- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

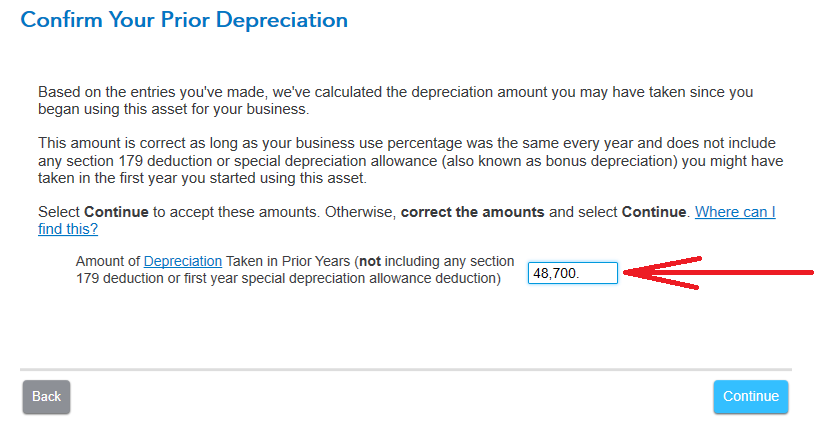

More than likely, you're looking at a summary. Waste of time in my opinion (and we all know what opinions are like). What matters here, is the IRS Form 4562 data. Look in the assets/depreciation section. THen pick an asset (I suggest the property itself) to edit, and work it through. On the "Confirm your prior depreciation" screen, you should see an amount greater that zero that shows the total of all depreciation taken over the years, up to your 2018 tax return. If it does, then you're good to go.

July 5, 2020

2:36 PM