurboTax there would be a different way to do it. maybe that option remains as an alternative)

if done correctly, the grand totals on Schedule D will match the grand totals on consolidated 1099-B.

Have fun.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

Thanks for your reply. After reading schedule D words describing box 1a/8a vs 1b/8b, your coaching is pretty clear. I now understand why no 8949 is needed for some transactions and that was my concern - that TT needed to show them on a 8949 when in fact TT reads the tax rules more clearly than I!

Thanks for your time.

Ed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

TurboTax technical support had no direct solution, but they did offer a workaround. By listing the individual sales as noncovered, even though they are covered, it forces the software to generate the desired 8949.

So, I will do that, white out the "noncovered" check box on the printed form, and manually check the "covered" box.

I understand the comments that form 8949 may not be necessary in my situation, and that I could attach my brokerage statement instead, but I don't want to do that. I like having the individual sales listed on my form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

It is not a solution.

If you do that your subtotals will appear on Schedule D Line 2 which is wrong.

you'd have to get Schedule D in PDF fillable form from irs.gov and do that by hand.

here's a solution.

use Box B to get the printout for your records.

change it back to Box A so you can e-File.

details are not required when you summarize Box A transactions without adjustments.

when details are not required (Box A) no mailing is necessary. No attachment is necessary.

If you have a lot of transactions, this is all just too fastidious and tedious so put a copy of your consolidated 1099-B behind your copy of 1040 for your records.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax 2022 does not generate form 8949 for individually entered stock sales

You need to understand how the IRS handles these sales ... the rule is a form 8949 is NOT required if there are only covered sales and no adjustments are needed. If that is the case the info goes to the Sch D directly and the 8949 is not needed nor desired by the IRS. Their computers will match up what is sent to them by the broker with what you put on the Sch D ... they do not want pages and pages of unneeded 8949 forms any longer. For those who print and mail in the return this is a welcome relief in paper, ink and postage so don't look a gift horse in the mouth. The 8949 is ONLY required for sales with adjustments and/or uncovered sales. Now that the reporting mandate of covered sales by the brokers have been in place for many years the amount of sales that are uncovered are dwindling.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

dpa500

Level 2

flin92

New Member

lrwilcox

New Member

dy242424

New Member