- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- TT Premier. Income and rental summary prior year 2018 rental income, expense expect for depreciation, all as $0. Why did TT not import this this from prior year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Premier. Income and rental summary prior year 2018 rental income, expense expect for depreciation, all as $0. Why did TT not import this this from prior year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Premier. Income and rental summary prior year 2018 rental income, expense expect for depreciation, all as $0. Why did TT not import this this from prior year?

For you 2019 taxes, did the depreciation for your rental property calculate automatically, i.e., were your rental property assets from 2018 shown in the Assets/Depreciation section for your rental property (without you having to add them again)?

If so, it could be that the prior year summary you are looking at didn't populate for 2018, but the information needed for 2019 taxes was properly transferred.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT Premier. Income and rental summary prior year 2018 rental income, expense expect for depreciation, all as $0. Why did TT not import this this from prior year?

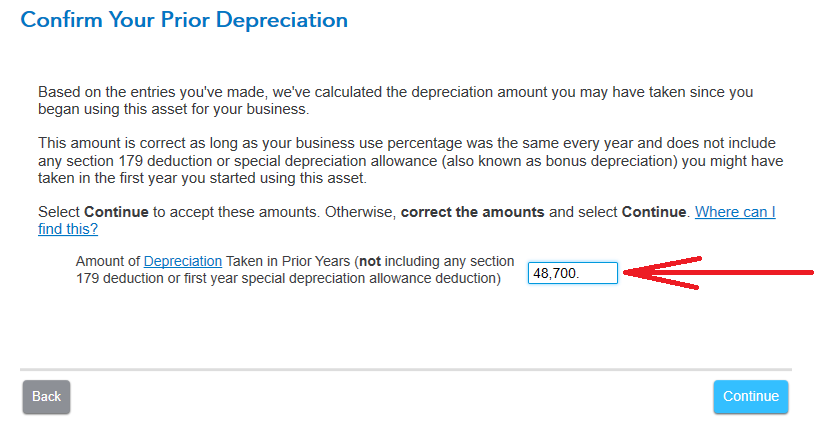

More than likely, you're looking at a summary. Waste of time in my opinion (and we all know what opinions are like). What matters here, is the IRS Form 4562 data. Look in the assets/depreciation section. THen pick an asset (I suggest the property itself) to edit, and work it through. On the "Confirm your prior depreciation" screen, you should see an amount greater that zero that shows the total of all depreciation taken over the years, up to your 2018 tax return. If it does, then you're good to go.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rita27

Level 1

atn888

Level 2

taxbadlo

Level 1

PeehPooh17

New Member

justintccasey

New Member